From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Talks & Strong Jobs Data Fuel Production Surge, But POSCO Gwangyang Lags

Asia’s steel market demonstrates overall positive sentiment, influenced by US-China talks and robust jobs data. Activity changes appear independent of the news item “Stock Market Today: Market rises on China talks“, but optimism from “US stocks end up on strong jobs data, China-US talks ahead. S&P 500 at highest since Feb.” and “Marktbericht: USA-China-Gespräche halten Börsen in Atem” may have contributed to increased production at several plants, with satellite observations showing generally increasing plant activity. No direct link between individual plant activity and trade talk specifics (e.g., rare earths) can be established based on the provided data.

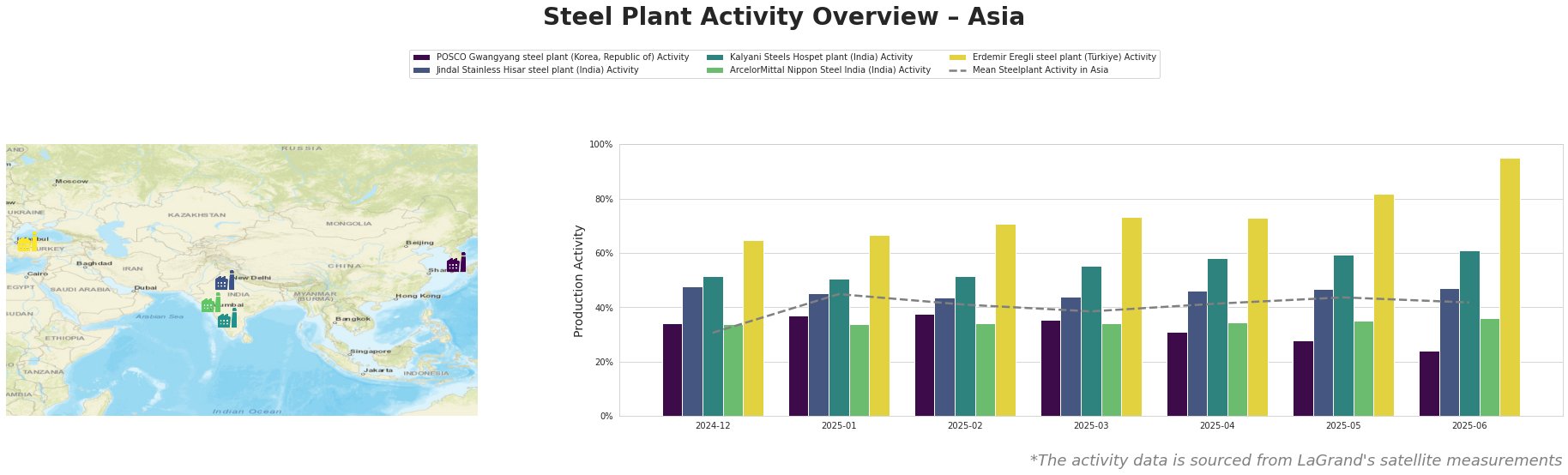

The mean steel plant activity in Asia shows an overall upward trend from December 2024 (31.0%) to May 2025 (44.0%), before slightly decreasing to 42.0% in June 2025. POSCO Gwangyang consistently operates below the mean, with a significant drop to 24.0% in June 2025. Jindal Stainless Hisar shows relatively stable activity. Kalyani Steels Hospet displays a consistent rise in activity, reaching 61.0% in June 2025. ArcelorMittal Nippon Steel India exhibits relatively stable activity, with a slight increase to 36.0% in June 2025. Erdemir Eregli shows the most significant increase, peaking at 95.0% in June 2025.

POSCO Gwangyang, an integrated steel plant in South Korea with a 23 million tonne crude steel capacity utilizing primarily BOF technology, has shown a consistent decrease in activity from 34.0% in December 2024 to 24.0% in June 2025, significantly below the Asian average. This decline does not appear to be directly linked to any of the provided news articles.

Jindal Stainless Hisar, an Indian steel plant with an 800,000-tonne crude steel capacity focused on stainless steel production via EAF, displays relatively stable activity between 44.0% and 48.0%. The fluctuations do not appear directly connected to the provided news articles.

Kalyani Steels Hospet, an integrated Indian steel plant with an 860,000-tonne crude steel capacity using both BF and DRI processes, demonstrates a steady increase in activity, rising from 51.0% in early 2025 to 61.0% in June 2025. The increase in activity does not appear to be directly linked to any of the provided news articles.

ArcelorMittal Nippon Steel India, located in Gujarat, has a 9.6 million tonne crude steel capacity using both BF and DRI, followed by EAF steelmaking. The plant’s activity remained relatively stable at approximately 34%, before rising slightly to 36% in June 2025. This stable trend does not appear to be directly linked to any of the provided news articles.

Erdemir Eregli, a Turkish integrated steel plant with a 4 million tonne capacity using BOF technology, has shown a substantial and consistent increase in activity, from 65.0% in December 2024 to 95.0% in June 2025. This increase is notable and may be indirectly linked to the overall positive market sentiment fueled by the news article “US stocks end up on strong jobs data, China-US talks ahead. S&P 500 at highest since Feb.” and “Marktbericht: USA-China-Gespräche halten Börsen in Atem“.

Given the significant drop in activity at POSCO Gwangyang and the overall positive market sentiment, steel buyers should:

- Monitor POSCO Gwangyang’s Production: Closely track POSCO Gwangyang’s output to anticipate potential supply shortages, as a level of 24% activity is significantly below its potential.

- Diversify Sourcing: Explore alternative sources for products typically supplied by POSCO Gwangyang, considering the plant’s diminished activity.

- Assess Erdemir Eregli Capacity: Investigate opportunities to increase procurement from Erdemir Eregli, given its substantial production increase, to potentially offset supply concerns from POSCO Gwangyang.

- Maintain awareness of US-China Trade Talks: Closely follow the news, specifically regarding outcomes of trade negotiations highlighted in “Marktbericht: USA-China-Gespräche halten Börsen in Atem“, to proactively adapt procurement strategies based on shifts in international trade relations and the potential impacts on steel prices.