From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Export Surge & India’s Shift Fuel Optimistic Outlook

Asia’s steel market is showing positive signs, driven by increased Chinese exports and a shift in India’s trade dynamics, although S&P Global anticipates continued pressure in Q4 as stated in “Asian steel market to remain under pressure in Q4 – S&P Global“. “China’s Steel Exports Rise 6.6% in January–October 2025” and “China increased steel exports by 6.6% y/y in January-October” highlight this export growth, although no explicit link to satellite-observed changes in plant activity levels can be established, suggesting broader economic factors are at play.

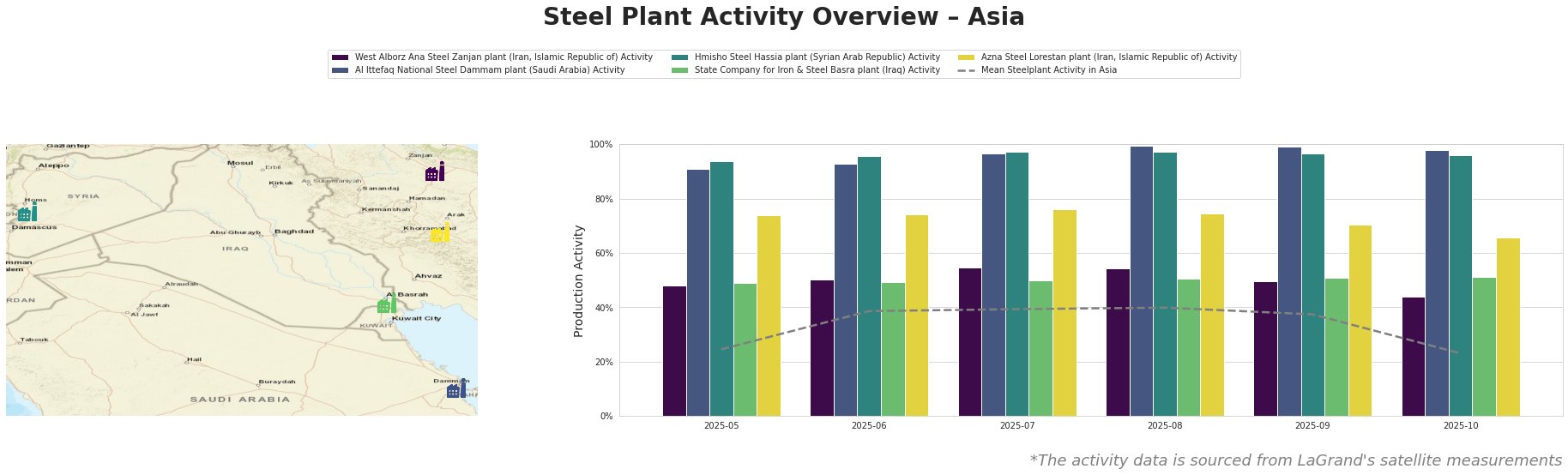

Overall, activity levels across the observed plants in Asia exhibited volatility. The average activity level decreased significantly in October to 23%, after hovering around 37-40% for the previous three months, indicating a potential slowdown in production towards the end of the observed period.

West Alborz Ana Steel Zanjan plant, an integrated DRI-EAF facility with a crude steel capacity of 1500 ttpa, showed a decline in activity in October to 44%, after a peak of 55% in July. No direct connection between this decrease and the news articles can be explicitly established.

Al Ittefaq National Steel Dammam plant, with a 1000 ttpa EAF-based capacity, consistently operated at high activity levels, peaking at 100% in August, and decreasing negligibly by October (98%), significantly above the Asian average. Its location in Saudi Arabia, where Chinese steel exports are booming as noted in “China increases steel exports to Saudi Arabia amid trade restrictions“, suggests a potential indirect influence, though no direct causal link can be confirmed.

Hmisho Steel Hassia plant, an integrated BF-EAF plant with 800 ttpa capacity, maintained a consistently high activity level around 96-97% throughout the observed period. This stability does not directly correlate with any specific news item.

State Company for Iron & Steel Basra plant, an EAF-based facility with a smaller 500 ttpa capacity, displayed relatively stable activity levels around 49-51%. No direct link can be established between this steady activity and any specific news event.

Azna Steel Lorestan plant, an EAF-based facility with a 1200 ttpa capacity, experienced a decline in activity in October to 66%. No direct correlation can be established between this decrease and any of the provided news articles.

The surge in Indian steel exports to 0.6 million tons, as reported in “India Becomes a Net Exporter of Steel in October” and “India became a net exporter of rolled steel in October“, has no direct connection to the observed activity data from the selected steel plants, which are primarily located outside of India, but shows a positive trend for the overall steel market in Asia,

Given China’s increased exports and India’s emergence as a net exporter, steel buyers should consider diversifying their sourcing strategies. Buyers who have historically relied on imports might explore domestic options within India, while those in regions heavily reliant on Chinese steel should monitor the impact of “trade restrictions” as cited in “China increases steel exports to Saudi Arabia amid trade restrictions” and prepare for potential price adjustments.

Additionally, monitor price fluctuations in the pig iron market as “Prices for Brazilian pig iron fell by $10/t in October” indicates potential cost savings or shifts in raw material costs, although the plant activity data doesn’t directly reflect this impact.

Considering S&P Global’s outlook “Asian steel market to remain under pressure in Q4 – S&P Global,” procurement strategies should prioritize flexibility and responsiveness to short-term market shifts. While the overall sentiment is positive, potential demand slowdowns, especially in China, require careful inventory management and agile procurement practices.