From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Angang Activity Stable Amid EU Trade Concerns, Regional Downturn Observed

Asia’s steel market shows a mixed picture with stable activity at Angang Steel contrasting a regional downturn. Observed changes in plant activity levels do not directly correlate to the news articles “EU groups call to curb imports of steel derivatives“, “EU to negotiate with US on steel imports-Merc“, and “EU to negotiate with US on steel imports – Merz” focusing on European trade dynamics, suggesting that those external factors have not yet impacted Asian steel production, or that their impact is masked by other market forces.

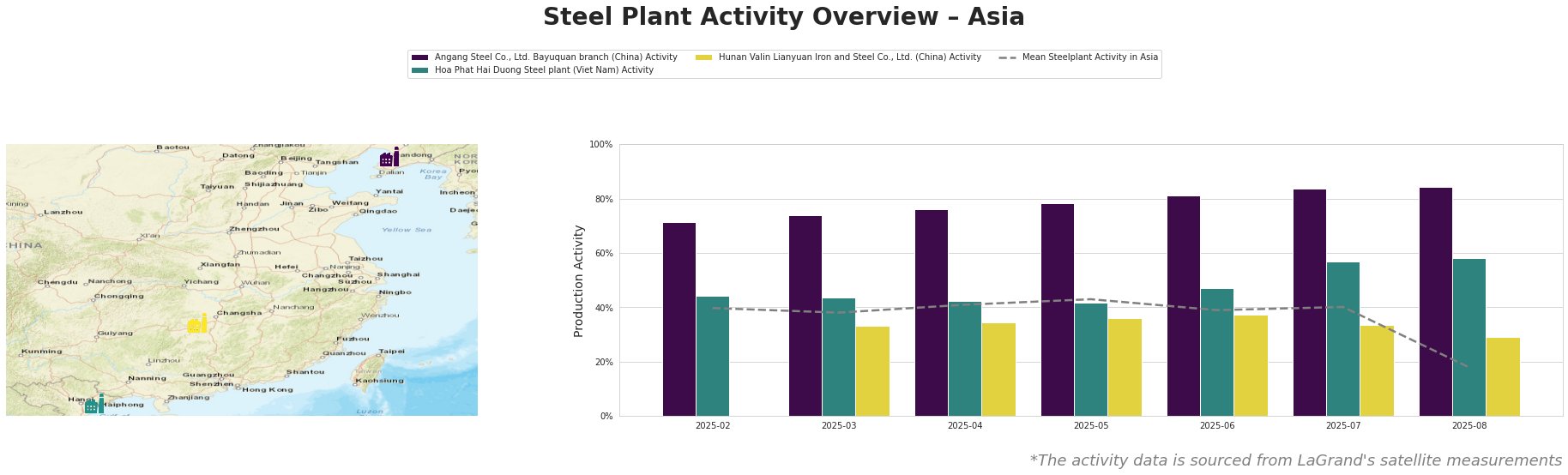

The mean steel plant activity in Asia saw a significant drop to 18% in August, down from 40% in July. Angang Steel maintained a high activity level of 84% in both July and August, bucking the regional downward trend. Hoa Phat Hai Duong Steel plant saw a slight increase from 57% in July to 58% in August. Hunan Valin Lianyuan Iron and Steel Co., Ltd. experienced a decrease from 33% in July to 29% in August.

Angang Steel Co., Ltd. Bayuquan branch, located in Liaoning, China, operates as an integrated BF steel plant with a crude steel capacity of 6.5 million tonnes, primarily producing finished rolled products such as container steel and ship plate. Despite the overall decline in regional activity, Angang’s activity remained stable at a high level of 84% between July and August, indicating continued strong production. No direct connection can be established between Angang’s activity and the EU-related news articles.

Hoa Phat Hai Duong Steel plant, located in Hai Duong, Vietnam, is an integrated BF steel plant with a crude steel capacity of 2.5 million tonnes, producing construction steel and hot rolled coil. Its activity increased slightly to 58% in August, contrasting the regional downtrend, suggesting localized demand or operational factors are at play. The increase in activity shows no direct impact from the European negotiations, but could still be impacted indirectly (see evaluated market implications).

Hunan Valin Lianyuan Iron and Steel Co., Ltd., situated in Hunan, China, is another integrated BF steel plant with a 9 million tonnes crude steel capacity, specializing in electric steel and automotive steel. Its activity decreased to 29% in August. No direct correlation can be established to the cited news articles.

The sharp drop in the mean steel plant activity in Asia in August suggests a potential region-wide slowdown. This could be due to various factors not explicitly covered in the provided news, such as changes in local demand, seasonal effects, or government policies. Given the stable high activity at Angang Steel and the slight increase at Hoa Phat Hai Duong, buyers should:

* Diversify Sources: The significant drop in mean regional activity highlights the risk of relying on a single supplier or region.

* Monitor Angang Steel: Given its stable output, Angang represents a more reliable short-term supplier but be aware that their focus on container steel and ship plate might shift availability of construction steel.

* Consider Hoa Phat: The slight increase in production at Hoa Phat Hai Duong indicates their ability to meet demand, especially for construction steel and hot rolled coil. However, be aware that the increase comes from lower levels than at Angang.

The European trade negotiations do not seem to be impacting production levels directly yet, but the Vietnamese plant’s increase might be due to anticipation of increased exports to Europe.