From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: EU-US Trade Tensions Loom, Select Plant Activity Fluctuates

Asia’s steel market faces potential disruption amid escalating EU-US trade tensions, though impacts on Asian steel production are currently indirect. The EU’s preparations for countermeasures against the US, as detailed in “EU treibt Verabschiedung von Gegenzöllen voran,” “Brüssel bereitet seine schärfste Handelswaffe vor,” and “The EU is preparing for swift countermeasures in the absence of an agreement with the US,” could trigger shifts in global trade flows. While no direct relationship between these news articles and observed changes in activity levels could be found, they set a backdrop of general uncertainty.

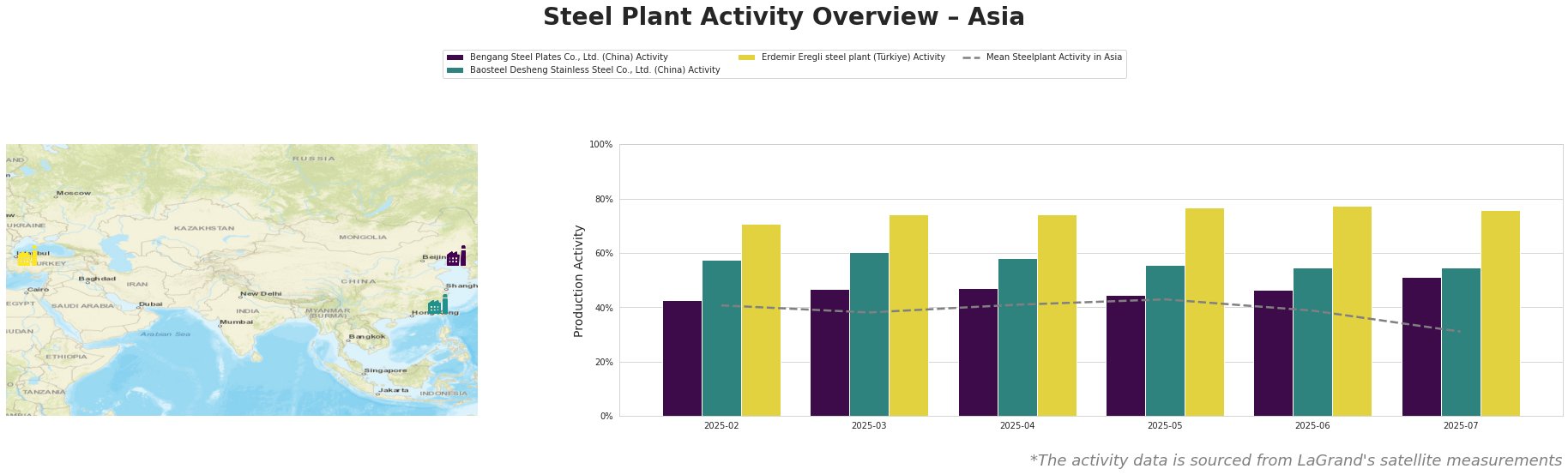

The mean steel plant activity in Asia shows a fluctuating trend, decreasing to 31% in July after peaking at 43% in May.

Bengang Steel Plates Co., Ltd., a major integrated steel producer in Liaoning, China, with a crude steel capacity of 12.8 million tonnes, primarily serves the automotive, building, and energy sectors. The plant’s activity level increased from 43% in February to 51% in July. No direct connection could be established between this rise and the provided news articles concerning EU-US trade tensions.

Baosteel Desheng Stainless Steel Co., Ltd., located in Fujian, China, focuses on stainless steel production with a crude steel capacity of 3.41 million tonnes. Activity at this plant has remained relatively stable around 55-60% during the observed period. No direct relationship could be established between this relatively steady activity level and the provided news regarding EU-US trade negotiations.

Erdemir Eregli steel plant in Türkiye, an integrated producer with a 4 million tonne crude steel capacity supplying the automotive, construction, and energy sectors, has maintained consistently high activity, fluctuating between 71% and 77%. A slight decrease from 77% to 76% in July does not show any connection to the trade tensions described in the news.

Evaluated Market Implications:

The potential for EU retaliatory measures against the US, specifically the ban on ferrous and aluminum scrap exports to the US from September 7th, as noted in “EU-US countermeasures could stop some scrap exports,” could indirectly impact global scrap markets. While Erdemir Eregli’s activity remains high, the Turkish plant depends on scrap. Given this plant’s reliance on scrap (implied via BOF and EAF), steel buyers should monitor potential disruptions to their scrap supply chains as the EU ban could redirect scrap flows and potentially increase prices in other regions. Given the current information, no specific action is advised regarding Bengang Steel Plates and Baosteel Desheng Stainless Steel.