From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Poised for Growth: ArcelorMittal’s Green Investments and Steady Plant Activity Signal Optimism

Europe’s steel market shows positive momentum as ArcelorMittal recommits to decarbonization efforts. The upturn is driven by the European Commission’s Steel and Metal Action Plan, and reflected in ArcelorMittal’s investments despite a challenging market environment. As reported in “ArcelorMittal Confirms Intention to Build €1.2 Billion EAF in Dunkirk,” “ArcelorMittal confirms its intention to invest in the decarbonization of its Dunkirk plant,” “ArcelorMittal has committed to resume the implementation of the French decarbonization plan in line with EU measures,” “The European steel giant is preparing to restart green projects after the summer holidays,” and “ArcelorMittal committed to restarting French decarbonization plan following EU measures,” ArcelorMittal is investing €2 billion in its French facilities, including a significant project in Dunkirk. While these investments are not immediately reflected in increased production, they signal long-term confidence in the European steel market. Satellite data provides no immediate supporting data for the Dunkirk plant as this investment will only start after the summer.

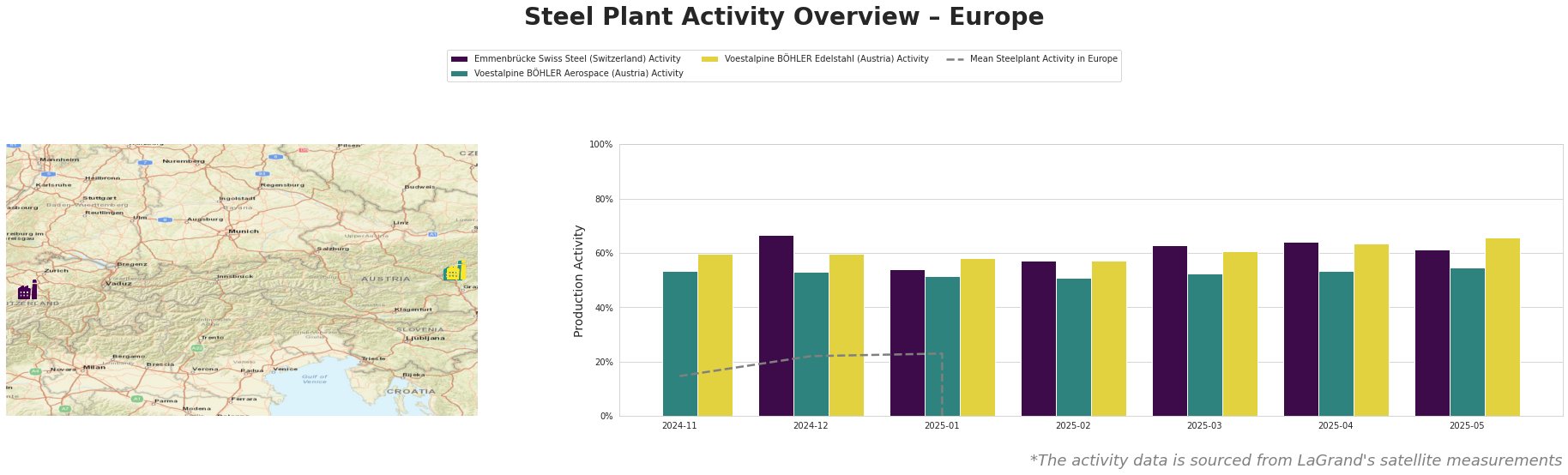

The data reveals inconsistent readings in the ‘Mean Steelplant Activity in Europe’, requiring further investigation. Observed plant activity data shows generally stable operations, with Emmenbrücke Swiss Steel showing a gradual decrease from 67% in December 2024 to 61% in May 2025, indicating a slight cooling in activity. In contrast, Voestalpine BÖHLER Aerospace maintains a stable activity, while Voestalpine BÖHLER Edelstahl shows a gradual increase to 66% in May 2025. None of the observed steel plants show any immediate correlation with the news about Arcelor Mittal’s future investments.

Emmenbrücke Swiss Steel (Switzerland) utilizes electric arc furnaces (EAF) for steel production, focusing on specialized steel products. The plant shows activity fluctuations, declining to 54% in January 2025, before recovering slightly. This facility is ResponsibleSteel certified. There is no direct link to the ArcelorMittal news.

Voestalpine BÖHLER Aerospace (Austria), another EAF-based steel plant, maintains relatively stable activity levels between 51% and 55%. As indicated by the plant name, its products likely support the Aerospace industry. The satellite data shows no immediate impact on its operations due to the ArcelorMittal announcements.

Voestalpine BÖHLER Edelstahl (Austria) also uses EAF technology. Its activity steadily increased from 60% in December 2024 to 66% in May 2025. While the plant has a crude steel capacity of 145 thousand tons annually and employs 2500 workers, there is no directly observable connection to the ArcelorMittal news in the satellite data.

While the long-term outlook for European steel is positive, the news articles suggest potential short-term supply chain risks for commodity steel grades as ArcelorMittal prioritizes green investments over current production volumes.

Recommended Procurement Actions:

- Monitor Regional Price Volatility: Steel buyers should closely monitor regional price fluctuations, particularly for commodity grades, in light of potential supply adjustments as ArcelorMittal implements its decarbonization strategy.

- Diversify Supplier Base: Given the focus on long-term investments rather than immediate production increases, steel buyers should consider diversifying their supplier base to mitigate potential supply disruptions from ArcelorMittal’s strategic shift.

- Evaluate Green Steel Options: Procurement professionals should begin evaluating and integrating “green steel” options into their supply chains, especially for long-term projects, aligning with the EU’s sustainability goals and leveraging the future output of ArcelorMittal’s EAF investments.