From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Surge Offsets US Import Shifts, Presents Procurement Opportunities

Asia’s steel market shows strong production activity despite shifts in US import patterns. Recent satellite data indicates increased activity at key Asian steel plants, while news articles detail changes in US steel imports and exports. These diverging trends present specific procurement opportunities for steel buyers focused on the Asian market.

Observed increases in Asian steel plant activity do not correlate with changes in US trade flows reported in articles such as “US CRC exports up 0.6 percent in July 2025,” “The US reduced its imports of rolled steel products by 16.8% m/m in August,” “US exports of plates in coil up 11.5 percent in July 2025,” “US CRC imports up 12.7 percent in July 2025,” and “US HRC imports up 16.7 percent in July 2025,” suggesting domestic or regional demand is driving Asian production.

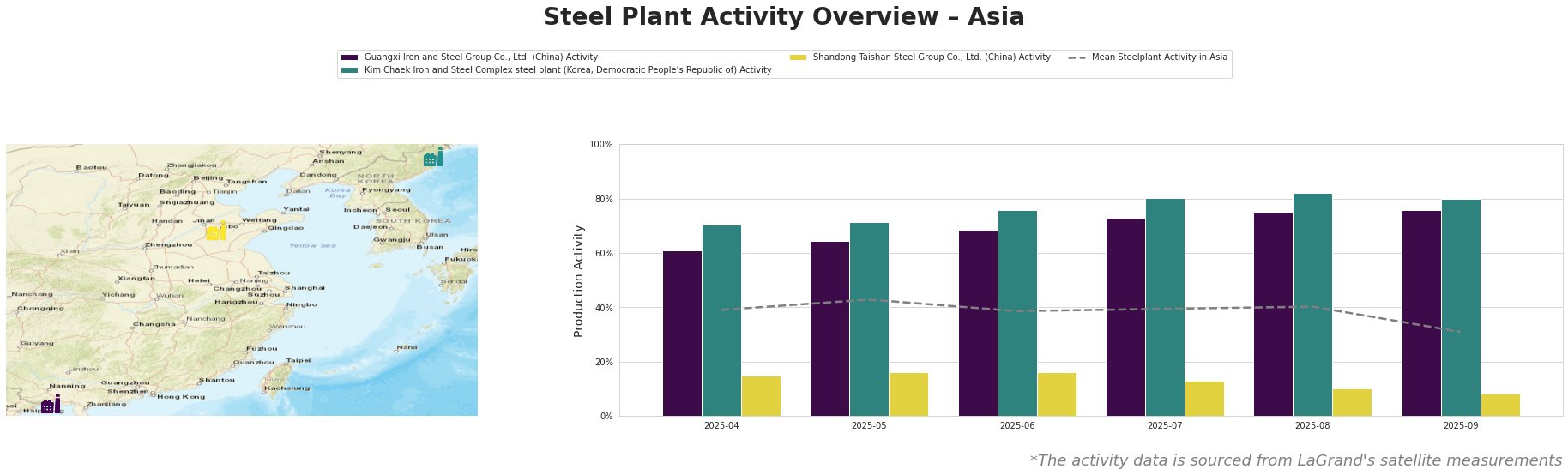

The mean steel plant activity in Asia fluctuated between 39% and 43% from April to August 2025, then dropped significantly to 31% in September. Guangxi Iron and Steel Group Co., Ltd., and Kim Chaek Iron and Steel Complex consistently operated above the Asian average, with Kim Chaek showing a peak activity of 82% in August. Shandong Taishan Steel Group Co., Ltd., operated significantly below the average, experiencing a notable decline from 16% in June to 8% in September.

Guangxi Iron and Steel Group Co., Ltd., an integrated BF steel plant in Guangxi, China, producing 9,200 TTPA Crude Steel primarily via BOF, has steadily increased its activity from 61% in April 2025 to 76% in September 2025, significantly exceeding the Asian average. This increase does not show a direct correlation to the US import/export news, suggesting strong regional demand. Its focus on finished rolled products, including cold rolled coil and hot-dip galvanized coil, aligns with products impacted by the US trade shifts but doesn’t indicate a direct connection.

Kim Chaek Iron and Steel Complex steel plant, located in North Hamgyeong, Democratic People’s Republic of Korea, consistently maintained high activity levels, peaking at 82% in August 2025 before declining slightly to 80% in September. This activity, also above the Asian average, doesn’t show a direct correlation to the US import/export news. This plant has a 6,000 TTPA crude steel capacity, utilizes integrated BF processes, and produces a wide range of products including hot and cold rolled steel, plate, and wire rod.

Shandong Taishan Steel Group Co., Ltd., an integrated BF steel plant in Shandong, China, experienced a significant decrease in activity, dropping from 16% in June 2025 to 8% in September 2025. This is significantly below the Asian average. With a 5,000 TTPA crude steel capacity, its production of hot and cold rolled coil could potentially be affected by global market fluctuations. However, no direct link to the US trade news can be explicitly established.

Given the sustained high activity at Guangxi Iron and Steel and Kim Chaek Iron and Steel, despite fluctuating US import dynamics, steel buyers should consider these plants as reliable suppliers for cold rolled coil and other finished products. The reduced activity at Shandong Taishan warrants caution, suggesting potential supply constraints. Steel analysts should monitor Shandong Taishan for further declines, as this could indicate broader regional economic challenges, however, no link can be established to the mentioned news articles.