From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong Growth in European Steel Production: Actionable Insights for Buyers

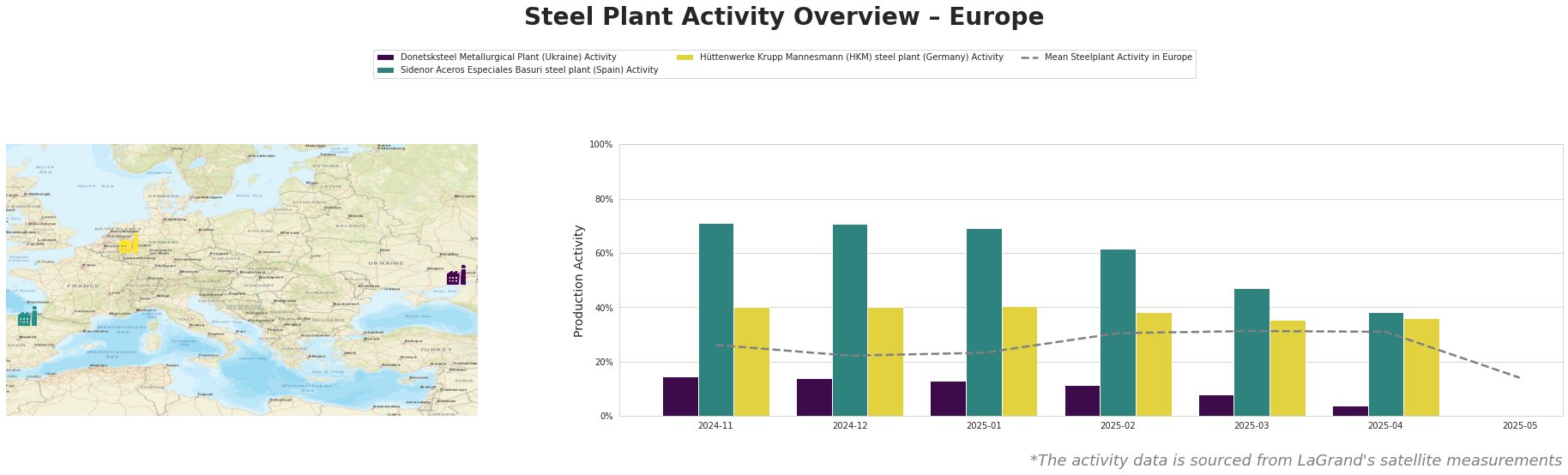

In Europe, the steel market sentiment remains Very Positive with notable production increases observed in various countries, primarily driven by regional demand recoveries. Recent reports, such as “Spain increased steel production by 10.9% y/y in March“ and “Ukraine reduced steel production in March by 9.9 – – Worldsteel,” directly correlate with satellite-observed changes in plant activity, highlighting a dynamic shift in the market landscape.

The Sidenor Aceros Especiales Basuri steel plant in Spain is performing strongly, maintaining high activity levels around 71% in late 2024, amidst a significant production increase of 10.9% year-on-year in March 2025. This increase seems aligned with the revived construction sector, showing stability in production capability. In stark contrast, the Donetsksteel Metallurgical Plant faces substantial operational challenges, as evidenced by a drop from 14% to just 4% activity by April 2025, notably correlating with “Ukraine reduced steel production in March by 9.9 – – Worldsteel,” indicating serious production difficulties.

On the other hand, Hüttenwerke Krupp Mannesmann (HKM) in Germany has remained stable, showing consistent activity levels near 36% towards the end of April, underscoring its capacity to maintain production despite an overall declining trend in the European first-quarter output.

The disparities in performance amongst these plants highlight potential areas for procurement strategy adjustments. Steel buyers should consider prioritizing procurement from the Sidenor Aceros Especiales Basuri plant due to its steady output and robust production capabilities, especially as construction demand surges. Conversely, close monitoring is advised for suppliers dealing with Ukrainian steel, particularly from Donetsksteel, given potential supply disruptions stemming from operational declines, as signaled by recent data.

In conclusion, tackling procurement strategies with a focus on retaining strong suppliers like Sidenor while carefully assessing the risks associated with sourcing from areas experiencing productive disruptions (like Ukraine) will be critical for steel buyers navigating the current market.