From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineFeralpi’s Green Investments Drive Positive Sentiment in Europe’s Steel Market: Recovery Anticipated

Europe’s steel market shows very positive sentiment fueled by investments in green technology and anticipated recovery, particularly in Germany. This is reflected in the news of “Feralpi foresees Germany recovery, launches FERGreen brand“ and “Feralpi Stahl launches new steel rolling mill in Riesa for €220 million“, signalling confidence and modernisation in the sector. The satellite data aligns with these announcements as activity in several steel plants increased in the observed period.

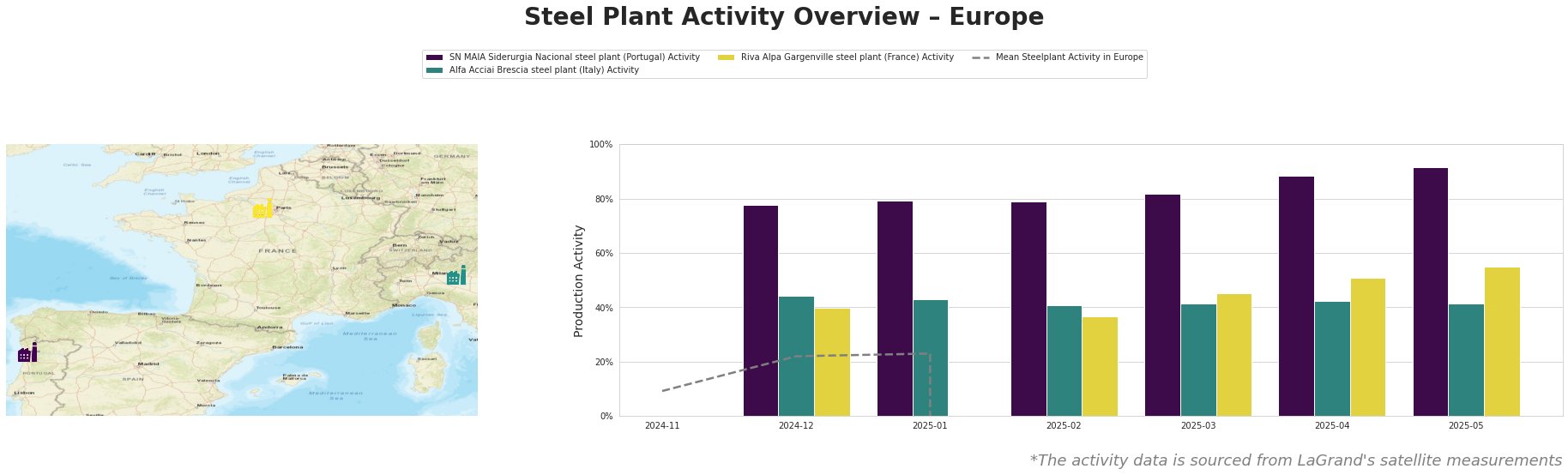

The mean steel plant activity in Europe showed large fluctuations, in the recent time period this culminated in significantly negative levels which would imply issues of data processing rather than indicating actual market conditions. The SN MAIA Siderurgia Nacional steel plant in Portugal showed a strong, consistent upward trend, reaching 92% activity in May 2025. Alfa Acciai Brescia steel plant in Italy has maintained a relatively stable activity level around 41-44%. Riva Alpa Gargenville steel plant in France showed increasing activity, rising from 40% in December 2024 to 55% in May 2025.

SN MAIA Siderurgia Nacional, located in Porto, Portugal, operates an EAF with a crude steel capacity of 600,000 tonnes per year, primarily producing rebar. Satellite data indicates consistently high and increasing activity, peaking at 92% in May 2025. This sustained high activity does not have a direct connection to any of the provided news article.

Alfa Acciai Brescia, situated in the Province of Brescia, Italy, uses EAF technology with a capacity of 1,700,000 tonnes of crude steel annually, producing billet and rebar. Satellite data reveals a stable activity level, fluctuating between 41% and 44% over the observed period. This relative stability aligns with the comments in the “Feralpi anticipates German recovery and launches FERGreen brand“ news article, which highlighted stable consumption in Italy, aided by the national recovery fund (PNRR).

Riva Alpa Gargenville, located in Île-de-France, France, has an EAF with a capacity of 700,000 tonnes of crude steel, producing billet and rebar. Satellite data shows a notable increase in activity, rising from 40% in December 2024 to 55% in May 2025. There is no direct connection to news article but it is important to note that this increase in production levels took place around the same time as the “Feralpi Stahl launches new steel rolling mill in Riesa for €220 million” and related publications.

Feralpi’s significant investment in green steel production, as highlighted in “Feralpi Stahl launches new steel rolling mill in Riesa for €220 million,” and “Feralpi Germany starts up new rolling mill“, suggests a potential shift in market dynamics. This shift could favor suppliers committed to sustainable practices. Considering Feralpi’s increased capacity and focus on green steel, buyers may anticipate potential supply disruptions from less sustainable producers. Procurement professionals should prioritize suppliers with robust decarbonization strategies and flexible supply chains. Buyers should explore forward contracts with Feralpi, securing supply of their FERGreen brand rebar to hedge against potential price increases tied to green steel premiums, this in direct reaction to the news of “Feralpi foresees Germany recovery, launches FERGreen brand”. Given the general production increase across Europe, diversification of supply chain is not needed at this time.