From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Downturn Amid German Concerns and Plant Activity Slowdown

Asia’s steel market shows signs of weakening due to a blend of international political tensions and decreased plant activity. The negative sentiment is fueled by concerns voiced in Europe regarding trade relations with China, as evidenced by news articles such as “Lars Klingbeil in China: Grüne Kritik an Reise” and “Kritik an Klingbeil: „Nach der Moskau-Connection brauchen wir nicht noch eine Peking-Connection““. While these articles do not directly correlate with immediate changes in observed Asian plant activity, they contribute to overall market uncertainty.

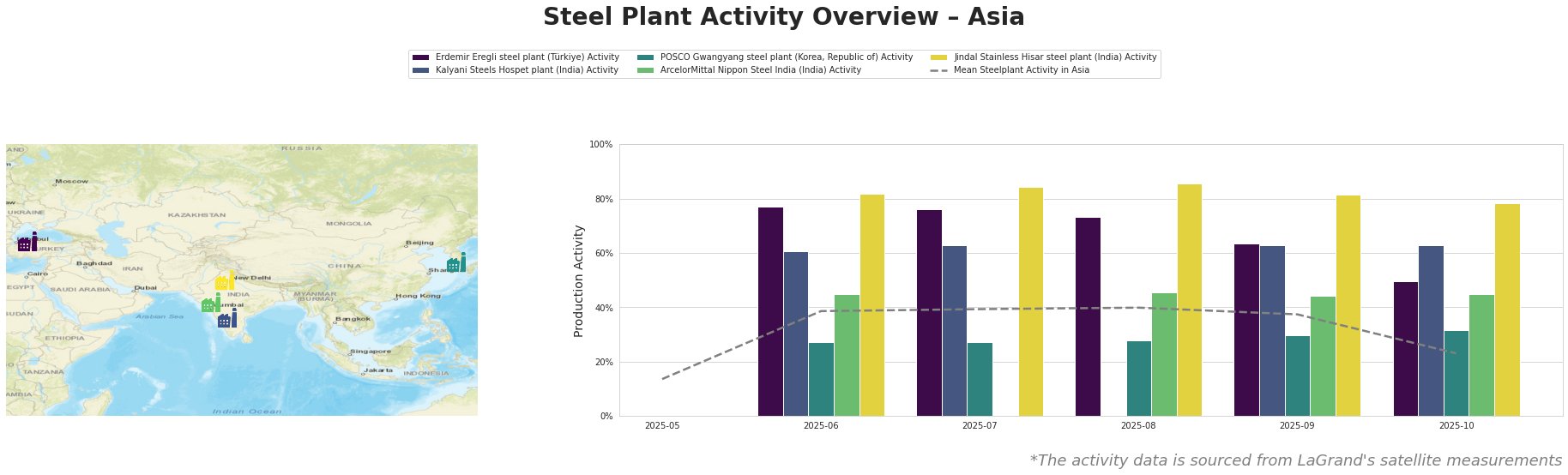

Measured steel plant activity in Asia:

The mean steel plant activity in Asia has seen a significant decline, dropping from 40% in August to 23% in October.

Erdemir Eregli, an integrated BF/BOF steel plant in Türkiye with a 4 million tonne crude steel capacity, experienced a marked decrease in activity, from 77% in June to 50% in October. No direct link to the provided news articles can be established for this decline. Its product mix includes hot and cold rolled coils and plates, serving the automotive, building, and energy sectors.

Kalyani Steels Hospet, an integrated BF/DRI steel plant in India, producing semi-finished and finished rolled products (rounds and bars), maintained a stable activity level around 62% between June and October. As with Erdemir Eregli, no explicit connection to the provided news articles can be established.

POSCO Gwangyang, a major integrated BF/BOF steel plant in South Korea with a 23 million tonne crude steel capacity, showed relatively stable activity between June and October, fluctuating between 27% and 32%. The plant’s diverse product range, including hot-rolled, plate, and stainless steel targets automotive, construction, and energy end-users. Similar to the previous two, no direct link to the provided news articles is evident.

ArcelorMittal Nippon Steel India, an integrated BF/DRI/EAF steel plant in India, also displayed stable activity levels in the range of 44% and 46% between June and October. The plant has a crude steel capacity of 9.6 million tons, producing hot-rolled, cold-rolled, and galvanized products. Its markets span automotive to infrastructure. No direct connection to any named news articles is found.

Jindal Stainless Hisar, an EAF-based stainless steel producer in India, experienced a gradual decline from 86% in August to 78% in October. Its product portfolio includes razor blades, coins, and stainless products, reaching various industries. There is no direct link between the observed activity change and the provided news articles.

Given the general downtrend in steel plant activity and the uncertainties raised by European concerns over trade with China, steel buyers and market analysts should undertake the following:

- Prioritize securing existing contracts: Due to the decline in the mean steel plant activity, assess current contracts with Asian suppliers.

- Assess supply chain risks: Closely monitor policy developments related to German-Chinese relations following “Lars Klingbeil in China: Grüne Kritik an Reise” and other related articles. This is important because the trip signals potential shifts in trade dynamics and supply chain stability.

- Negotiate flexible delivery schedules: Given market uncertainty, negotiate contract terms allowing for adjustments to delivery volumes.

- Maintain close communication with suppliers. Understand the potential impact of geopolitical tensions and environmental regulations on their operations.