From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Chinese PMI Surge & Rising Iron Ore Fuel Price Hikes, Activity Shift in Fujian

Asia’s steel market exhibits positive sentiment driven by increased Chinese demand and rising raw material prices. As highlighted in “China’s steel sector PMI increases to 50.5 percent in July 2025,” China’s steel sector PMI reached 50.5% in July, signaling expansion. The price of iron ore have risen by “Iron ore prices have risen by more than 10% since the beginning of July” and this price surge supports price increases alongside the report from “MOC: Average steel prices in China edge up slightly in July 14-20” with finished steel prices increasing. Satellite data reflects these market dynamics, although direct links to all observed activity changes cannot be definitively established.

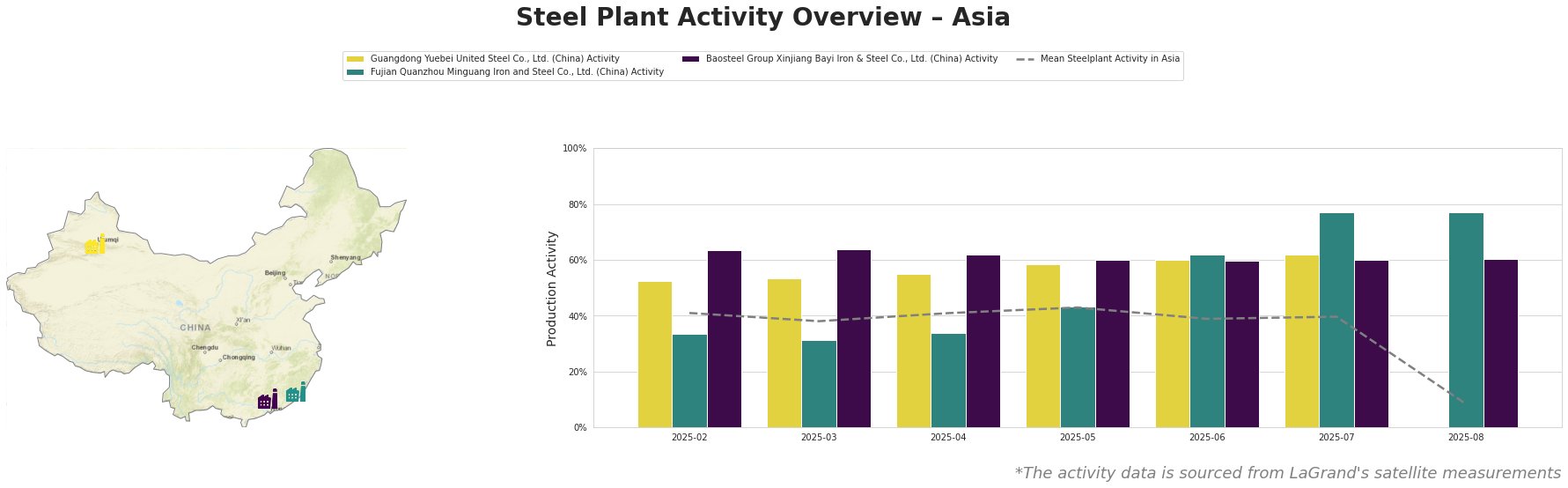

The mean steel plant activity in Asia fluctuated between 38% and 43% from February to July 2025, then dropped sharply to 8% in August. Guangdong Yuebei United Steel Co., Ltd. showed a steady increase in activity from 53% in February to 62% in July. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. experienced a notable increase in activity, rising from 34% in April to 77% in July. Baosteel Group Xinjiang Bayi Iron & Steel Co., Ltd. maintained a relatively stable activity level, hovering between 60% and 64% throughout the observed period. No direct connection could be established between the significant drop in mean steel plant activity in Asia in August with the provided news articles.

Guangdong Yuebei United Steel Co., Ltd., an integrated BF steel plant in Guangdong producing rebar for building and infrastructure, saw its activity level increase steadily from 53% in February to 62% in July. This aligns directionally with the news from “MOC: Average steel prices in China edge up slightly in July 14-20” and “China’s steel sector PMI increases to 50.5 percent in July 2025“, suggesting increased demand and production.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., a BF-BOF based integrated steel plant in Fujian, produces round bar, high-speed bar, coiled rebar and wire rod. The plant’s activity sharply increased from 34% in April to 77% in July. This increase could be reflective of the rising demand indicated in “China’s steel sector PMI increases to 50.5 percent in July 2025“, though a definitive link cannot be established. The plant is located on the coast and has good access to logistics.

Baosteel Group Xinjiang Bayi Iron & Steel Co., Ltd., a large integrated BF-BOF steel plant in Xinjiang producing cold rolled products, hot rolled products, high-speed wire rods, and plate products, exhibited a stable activity level around 60-64% from February to July. This sustained level suggests consistent production, but no direct connection to any of the provided news articles could be established.

The increase in steel sector PMI and rising steel prices, combined with the observed activity increase at Fujian Quanzhou Minguang Iron and Steel Co., Ltd., suggest potential tightness in the long steel (rebar, wire rod) supply chain, especially in coastal areas. Steel buyers should secure contracts with suppliers that can demonstrate stable production, such as Guangdong Yuebei United Steel. Buyers should also closely monitor iron ore prices, as indicated by “Iron ore prices have risen by more than 10% since the beginning of July“, as rising input costs will translate into higher finished steel prices. Traders should take the cost increase into consideration when forecasting prices.