From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndian Steel Exports Surge Despite US Tariff Impact: A Positive Outlook for Asia

India’s increased steel exports and steady plant activity levels signal a positive outlook for the Asian steel market, even with adjustments due to global trade dynamics. The report leverages insights from the news articles “India increased steel exports by 12% y/y in April” and satellite-observed activity, establishing direct connections between export trends and regional production.

India’s steel exports rose 11.7% year-on-year in April, as reported in “India increased steel exports by 12% y/y in April“. This increase appears to be partially reflected in the observed activity levels at the NMDC Nagarnar and Tata Steel BSL Dhenkanal plants in India, which have remained relatively high. However, no direct relationship can be established for the West Alborz Ana Steel Zanjan plant in Iran, as its activity level decreased despite the general positive outlook.

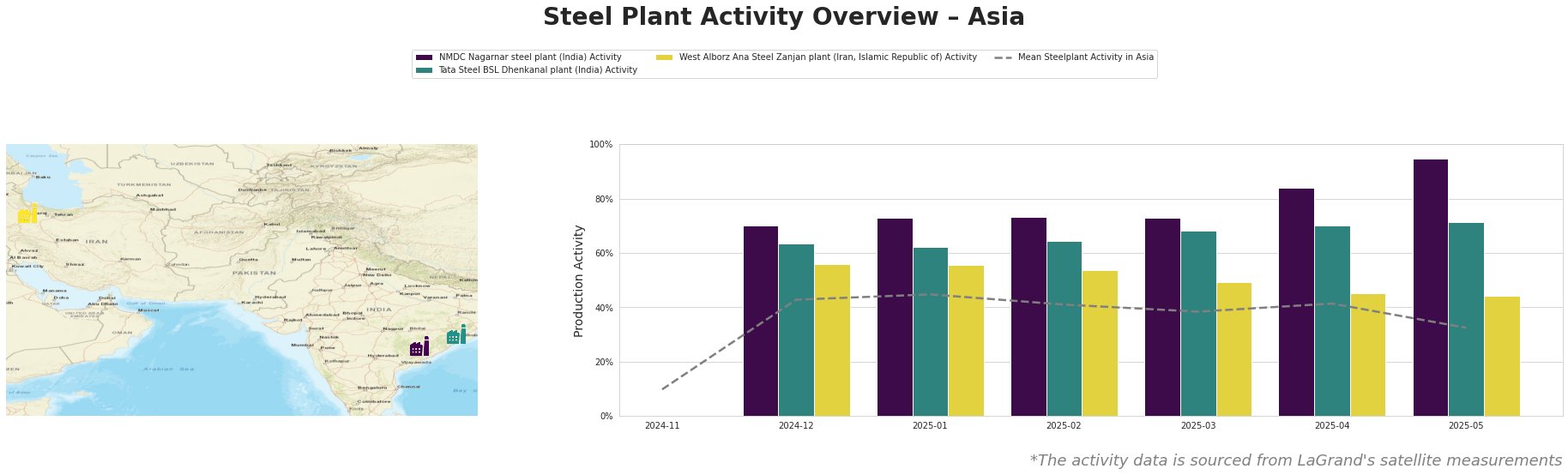

The mean steel plant activity in Asia started low, at 10% in November 2024, before climbing to a peak of 45% in January 2025, then fluctuating to end at 32% in May 2025. The NMDC Nagarnar plant shows consistently high activity, climbing to 95% in May 2025, while the Tata Steel BSL plant shows generally high activity levels, peaking at 71% in May 2025. The West Alborz Ana Steel Zanjan plant’s activity is the lowest, falling to 44% in May 2025.

NMDC Nagarnar steel plant: This integrated BF-BOF plant in Chhattisgarh, India, boasts a crude steel capacity of 3 million tons per annum (ttpa) and produces finished rolled products like hot rolled coils, sheets, and plates. Its activity has shown a steady climb to 95% in May, well above the Asian average, suggesting it is operating at near full capacity. This high activity may be linked to the increased export demand reported in “India increased steel exports by 12% y/y in April,” particularly the growth in flat product exports.

Tata Steel BSL Dhenkanal plant: Located in Odisha, India, this integrated plant utilizes both BF and DRI processes, with a crude steel capacity of 5.6 million ttpa. It produces both semi-finished and finished rolled products, including hot rolled coil, pipe, and sheet. The plant’s activity has remained relatively stable, around 70%, likely contributing to India’s increased export volume. The news “India increased steel exports by 12% y/y in April” notes that India’s increased focus on EU markets may be influencing plant activity.

West Alborz Ana Steel Zanjan plant: This DRI-based plant in Zanjan, Iran, has a crude steel capacity of 1.5 million ttpa, primarily producing semi-finished products like billets. Its activity has declined to 44% in May. No explicit connection to the provided news articles can be established.

Evaluated Market Implications:

The rise in Indian steel exports, coupled with high activity at NMDC Nagarnar and Tata Steel BSL plants, indicates potential supply shifts. Given the US tariffs mentioned in “India increased steel exports by 12% y/y in April,” Asian steel buyers can anticipate a possible redirection of Indian steel originally intended for the US market.

- Recommended Procurement Action: Steel buyers should closely monitor Indian export prices, particularly for hot rolled coils and sheets. Negotiate contracts with Indian suppliers, leveraging potential price advantages due to redirected exports. Also, monitor the EU quota developments mentioned in the “India increased steel exports by 12% y/y in April” article, as this market shift may influence Indian steel availability in other regions.