From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineActivity Decrease at Simec Steel Plant Signals Potential Supply Challenges Amid Rising Demand

Introduction

The Simec Pindamonhangaba steel plant, located in São Paulo, Brazil, has recently shown a decrease in operational activity, raising concerns among buyers and analysts. Owned by Simec Group, this facility has an annual production capacity of 500,000 tonnes, primarily producing finished rolled products such as wire rod and rebar for the building and infrastructure sectors.

Activity Change Overview

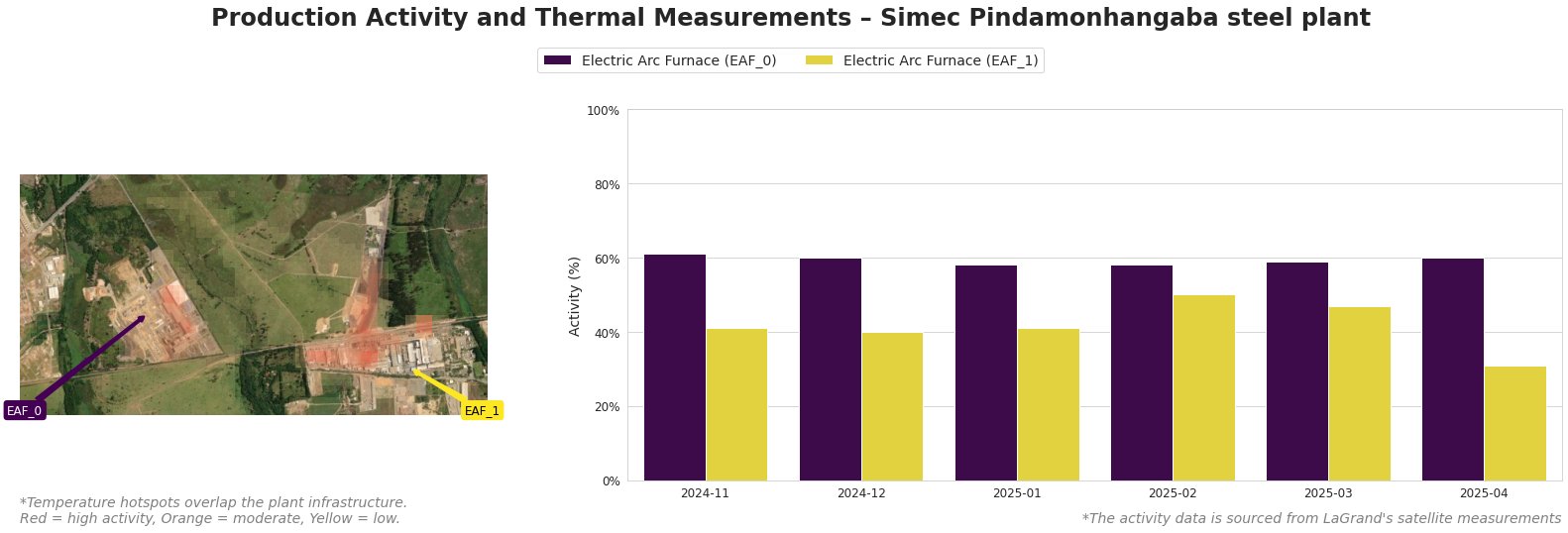

Recent thermal activity data indicates a sustained decline in operations, particularly affecting both Electric Arc Furnaces. Notably, from November 2024 to April 2025, there was a downward trend, culminating in a significant drop in performance that may impact supply chain dynamics.

Trends Observed

The data illustrate a general decline in thermal activity, particularly in EAF_1, which fell to 31.0% in April 2025. This consistent downward trajectory signifies operational challenges, which may cause bottlenecks in supply as demand within Brazil’s building and infrastructure market is expected to rise, influenced by trends in other sectors, as mentioned in Brazil’s CSN expects flat steel, upside ahead and Brazil’s Usiminas steel price outlook murky.

Implications for Steel Buyers and Market Analysts

The downward trend in Simec’s production efficiency could lead to potential supply limitations amidst a backdrop of rising demand in the domestic market. Analysts should closely monitor these developments, as they may influence pricing strategies and market stability. Increased pressures from imports—highlighted in Brazil’s Usiminas steel price outlook murky—could exacerbate these supply issues, impacting overall market conditions. With evolving regulatory landscapes in nearby markets, particularly concerning production in China (China continues efforts to regulate steel production), the implications for operational capacities and competitive posture in Brazil become critical points for assessment.