From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market Shows Resilience Despite Economic Headwinds: Plant Activity Analysis

Germany’s steel market demonstrates underlying resilience despite economic uncertainties. Observed steel plant activity, while fluctuating, remains relatively stable. The analysis ties activity to broader economic sentiment reflected in recent news, specifically the debate around work-life balance and economic productivity.

The steel plant activities need to be seen against the backdrop of concerns raised in “Friedrich Merz: „Mit 4-Tage-Woche und Work-Life-Balance können wir den Wohlstand nicht erhalten“” and “Bundeskanzler Merz: „Mit 4-Tage-Woche und Work-Life-Balance können wir den Wohlstand nicht erhalten“” regarding Germany’s economic future and the potential impact of reduced working hours and declining wind energy production on national prosperity. While no direct causal link between these articles and observed steel plant activity can be explicitly stated, the sentiment expressed in these articles does create the economic backdrop to assess the steel market. No direct link can be established between the observed steel plant activity and the other articles about the supply chain law (“Union und SPD: ++ Merz widerspricht Klingbeil – „Wir werden das Lieferkettengesetz abschaffen“ ++ Liveticker“) government updates (“Liveticker zur Merz-Regierung: Frei: Es gibt keine Grenzschließungen, nur Grenzkontrollen | FAZ“) and the government’s overall goals (“Regierungserklärung: Migration, Aufrüstung, „Wohlstand für alle“ – Merz gibt den Bürgern ein Versprechen“).

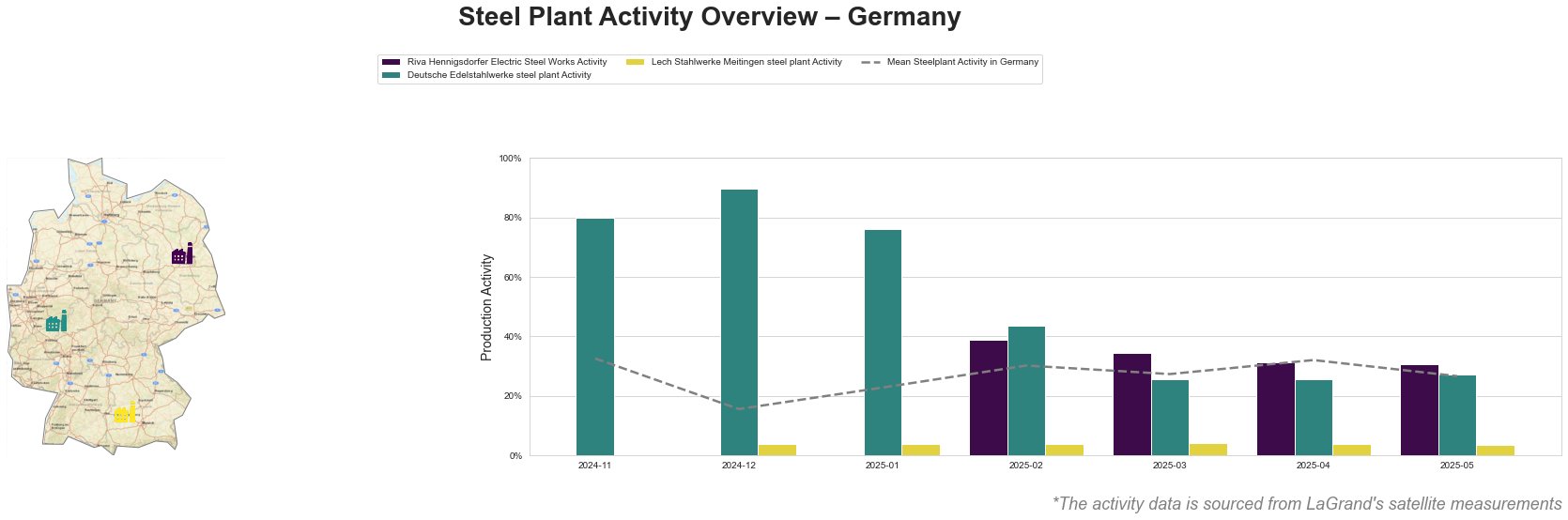

The mean steel plant activity in Germany shows significant volatility between November 2024 and May 2025, with a low of 16% in December 2024 and a high of 33% in November 2024. Recent months show relative stability between 27% and 32%. Deutsche Edelstahlwerke steel plant exhibits significantly higher activity than the mean in late 2024 (80% in November, 90% in December), before decreasing to 27% in May 2025. Lech Stahlwerke Meitingen steel plant consistently shows the lowest activity, remaining stable at 4% from December 2024 onward. Riva Hennigsdorfer Electric Steel Works activity is only available from February 2025, remaining relatively stable around 31-39%.

Riva Hennigsdorfer Electric Steel Works, located in Brandenburg, possesses a crude steel capacity of 1 million tonnes per year, utilizing electric arc furnaces (EAF) to produce semi-finished and finished rolled products, including rebar for the automotive sector. Activity data, available from February 2025, shows a stable trend around 31-39%. No direct connection between this observed activity level and the cited news articles can be established.

Deutsche Edelstahlwerke steel plant in North Rhine-Westphalia operates with a 600,000-tonne crude steel capacity, relying on EAF technology. The plant produces billets, squares, and forged products for diverse sectors, including automotive, energy, and infrastructure. The plant showed high activity in late 2024, reaching 90% in December, followed by a decline to 27% in May 2025. No direct connection between this sharp decline and the cited news articles can be established.

Lech Stahlwerke Meitingen steel plant in Bavaria has a crude steel capacity of 1.4 million tonnes, utilizing EAFs for the production of pipes, tubes, and billets, catering to the automotive, construction, and energy sectors. Activity has remained consistently low at 4% since December 2024. No direct connection between this consistently low activity level and the cited news articles can be established.

Based on the consistently low activity at Lech Stahlwerke Meitingen, steel buyers should monitor their supply chains for potential disruptions in pipes, tubes, and billets. Diversification of suppliers for these products is advisable. The drop in activity at Deutsche Edelstahlwerke warrants careful monitoring of billet and square supply, although no immediate action is necessary given recent activity stabilization.