From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Downturn: US Tariffs & Sluggish Demand Impacting Production

Asia’s steel market faces a downturn, primarily driven by the impact of US tariffs on global trade flows and subsequent subdued demand. This trend is reflected in observed activity levels, though a direct causal link to the news article “EU steelmakers hope for easing global trade tensions“ could not be explicitly established. The articles “US tariffs hit EU stainless longs market“ and “US tariffs hit the stainless steel pipe market in the EU“ highlight the diversion of Asian steel to Europe due to US tariffs, potentially impacting regional Asian demand and production.

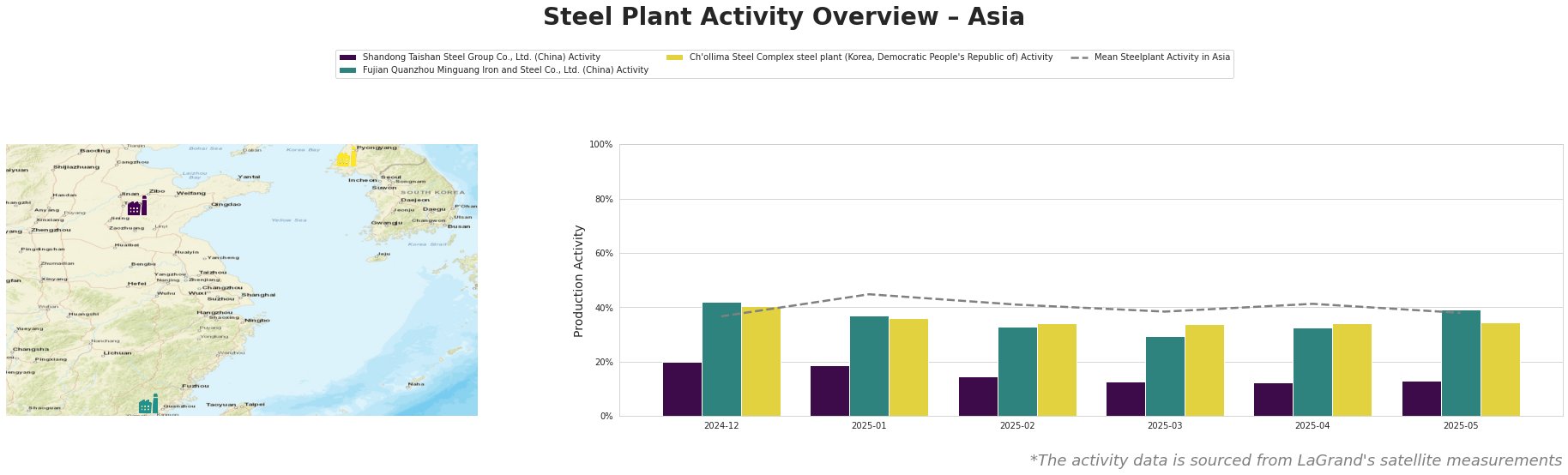

The average steel plant activity across Asia fluctuated, peaking at 45% in January 2025 and settling at 38% in May 2025. Shandong Taishan Steel Group Co., Ltd. consistently operated below the Asian average, exhibiting a significant decline from 20% in December 2024 to 13% in May 2025. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. also experienced a decrease from 42% in December 2024 to 29% in March 2025, before recovering to 39% in May 2025. Ch’ollima Steel Complex maintained relatively stable activity levels around 35% throughout the period.

Shandong Taishan Steel Group Co., Ltd., an integrated steel plant with a 5000 ktpa crude steel capacity, specializing in hot and cold rolled coil and stainless steel, showed a consistent decline in activity from 20% in December 2024 to 13% in May 2025. The observed drop suggests potential production cuts, though no direct link could be established with the named news articles.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., another integrated steel plant with a 2550 ktpa crude steel capacity, producing round bar, coiled rebar, and wire rod, experienced a decrease in activity levels, bottoming out at 29% in March 2025 before partially recovering to 39% in May 2025. The initial decline could be linked to the general market downturn mentioned in “US tariffs hit EU stainless longs market” and “US tariffs hit the stainless steel pipe market in the EU”, although a definitive connection cannot be confirmed.

Ch’ollima Steel Complex, with a 760 ktpa crude steel capacity producing plates and wire rod, maintained a stable activity level, deviating less than 6% from its initial 40% level. Its relative stability contrasts with the fluctuations observed at the other plants; however, no direct connections to the news articles could be established.

Based on observed production declines at Shandong Taishan and Fujian Quanzhou, and considering the potential redirection of Asian steel to Europe due to US tariffs as reported in “US tariffs hit EU stainless longs market” and “US tariffs hit the stainless steel pipe market in the EU”:

- Potential Supply Disruptions: Buyers relying on Shandong Taishan for hot/cold rolled coil and stainless steel, and Fujian Quanzhou for bar and wire rod, should anticipate potential supply constraints.

- Recommended Procurement Actions: Steel buyers should diversify their supplier base beyond Shandong Taishan and Fujian Quanzhou to mitigate supply risk. Explore alternative suppliers in Southeast Asia and potentially consider European sources, recognizing that prices may be affected by the diverted Asian supply. Analysts should closely monitor inventory levels of affected product categories and track pricing volatility.