From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Reacts to Production Cuts and Oversupply: A Mixed Outlook

In Europe, the steel market faces a complex situation with production adjustments and oversupply issues. Recent satellite data shows varying activity levels across key steel plants. “Italy reduced steel production by 10.8% m/m in April,” which may be related to observed activity changes; however, a definitive link cannot be established based on the provided information. Simultaneously, “Excess production capacity affects Italian stainless steel sheets,” creating price pressures and impacting market dynamics.

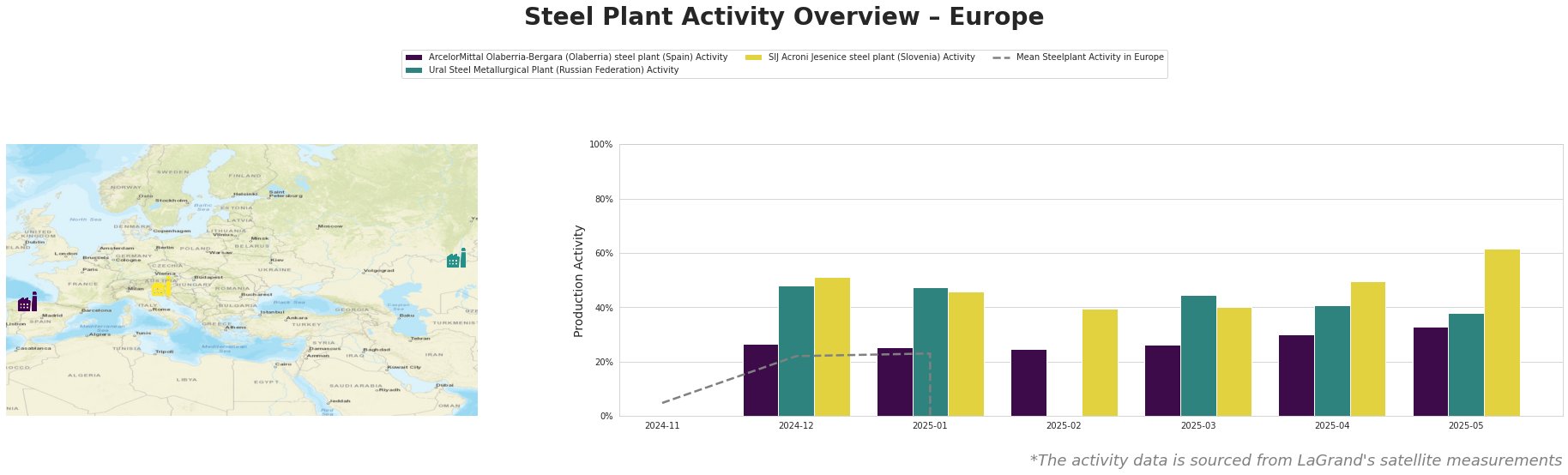

The mean steel plant activity in Europe shows no clear trend due to anomalous negative values in the recent months.

ArcelorMittal Olaberria-Bergara (Olaberria) steel plant, a BOF-based facility in Spain producing primarily flat and finished rolled products, has shown a steady increase in activity, rising from 27% in December 2024 to 33% in May 2025. While “Italy reduced steel production by 10.8% m/m in April” indicates broader European production adjustments, there’s no direct evidence linking this news to the Olaberria plant’s upward activity trend. No explicit connection to the activity of the plant to the news could be established.

Activity at Ural Steel Metallurgical Plant decreased from 48% in December 2024 and January 2025 to 38% in May 2025. The plant, which uses both BF and EAF technologies and produces a range of products, including pig iron and flat products, might be experiencing operational adjustments. However, a link to the named articles cannot be directly established.

The SIJ Acroni Jesenice steel plant, an EAF-based facility producing flat rolled products, has seen a marked increase in activity, rising from 51% in December 2024 to 62% in May 2025. This increase contrasts with “Italy reduced steel production by 10.8% m/m in April”, but it’s unclear if this is a direct result of the Italian market dynamics. No explicit connection to the activity of the plant to the news could be established.

The “Excess production capacity affects Italian stainless steel sheets,” and “Assofermet on the Italian steel market: Lack of momentum in April amid global tensions and slowing industrial growth in the EU“, point to a challenging environment, particularly for stainless steel buyers. Given the reported oversupply and price pressures, buyers of stainless steel sheets, especially in Italy, should consider short-term contracts to capitalize on potential price declines. Closely monitor import data and CBAM implementation timelines to anticipate further market shifts. Based on “Italy reduced steel production by 10.8% m/m in April” and the overall neutral market sentiment, cautiously explore opportunities to diversify suppliers while maintaining established relationships to ensure supply stability.