From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Surges on US-China Trade Truce, Activity Spikes

The North American steel market is experiencing a period of optimism driven by recent developments in US-China trade relations. The positive market sentiment is underpinned by news such as “U.S.-China Trade Deal: Doesn’t Cover Steel, Cars, Aluminum” and “Analysis-Investors cheer US-China tariff truce, but cautious over a final deal” indicating a potential ease in trade tensions. While steel itself wasn’t directly addressed in the trade reset, the general positive economic outlook appears to have a positive influence on the market. The effect of these developments is expected to increase transportation rates as noted in “Transportation rates likely to surge during tariff pause“. A direct relationship between these news events and all observed steel plant activity levels cannot be conclusively established based on available data, but the observed increases in certain plants correlate with the positive market sentiment.

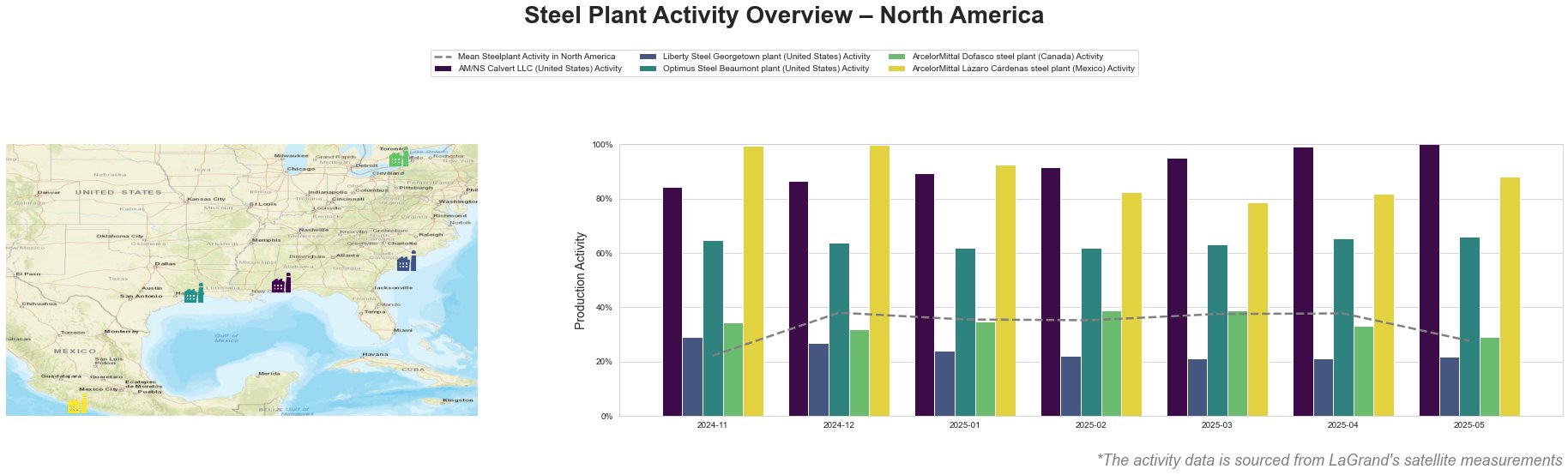

The mean steel plant activity in North America fluctuated throughout the observed period, peaking at 38% for several months before dropping to 28% in May 2025. AM/NS Calvert LLC consistently operated at well above the mean, reaching its peak activity level of 100% in May 2025. Liberty Steel Georgetown plant activity remained consistently below the mean, hovering around 20-30%. Optimus Steel Beaumont plant operated above the mean, with activity around 60-70%. ArcelorMittal Dofasco steel plant showed some fluctuation but stayed relatively close to the mean. ArcelorMittal Lázaro Cárdenas steel plant demonstrated very high activity initially at 100% before settling to the 80-90% range.

AM/NS Calvert LLC, an EAF steel plant in Alabama with a 1500 ttpa crude steel capacity, producing finished rolled products for automotive and other sectors, exhibited consistently high activity, culminating in 100% activity in May 2025. A direct relationship to the news articles cannot be conclusively established, but the plant’s sustained high activity suggests strong demand.

Liberty Steel Georgetown plant, a smaller EAF-based operation in South Carolina with a 908 ttpa crude steel capacity, producing semi-finished and finished rolled products, has consistently lower-than-average activity. Production activity has been consistent throughout the entire period. A clear link to the provided news cannot be explicitly established based on the data.

Optimus Steel Beaumont plant, an EAF steel plant in Texas with a 700 ttpa crude steel capacity producing semi-finished and finished rolled products, maintained activity around 60-70%. Similar to AM/NS Calvert, the high activity might reflect positive market conditions but lacks a direct link to the provided news.

ArcelorMittal Dofasco, an integrated (BF) steel plant in Ontario with a 4050 ttpa crude steel capacity, producing a range of finished rolled products, experienced some fluctuations, with activity dropping to 29% in May 2025. It is unclear from the news articles whether the US-China trade dynamics are directly affecting the Canadian plant.

ArcelorMittal Lázaro Cárdenas, an integrated (BF and DRI) steel plant in Michoacán, Mexico, with a 5700 ttpa crude steel capacity, producing semi-finished and finished rolled products, initially operated at 100% activity before settling in the 80-90% range. The change in the plant’s production rate is correlated to the announcement of “U.S.-China Trade Deal: Doesn’t Cover Steel, Cars, Aluminum” but a clear cause cannot be established.

The news “Transportation rates likely to surge during tariff pause” suggests potential cost increases in transportation. Given that AM/NS Calvert LLC and Optimus Steel Beaumont plant are operating at high capacity, steel buyers should anticipate potential challenges in securing transportation and prioritize orders to these plants as transportation rates are likely to surge. Due to the trade truce having a positive impact on market conditions and the increased logistical costs due to higher transportation rates, steel buyers should lock in prices and secure contracts now to avoid higher prices in the future.