From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Output Dips, India Plants Stable Amid Export Surge

Asia’s steel market shows mixed signals. While China’s production declines, Indian plants exhibit relative stability. According to “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025” and “China cuts steel production to 73 million tons in September,” China experienced a significant drop in steel output, attributed to seasonal factors and policy shifts. However, no direct relationship between these specific Chinese production cuts and the satellite-observed activity of Indian steel plants can be definitively established based on the provided information.

Here’s a summary of recent activity:

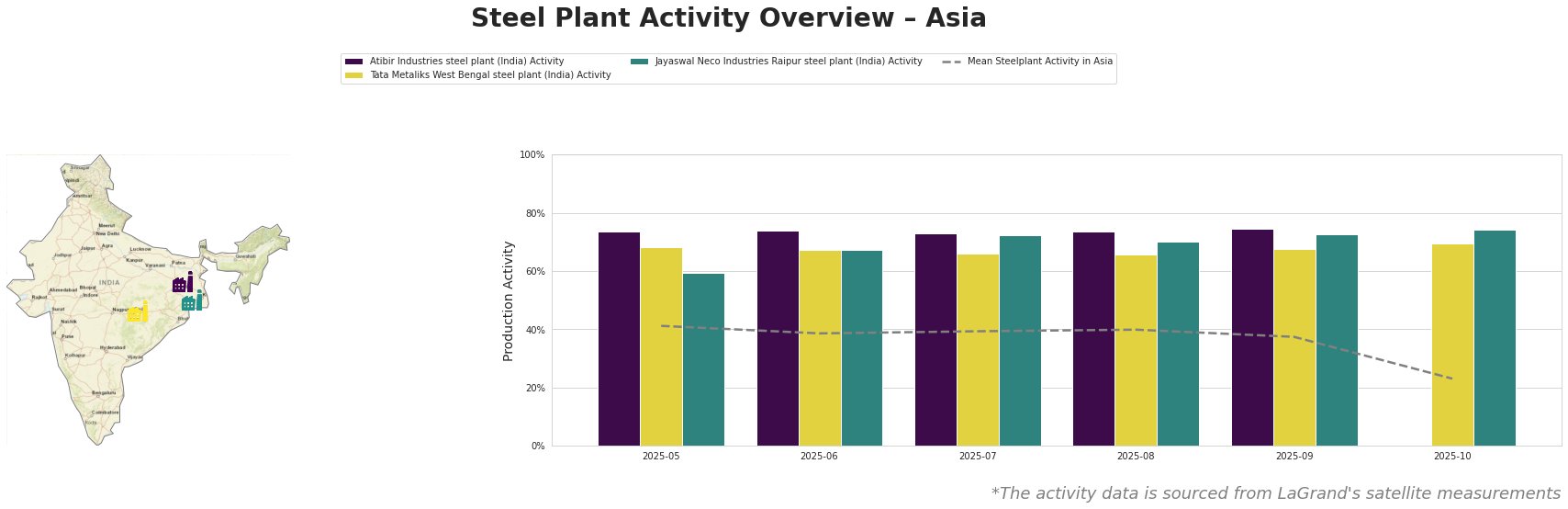

The mean steel plant activity in Asia has fluctuated and then sharply decreased, falling to 23.0% by the end of October. Atibir Industries maintained a relatively high and stable activity level from May to September. The Tata Metaliks West Bengal steel plant showed consistently high activity levels between 66.0% and 70.0%. Jayaswal Neco Industries Raipur steel plant’s activity also remained relatively high and stable, peaking at 74.0% in October. Note that in October, the mean Steelplant activity in Asia drops sharply, while the Jayaswal Neco Industries Raipur steel plant reaches a measured all-time high.

Atibir Industries, a 600 ttpa crude steel capacity plant in Jharkhand, India, utilizes integrated (BF) production with BF and BOF equipment. The plant maintained a high activity level around 74% from May to September 2025. There is no explicit link to the China-related news articles, suggesting local demand or export strategies are driving production. The plant is ResponsibleSteel certified.

Tata Metaliks West Bengal, with a 255 ttpa crude steel capacity, employs integrated (BF) production. Its activity remained stable around 66-70% from May to October 2025. The plant focuses on pig iron and ductile pipes and holds ISO14001 and ResponsibleSteel certifications. There’s no direct connection to the Chinese production news.

Jayaswal Neco Industries Raipur, a 1200 ttpa crude steel capacity plant in Chhattisgarh, India, uses integrated (BF and DRI) production. Activity remained high, increasing to 74% by October. The facility uses BF, DRI, and EAF equipment. They produce pig iron, DRI, blooms, billets, and rolled products. The plant’s consistently high activity, despite the decline in the Asia-wide mean, suggests robust regional demand or effective export strategies, with no direct impact discernible from the provided Chinese steel production news. The plant is ISO14001 and ResponsibleSteel certified.

Given the reduction in China’s crude steel output as detailed in “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025,” and the surge in Chinese semi-finished steel exports reported in “China’s semi-finished steel exports rise 215.43% in January – September 2025,” steel buyers should anticipate potential pricing volatility, particularly for semi-finished products. While Indian plant activity remains stable, the substantial increase in Chinese exports may create downward pressure on prices, especially for commoditized steel grades. Procurement professionals should consider diversifying their supply sources and closely monitor price trends from Chinese exporters, leveraging this potential oversupply. Indian steel production is not significantly impacted in observed activity despite the output dip in China and corresponding rise in exports, the long-term effects are unclear and should be watched carefully by procurement professionals.