From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Economic Slowdown Impacts European Steel: Activity Mixed Amid Climate Goals

Europe’s steel market faces mixed signals as Germany’s economic slowdown impacts production levels, while climate goals add further complexity. The “Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft” and “Deutschland ist laut Expertenrat vorerst auf Klimakurs” articles highlight that emissions reductions are partly driven by decreased industrial output, a factor potentially linked to observed changes in steel plant activity. However, no direct correlation between these articles and the satellite-observed activities could be directly established.

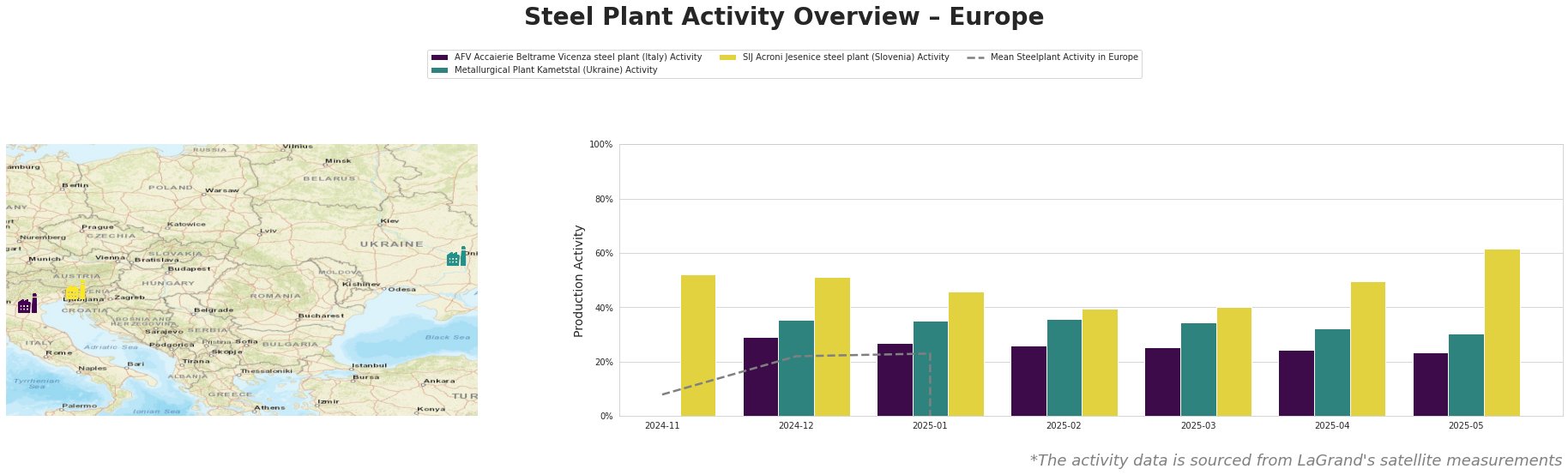

The mean steel plant activity in Europe displays wildly deviating activity levels between the reporting dates and is therefor not useful as an indicator. AFV Accaierie Beltrame Vicenza steel plant consistently operated below 30% capacity from December 2024 to May 2025, showing a gradual decline to 23%. Metallurgical Plant Kametstal demonstrates a similar downtrend, decreasing from 35% in December 2024 to 30% in May 2025. In contrast, SIJ Acroni Jesenice steel plant shows increased activity, rising significantly from 51% in December 2024 to 62% in May 2025.

AFV Accaierie Beltrame Vicenza steel plant, an electric arc furnace (EAF) based plant with a 1.2 million tonne crude steel capacity, primarily serves the building, infrastructure, tools, machinery, and transport sectors. Its activity has steadily declined from 29% in December 2024 to 23% in May 2025. It’s important to note that no direct connection can be established between the Italian plant’s activity and the news articles primarily focusing on Germany.

Metallurgical Plant Kametstal, an integrated BF-BOF plant in Ukraine with a 4.2 million tonne crude steel capacity, produces semi-finished and finished rolled products for the energy and transport sectors. The plant’s activity decreased from 35% in December 2024 to 30% in May 2025. No direct link can be established between the German news articles and the activities of this plant in Ukraine.

SIJ Acroni Jesenice steel plant, an EAF-based plant in Slovenia with a 726,000-tonne crude steel capacity, focuses on flat rolled products for the building, infrastructure, tools, and machinery sectors. The plant shows increased activity, rising significantly from 51% in December 2024 to 62% in May 2025, possibly reflecting localized demand shifts within Europe. There is no direct evidence to link this growth to the provided news articles.

Given the German economic slowdown reported in “Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft” and “Germany cuts tax forecasts by €81 billion by 2029“, steel buyers should anticipate potential downward pricing pressure on standard steel grades, particularly those linked to German industrial demand. The “Wie klimafreundlich sind Gaskraftwerke?” article raises questions about the long-term energy strategy, suggesting potential volatility in energy costs for steel production. Procurement professionals should explore fixed-price contracts or hedging strategies to mitigate risk.