From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Declines Signal Supply Risks Amidst Gloomy European Outlook

Asia’s steel market faces a concerning downturn, reflected in recent steel plant activity, amidst broader global uncertainty. The observed decline in Asian steel plant activity does not directly correlate with the explicitly provided news articles focusing on the European market. However, the reported challenges in Europe, such as those detailed in “Steel demand in Europe will recover only slightly” and “Eurofer: US friction delays EU demand recovery,” point to a broader global economic slowdown that could indirectly impact Asian steel demand and production. There is no established direct connection through explicit linkages.

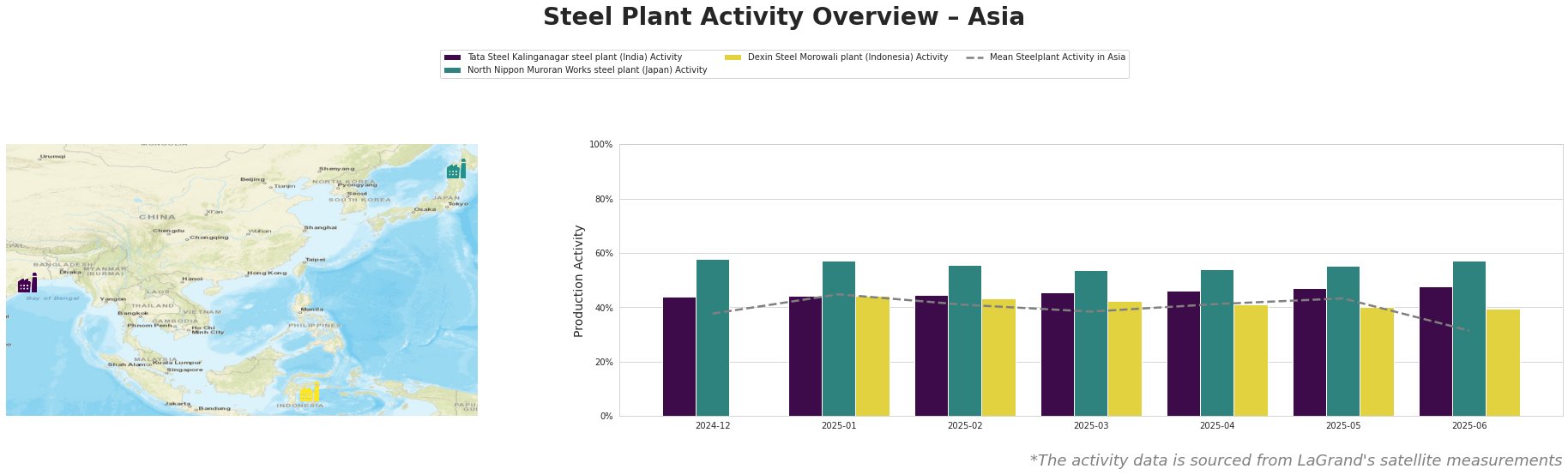

Monthly Steel Plant Activity in Asia

The mean steel plant activity across the observed Asian plants shows a clear downward trend, dropping from 43.0% in May to 31.0% in June. Tata Steel Kalinganagar plant’s activity increased throughout the period, reaching 48% in June. The North Nippon Muroran Works plant demonstrated relative stability, fluctuating between 54% and 58%, however also experiencing a slight drop in activity levels. Dexin Steel Morowali plant, after an initial reading of 44% in January, gradually declined to 39% by June. The substantial drop in the mean activity level in June is largely driven by declines in the Dexin Steel Morowali plant.

Tata Steel Kalinganagar, located in Odisha, India, is an integrated steel plant with a 3000 ttpa crude steel capacity, utilizing BF and BOF technologies and sourcing iron ore from a captive mine. The plant primarily produces finished rolled products for the automotive sector. Activity at the Kalinganagar plant increased from 44% in December 2024 to 48% in June 2025, bucking the regional downward trend. Given the exclusive focus on European market dynamics in the provided articles, no direct link between the performance of the Kalinganagar plant and the news reports can be established.

North Nippon Muroran Works, situated in Hokkaidō, Japan, combines integrated BF and EAF steelmaking with a crude steel capacity of 2598 ttpa. The plant produces semi-finished and finished rolled products, including bars and wires, serving the automotive sector and also provides power generated via by-product gas and coal to Hokkaido Electric Power. The plant’s activity has remained relatively stable but experienced a slight decline from 58% in December 2024 to 57% in June 2025. The “Eurofer: US friction delays EU demand recovery” article mentions a weak automotive sector in Europe potentially impacting demand for steel products. However, it is not possible to confirm if this affects North Nippon Muroran Works specifically.

Dexin Steel Morowali plant, located in Central Sulawesi, Indonesia, possesses a 3500 ttpa crude steel capacity, operating an integrated BF-BOF process. It produces both semi-finished (slab, billet) and finished rolled products (wire rod, bar), catering to the building and infrastructure sectors, as well as the automotive industry. The plant’s activity dropped from 44% in January 2025 to 39% in June 2025, contributing to the overall decline in the regional mean activity level. There is no established direct connection through explicit linkages.

Given the significant decline in mean steel plant activity in Asia, coupled with the pessimistic outlook for European steel demand highlighted in “European steel demand will recover only modestly,” and the potential for delayed recovery due to US trade friction as stated in “Eurofer: US friction delays EU demand recovery,” steel buyers should consider the following:

- Diversify Sourcing: The drop in activity at the Dexin Steel Morowali plant (Indonesia) warrants diversifying procurement sources to mitigate potential supply disruptions specifically for wire rod, slab, and bar products.

- Monitor Regional Trends Closely: Given the overall negative trend in Asian steel plant activity, closely monitor activity levels at other plants in the region to anticipate further supply-side issues and adjust procurement strategies accordingly.