From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market: Demand Surge & Positive Outlook Following Tariff Easing

Recent developments in the Asian steel market reflect a very positive sentiment, influenced notably by periods of heightened activity among key production facilities. Notably, the articles Donald Trump Likely To Ease Tariffs Impact On Automakers: Report and Donald Trump’s Reciprocal Tariffs Likely To Be Relaxed For Auto Industry indicate a strategic easing of tariffs that may enhance automotive industry operations in the U.S., leading to potential increases in steel demand. This easing coincides with observable increases in activity levels at Asian steel plants, such as the SeAH Besteel Gunsan facility.

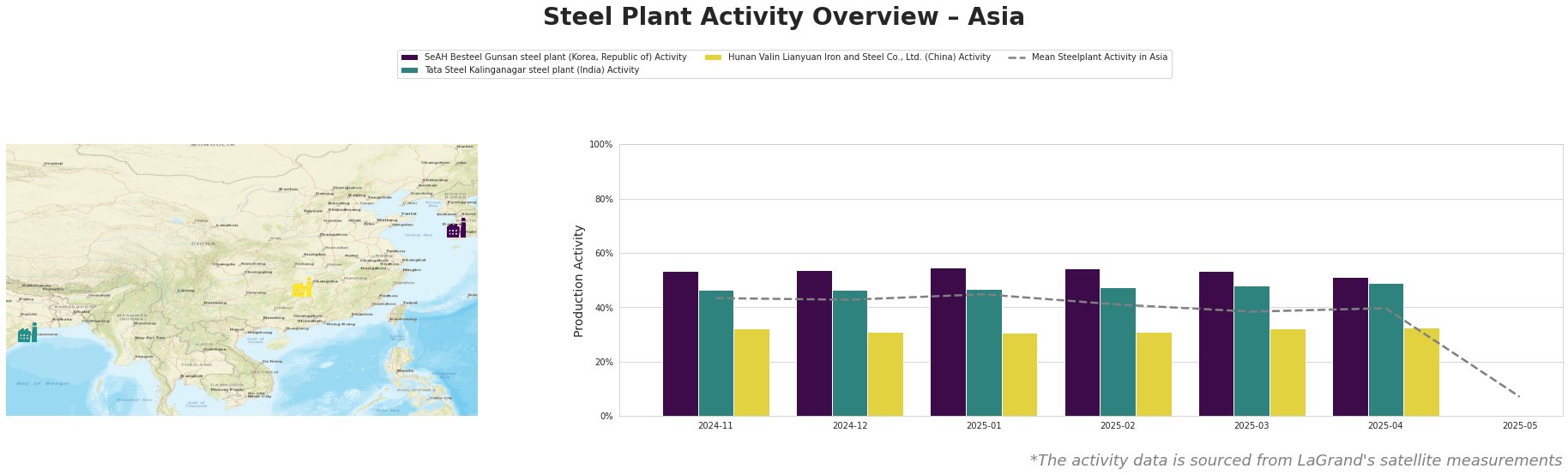

The SeAH Besteel Gunsan plant, equipped with an Electric Arc Furnace (EAF) and a workforce of 9,600, has shown remarkable resilience with activity peaking at 55% in January 2025. This trend suggests alignment with the favorable automotive sector conditions following the tariff easing, emphasizing its role in supplying components necessary for the automotive industry.

Conversely, Tata Steel Kalinganagar, with substantial integrated steelmaking capacity, has maintained steady activity levels. Despite fluctuations, its January 2025 activity reached 47%, reflecting stable production aligned with market expectations. Nonetheless, it’s critical to observe that Hunan Valin’s activity trends remain lower, averaging 32%, indicating potential supply scarcities due to lower production efficiency during the same period.

While no direct correlation was identified between current activity levels and the automotive sector developments at Hunan Valin, the overall boost in the industry segments is likely to benefit from the anticipated demand surge.

Key supply implications include:

– SeAH Besteel Gunsan may face heightened demand due to its strategic alignment with the automotive sector, indicating potential challenges in fulfilling orders if activity levels unevenly fluctuate.

– Hunan Valin could represent a risk for buyers due to its low activity levels; it may not meet demand spikes without prior adjustments.

Procurement actions are recommended focusing on:

1. Early engagement with SeAH Besteel to secure contracts for automotive-related steel components ahead of potential supply shortfalls as demand from the U.S. automakers rises, fueled by tariff relaxations.

2. Monitor Tata Steel Kalinganagar for procurement opportunities, especially as it maintains its production levels, which could offer stability amidst market flux.

With these insights, steel buyers should strategically position themselves to navigate potential market fluctuations effectively.