From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Optimism: ArcelorMittal’s Green Investments & Plant Activity Signal Recovery

Europe’s steel market shows signs of recovery fueled by EU’s Steel Action Plan and ArcelorMittal’s reaffirmed decarbonization efforts. “ArcelorMittal Confirms Intention to Build €1.2 Billion EAF in Dunkirk” and “ArcelorMittal committed to restarting French decarbonization plan following EU measures” indicate a renewed commitment to investments in France, spurred by favorable policy changes. While some adjustments occur at specific plants, the overall sentiment is positive, driven by anticipated market protection mechanisms and decarbonization initiatives.

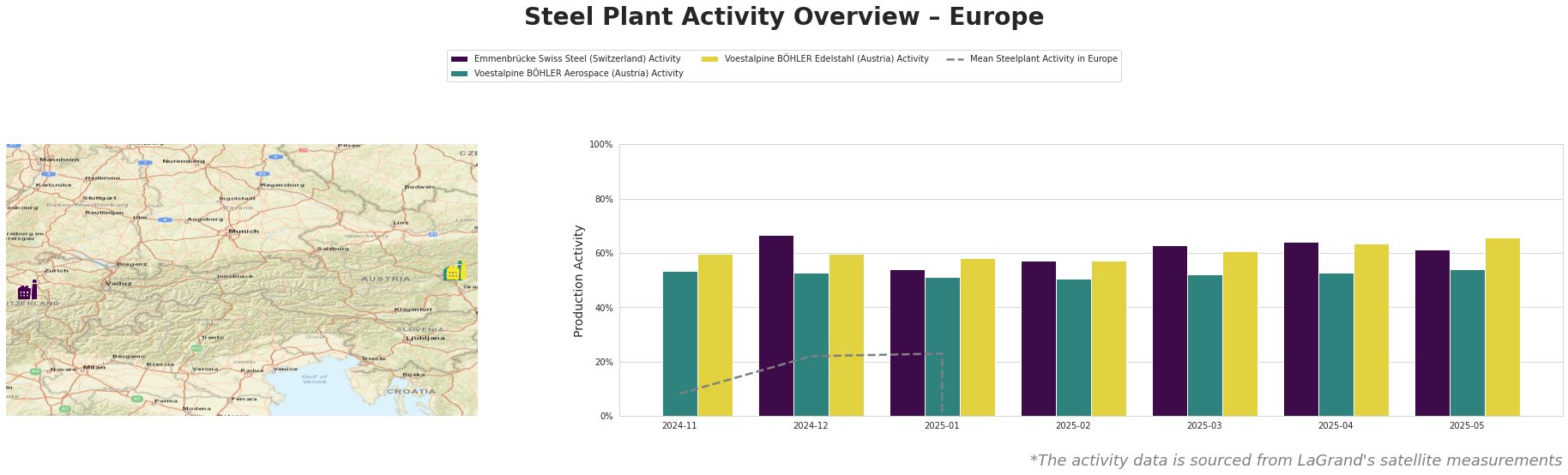

The Mean Steelplant Activity in Europe exhibits erratic behavior with strongly negative values from February 2025 onwards, rendering it unusable for market analysis.

Emmenbrücke Swiss Steel: This plant, relying on EAF technology, showed consistent activity levels between 54% and 67% from December 2024 to May 2025. A dip from 67% in December 2024 to 54% in January 2025 was followed by a subsequent increase up to 64% in April 2025, before settling to 61% in May 2025. Given the news article “Macron unwilling to nationalize ArcelorMittal France,” which highlights potential shifts in European steel production dynamics due to competition and restructuring, a potential connection cannot be established, as the the plant is not operated by ArcelorMittal.

Voestalpine BÖHLER Aerospace: This plant, also using EAF technology, maintained relatively stable activity levels between 51% and 54% during the observed period. The activity increased to 54% in May 2025. A direct link to the news articles focusing on ArcelorMittal cannot be established, as these news reports don’t mention Voestalpine BÖHLER Aerospace.

Voestalpine BÖHLER Edelstahl: This plant, equipped with EAF and boasting a crude steel capacity of 145ktpa, showed robust activity, ranging from 57% to 66%. Activity increased steadily reaching 66% in May 2025. As with Voestalpine BÖHLER Aerospace, no direct connection to the ArcelorMittal-centric news articles can be established.

The ArcelorMittal-specific news reports do not allow to establish direct connections with activity changes at these Voestalpine plants.

Evaluated Market Implications:

ArcelorMittal’s commitment to investing €1.2 billion in an EAF in Dunkirk (“ArcelorMittal Confirms Intention to Build €1.2 Billion EAF in Dunkirk”) suggests an increased future supply of EAF-produced steel in the region.

* Procurement Action: Steel buyers should proactively engage with ArcelorMittal to understand the future availability and pricing of EAF-produced steel from the Dunkirk plant, securing potential long-term supply agreements, especially in light of the EU’s Steel Action Plan aimed at limiting imports and promoting internal production.

The French President’s commitment to safeguarding jobs at ArcelorMittal France (“Macron unwilling to nationalize ArcelorMittal France”) coupled with the company’s significant investment in France may mean that ArcelorMittal will remain a key supplier.

* Procurement Action: Given the uncertainty created by possible workforce reductions, steel buyers should actively monitor ArcelorMittal’s production and supply chain developments in France to anticipate and mitigate potential disruptions, seeking alternative suppliers if necessary to ensure uninterrupted supply.