From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Fluctuations Amidst Rising US Exports, Procurement Strategies Advised

Asia’s steel market exhibits mixed signals as plant activity fluctuates, coinciding with increased US steel exports, but direct connections are difficult to establish. The activity changes should be carefully tracked because of the “US tool steel exports up 24.2 percent in May 2025” and “US iron and steel scrap exports up 17.3 percent in May 2025“, which could influence global steel supply chains, which will be further detailed below.

Measured Activity Overview

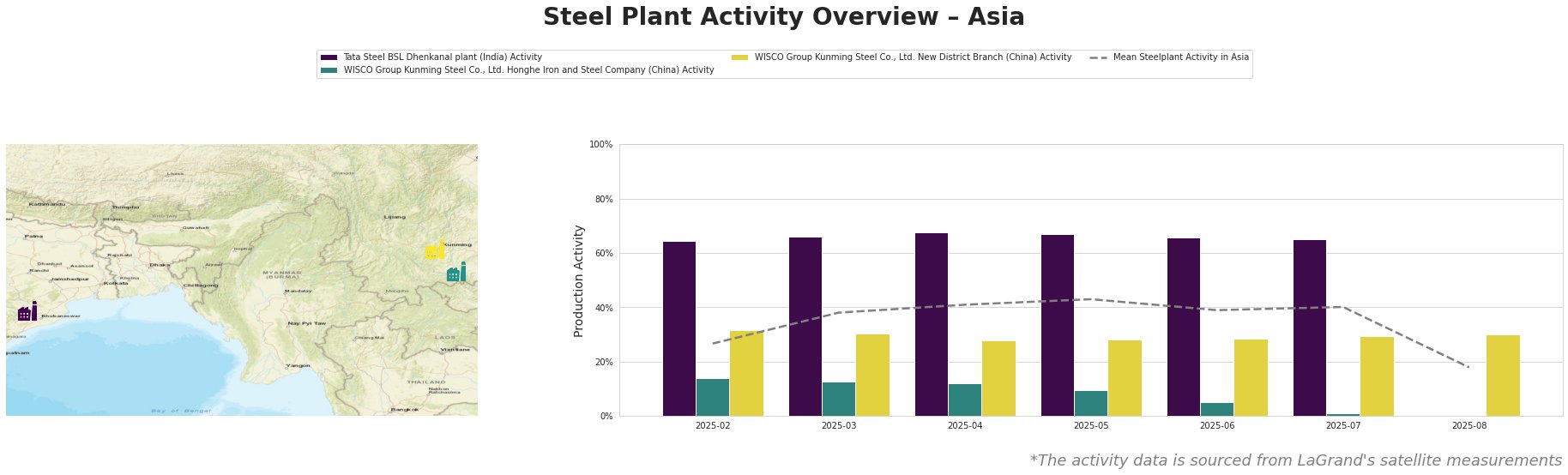

The mean steel plant activity in Asia peaked in May 2025 at 43% and then sharply decreased to 18% in August 2025. The Tata Steel BSL Dhenkanal plant in India consistently operated above the mean activity level, remaining relatively stable from February to July 2025. In contrast, the WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company in China experienced a significant decline in activity, plummeting from 14% in February 2025 to 0% in August 2025. The WISCO Group Kunming Steel Co., Ltd. New District Branch maintained a stable activity level around 30% throughout the observed period, despite the overall market fluctuations. No direct connection between the steel plant activity and the news “US tool steel exports up 24.2 percent in May 2025”, “US iron and steel scrap exports up 17.3 percent in May 2025”, or “US steel mill shipments up 9.8 percent in June 2025” could be established.

Tata Steel BSL Dhenkanal plant, an integrated steel plant in Odisha, India, shows consistently high activity levels compared to the Asian average. With a crude steel capacity of 5600 ttpa (thousand tons per annum) using both BF (Blast Furnace) and DRI (Direct Reduced Iron) processes, and producing hot rolled coil, pipe, and sheet, its stable operation suggests reliable supply. The plant holds a ResponsibleSteel Certification, indicating adherence to sustainability standards. The activity decreased to 65% at the end of July 2025, after a period of stabilization. This does not seem to be related to the news around “US tool steel exports up 24.2 percent in May 2025”, “US iron and steel scrap exports up 17.3 percent in May 2025”, or “US steel mill shipments up 9.8 percent in June 2025”.

WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company, located in Yunnan, China, produces finished rolled products with a crude steel capacity of 1150 ttpa using BF and BOF (Basic Oxygen Furnace) processes. The plant’s activity has sharply declined over the observed period, reaching 0% in August 2025. This substantial drop could indicate production cuts or facility maintenance, potentially impacting regional supply of bars, wire, and hot-rolled strips. No connection with the news around “US tool steel exports up 24.2 percent in May 2025”, “US iron and steel scrap exports up 17.3 percent in May 2025”, or “US steel mill shipments up 9.8 percent in June 2025” can be established.

WISCO Group Kunming Steel Co., Ltd. New District Branch, also in Yunnan, China, maintains a stable activity level. This plant has a larger crude steel capacity of 2800 ttpa, relying on BF and BOF processes for production. The relative stability of this plant’s output may partially offset the decreased activity at the Honghe Iron and Steel Company.

Evaluated Market Implications

The substantial drop in activity at WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company presents a potential supply disruption in the regional market for bars, wire, and hot-rolled strips, as the plant’s activity plummeted to 0% in August 2025.

Recommended Procurement Actions:

- For buyers relying on WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company for steel products: Immediately diversify your supply base to mitigate risks associated with the plant’s decreased production. Explore alternative suppliers in China or other Asian countries for bars, wire, and hot-rolled strips.

- For market analysts: Closely monitor inventory levels and price fluctuations in the Yunnan region and surrounding areas. Track activity at other WISCO Group facilities to assess potential shifts in production strategies. Examine import/export data to identify alternative sources filling the supply gap. Pay close attention to scrap availabilities.

These actions are explicitly justified by the observed decline in plant activity and the potential impact on regional steel supply and pricing.