From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Mixed Amidst Brazilian Export Shifts

Asia’s steel market shows mixed activity levels, partially influenced by shifts in global trade flows stemming from Brazilian export adjustments. The “Prices for Brazilian pig iron fluctuated between $400 and $405/t in August” and “Brazilian pig iron exports decline in July” articles suggest a possible redirection of pig iron exports toward Asia due to US tariffs and reduced Brazilian exports to the US. However, no direct correlation between these articles and the recent activity of specific Asian steel plants can be definitively established based solely on the provided data.

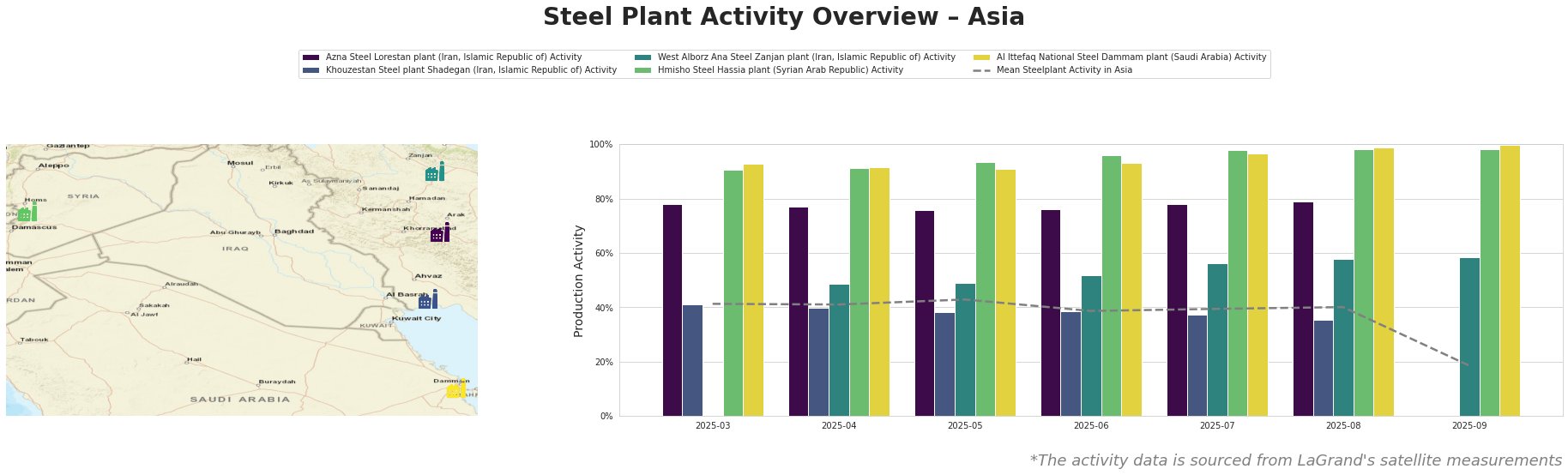

The mean steel plant activity in Asia decreased sharply to 19% in September, a significant drop from the previous months.

Azna Steel Lorestan plant: This Iranian EAF-based plant, producing 1200 ttpa of semi-finished products like sheets and slabs, consistently operated well above the Asian mean activity level, hovering around 76-79% between March and August. No data is available for September. No direct link between the observed activity levels and the provided news articles can be established.

Khouzestan Steel plant Shadegan: Also located in Iran, this integrated DRI-EAF plant with a 3600 ttpa crude steel capacity and 4000 ttpa iron capacity showed a gradual decline in activity from 41% in March to 35% in August. No data is available for September. As a producer of semi-finished products (bloom, slab, billets) using DRI, any shift in global pig iron flows might indirectly influence its operations. However, based on the current information, no direct relationship can be proven.

West Alborz Ana Steel Zanjan plant: This Iranian integrated DRI-EAF plant, with 1500 ttpa crude steel capacity, showed a steady increase in activity, rising from 49% in April to 58% by August, remaining constant until September. The observed plant activity changes are unrelated to the provided news excerpts.

Hmisho Steel Hassia plant: This Syrian integrated BF-EAF plant with 800 ttpa crude steel capacity operated at consistently high levels, ranging from 91% to 98% throughout the observed period. The high activity levels at Hmisho Steel Hassia plant seem disconnected from global trade dynamics described in the Brazilian steel market news articles.

Al Ittefaq National Steel Dammam plant: This Saudi Arabian integrated DRI-EAF plant with 1000 ttpa crude steel capacity increased its activity from 93% in March to 100% in September, operating at all-time-high levels. The observed activity increases are unrelated to the provided news excerpts.

Given the decrease in mean steel plant activity levels in Asia during September and potential redirection of Brazilian exports, steel buyers should closely monitor price fluctuations and supply availability, especially for pig iron. Procurement teams are advised to diversify their sourcing strategies, exploring alternative suppliers within and outside of Asia to mitigate potential supply disruptions or price increases. Actively track import/export data related to pig iron and slabs, particularly from Brazil, to anticipate further market adjustments. While the article “ArcelorMittal Brazil shifts slab trade” discusses the impact of US tariffs and ArcelorMittal’s strategy to redirect exports to Europe and Turkey, there is no direct evidence suggesting increased availability of Brazilian slabs in Asia, hence no direct implications can be derived.