From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Demand Rebound Expected in 2026, Plant Activity Shows Divergent Trends

Asia’s steel market is poised for growth, with activity at key plants reflecting both optimism and challenges. “Global steel demand will grow by 1.3% y/y in 2026 – WorldSteel” indicates a positive outlook, while “BIR: Global recycled steel market sees brief stability before demand weakens” points to potential feedstock pressures. Observed activity changes in selected steel plants do not show a direct link to the mentioned recycled steel market developments, but do appear to align with an anticipation of increased demand as highlighted by the WorldSteel reports.

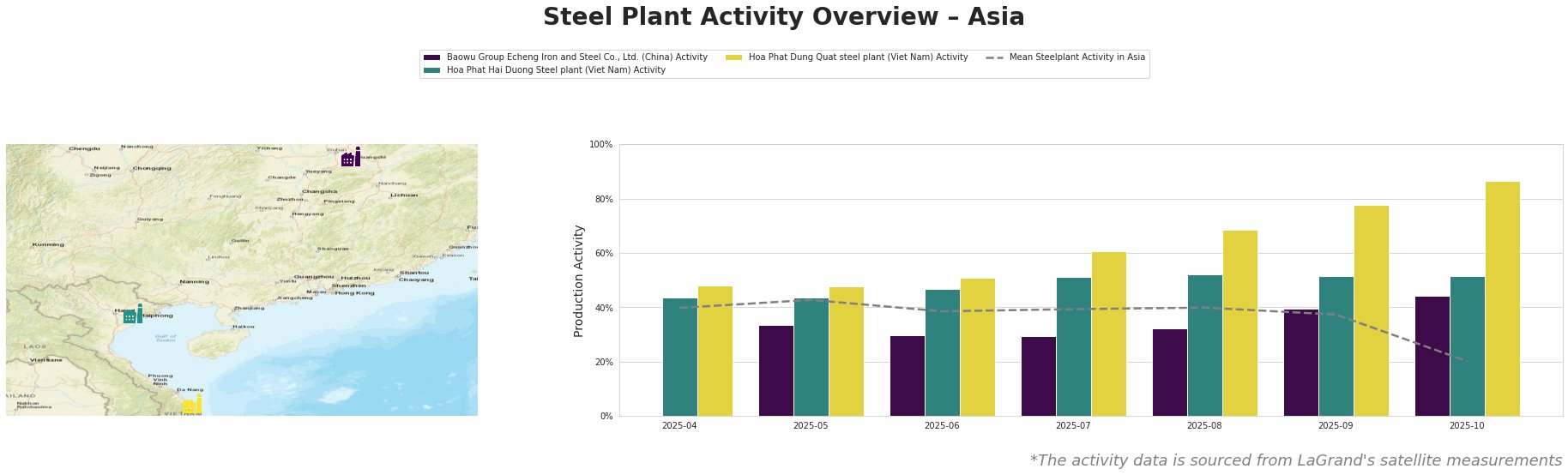

The mean steel plant activity in Asia experienced a sharp decline in October, dropping to 20% after hovering around 40% in the preceding months. The data reveals divergent trends among the observed plants. Baowu Group Echeng Iron and Steel Co., Ltd. initially showed activity below the Asian mean, peaking in September at 40% before jumping to 44% in October, moving against the general downward trend. Hoa Phat Hai Duong Steel plant operated consistently around the mean, while Hoa Phat Dung Quat steel plant showed a sustained increase in activity, reaching a high of 86% in October, significantly above the Asian mean.

Baowu Group Echeng Iron and Steel Co., Ltd., located in Hubei, China, is an integrated BF-BOF steel plant with a crude steel capacity of 4.4 million tonnes per annum (ttpa). It focuses on finished rolled products like spring steel and alloy steel wire rods. From July to August 2025, its activity remained below the Asian average. Notably, its activity increased to 44% in October, contrasting the sharp decline in the Asian average. This increase in activity may be linked to China’s efforts to maintain exports, despite domestic demand challenges, as suggested by “BIR: Global recycled steel market sees brief stability before demand weakens,” though no direct connection can be explicitly established from the provided data.

Hoa Phat Hai Duong Steel plant in Vietnam, also an integrated BF-BOF facility with a 2.5 million ttpa crude steel capacity, produces construction steel and hot rolled coil. Its activity closely mirrored the average Asian activity until October, maintaining a stable level slightly above 50%. The stability in production levels aligns with the positive growth prospects for developing Asian economies outlined in “Worldsteel: Global steel demand to remain stable in 2025 before rebounding in 2026”, specifically mentioning Vietnam as one of the countries expected to experience robust growth.

Hoa Phat Dung Quat steel plant, the largest of the three observed with a 5.6 million ttpa crude steel capacity, is another integrated BF-BOF plant located in Quang Ngai, Vietnam, producing construction steel and hot rolled coil. The plant showed continuous growth in activity from April to October, reaching 86% activity, significantly outpacing both the Asian average and the other observed plants. This strong performance is consistent with “Worldsteel: Global steel demand to remain stable in 2025 before rebounding in 2026,” which projects robust growth in developing economies like India and Vietnam. The Dung Quat plant’s focus on building and infrastructure-related steel products positions it well to capitalize on this projected growth.

Based on the provided data, the sharp decline in the Asian mean activity coupled with the strong upward trend at Hoa Phat Dung Quat, suggests a potential shift in regional supply dynamics. For steel buyers:

* Monitor Vietnamese HRC Pricing: Given the increased activity at Hoa Phat Dung Quat and the overall positive outlook for Vietnamese steel demand, carefully monitor HRC pricing from this plant and other Vietnamese producers. Consider negotiating forward contracts to secure supply and hedge against potential price increases.

* Evaluate Baowu Echeng as an alternative supplier: The increased activity at Baowu Echeng against the overall Asian trend suggests a potentially stable supply source. Buyers should evaluate Baowu Echeng as an alternative, particularly for products like spring steel and alloy steel wire rods, considering potential cost advantages.

* Factor global scrap market volatility into procurement strategies: The article “BIR: Global recycled steel market sees brief stability before demand weakens” highlights the instability in the global scrap market. Procurement strategies should incorporate flexible sourcing options and consider the potential impact of scrap price fluctuations on steel production costs, particularly for EAF-based steelmakers in other regions of Asia. No direct impact is explicitly connected to the observed plants.