From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Chinese Semis Exports Surge; Monitor EAF Plant Activity for Supply Shifts

Asia’s steel market is seeing a significant shift driven by increased Chinese exports and fluctuating regional plant activity. According to “China quadrupled its exports of semi-finished steel products in January-May” and “China’s semis exports up 75% in May from April, surge 306% in Jan-May, 2025“, China’s semi-finished steel exports have surged, impacting global markets. The news article “China’s rebar output down 1.6 percent in January-May” describes a recent decrease in Chinese rebar production, which might influence production scheduling in some regional steel plants. A direct relationship between this news and observed plant activity levels can not be established.

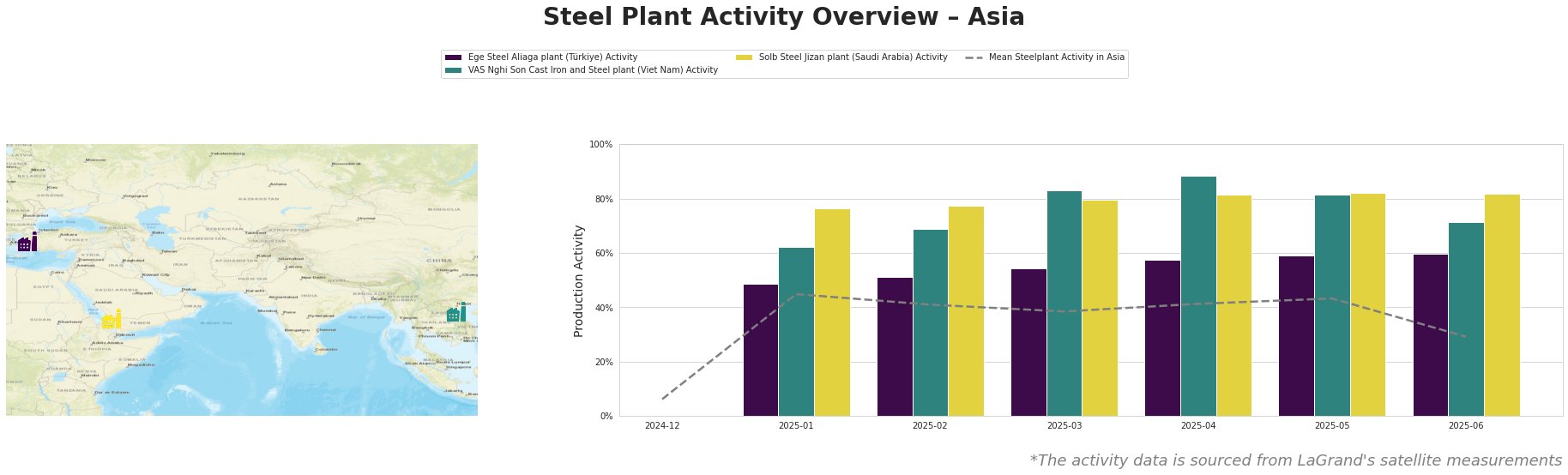

The mean steel plant activity in Asia started at a low of 6.0% in December 2024 before experiencing a significant rise to 45.0% in January 2025. Activity then decreased gradually to 38.0% by March 2025, followed by a slight increase and then a more significant drop to 29.0% in June 2025. The observed steel plants showed diverse behavior compared to the mean activity: The Ege Steel Aliaga plant showed a relatively steady increase in activity, rising from 49.0% in January 2025 to 60.0% in June 2025, consistently above the mean activity level. The VAS Nghi Son Cast Iron and Steel plant peaked at 88.0% in April 2025, before dropping to 71.0% in June 2025, displaying activity well above the mean. The Solb Steel Jizan plant showed the highest consistent activity level, remaining stable at approximately 82.0% from April through June 2025.

Ege Steel Aliaga plant, located in İzmir, Türkiye, operates with a 2,000 TPA EAF capacity, focusing on semi-finished and finished rolled products such as rebar and wire rod. Satellite data indicates a steady increase in activity from 49.0% in January 2025 to 60.0% in June 2025. It is certified with Responsible Steel Certification. There is no direct evidence from the provided news articles to directly explain this trend.

VAS Nghi Son Cast Iron and Steel plant in Thanh Hoa, Viet Nam, has a 3,150 TPA EAF capacity and produces billet, rebar, and wire rod. Satellite observations show activity peaked at 88.0% in April 2025 but decreased to 71.0% in June 2025. This plant is also Responsible Steel Certified. A direct relationship between the observed changes in activity levels and the provided news articles could not be established.

Solb Steel Jizan plant, situated in the Jizan Region of Saudi Arabia, has a 1,200 TPA EAF capacity, manufacturing billet, rebar, rebar in coil, and wire rod. Its activity has remained consistently high, around 82.0% from April through June 2025. The plant is Responsible Steel Certified. The high activity levels could indicate strong regional demand, but a direct connection to the provided news articles cannot be established.

The surge in Chinese semi-finished steel exports, as highlighted in “China quadrupled its exports of semi-finished steel products in January-May” and “China’s semis exports up 75% in May from April, surge 306% in Jan-May, 2025“, suggests a potential shift in supply dynamics. Given the increased exports of semi-finished products from China and their potential impact on regional markets, procurement professionals should closely monitor price fluctuations and lead times from Chinese suppliers. Furthermore, the news article “China’s rebar output down 1.6 percent in January-May” is likely to influence the product focus of different steel plants in the region, as steel plants might adjust their billet production for export markets.

Recommended Actions for Steel Buyers and Market Analysts:

* Monitor Ege Steel Aliaga Plant: The consistently increasing activity at the Ege Steel Aliaga plant suggests a stable, reliable supply source. However, monitor for any disruptions in raw material supply, especially given the broader market volatility.

* Assess VAS Nghi Son Plant Capacity: The drop in activity at the VAS Nghi Son plant from April to June warrants further investigation. Buyers should assess whether this decrease indicates a temporary maintenance period or a longer-term production adjustment, and diversify supply sources accordingly.

* Evaluate Solb Steel Jizan Plant for Regional Supply: The Solb Steel Jizan plant’s steady activity signals a consistent regional supplier. Procurement professionals focusing on the Middle East should evaluate Solb Steel Jizan as a reliable source for rebar and wire rod.

* Leverage Chinese Semis Exports Strategically: Given the surge in Chinese semi-finished steel exports, procurement teams should explore opportunities to leverage these exports for cost savings, but also factor in potential trade-related risks and geopolitical considerations.