From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Production Cuts Impacting Regional Supply Amid Rising Turkish Imports

In Asia, steel production dynamics are shifting due to environmental regulations and import trends. Stricter production cuts in Tangshan, China, as reported in “Output cuts in Tangshan in August to be much bigger than in July,” are likely influencing regional supply, although a direct link to overall activity levels cannot be explicitly established. These cuts coincide with a decrease in China’s crude steel output as noted in “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July.” Simultaneously, Turkey’s steel imports are surging, evidenced by “Turkey’s CRC imports up 33.5 percent in H1 2025” and “Turkey’s billet imports up 59.2 percent in H1 2025“, indicating a shift in trade flows within the region. Taiwan’s steel export value declined, as highlighted by “Taiwan’s iron and steel export value down 8.2 percent in January-July 2025,” while US scrap exports also decreased, detailed in “US iron and steel scrap exports down 19.1 percent in June 2025“.

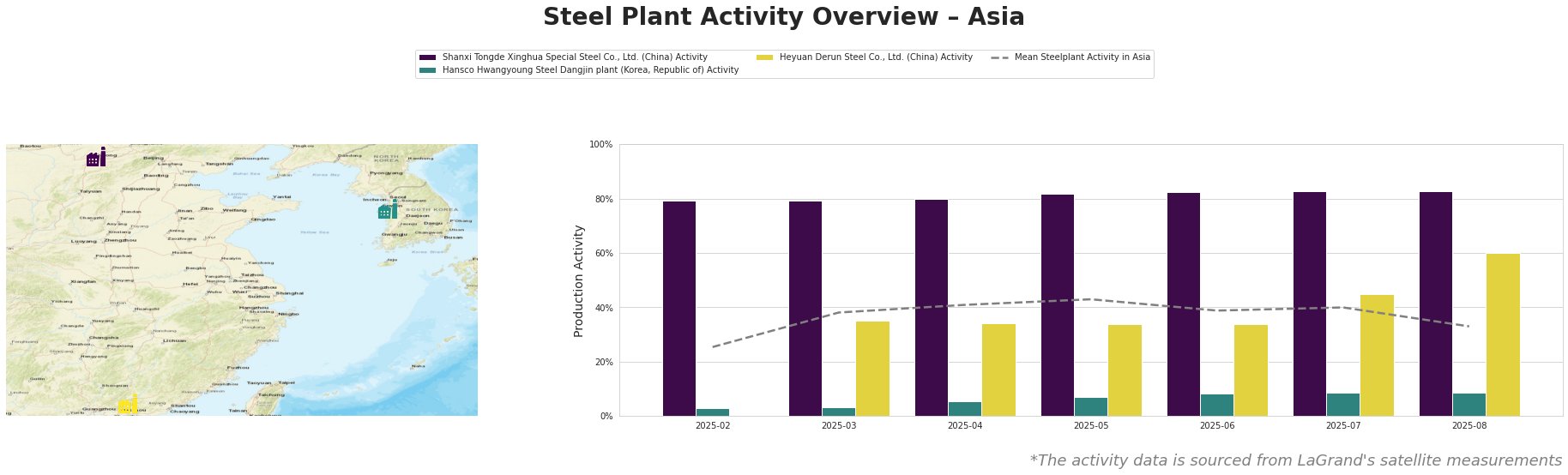

The mean steel plant activity in Asia saw a peak in May 2025 at 43%, then experienced a notable decrease to 33% by August 2025. Shanxi Tongde Xinghua Special Steel Co., Ltd., an integrated BF/BOF producer of billet and rebar, maintained consistently high activity levels, ranging from 79% to 83% throughout the observed period, significantly above the Asian mean. Hansco Hwangyoung Steel Dangjin plant, a South Korean EAF-based rebar and billet producer, exhibited very low activity, remaining below 10% throughout the period. Heyuan Derun Steel Co., Ltd., a Chinese EAF-based rebar and billet producer, showed a significant increase in activity from 34% in June 2025 to 60% in August 2025. No direct connection between the observed activity levels and the provided news articles can be explicitly established for these plants.

Shanxi Tongde Xinghua Special Steel Co., Ltd., a Chinese integrated steel plant utilizing BF/BOF technology with a crude steel capacity of 2.5 million tonnes, maintained very high activity levels throughout the period, peaking at 83% in July and August 2025. Given its location and BF/BOF production route, no direct correlation can be established between its activity and the production cuts mentioned in “Output cuts in Tangshan in August to be much bigger than in July,” which focused on Tangshan and sintering restrictions.

Hansco Hwangyoung Steel Dangjin plant, a South Korean EAF-based steel plant with a crude steel capacity of 800,000 tonnes, producing rebar and billet, consistently operated at very low activity levels. No direct connection to the provided news articles can be established.

Heyuan Derun Steel Co., Ltd., a Chinese EAF-based steel plant in Guangdong province with a crude steel capacity of 1.2 million tonnes, producing rebar and billet, experienced a substantial increase in activity, rising from 34% in June to 60% in August 2025. Given its EAF production route and location outside of the Beijing-Tianjin-Hebei region, no direct connection can be established between its activity and the production cuts mentioned in “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July” or “Output cuts in Tangshan in August to be much bigger than in July“.

The production cuts in Tangshan, as reported in “Output cuts in Tangshan in August to be much bigger than in July,” combined with the overall decrease in China’s crude steel output reported in “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July,” signal potential supply disruptions in the Chinese market, particularly for billet and rebar. Despite some plants showing strong activity, the observed decrease in mean activity across Asia in August might reflect more extensive output reductions than those detailed for Tangshan. Steel buyers should closely monitor Chinese domestic prices and lead times, and consider diversifying their sourcing to mitigate risks from potential supply shortages. Given the surge in Turkish billet imports, as noted in “Turkey’s billet imports up 59.2 percent in H1 2025“, Turkish suppliers may present an alternative, however, monitor prices closely to understand the impacts on importing from Turkey.