From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineDeclining Steel Production Trends in Europe: A Cautious Outlook for Buyers

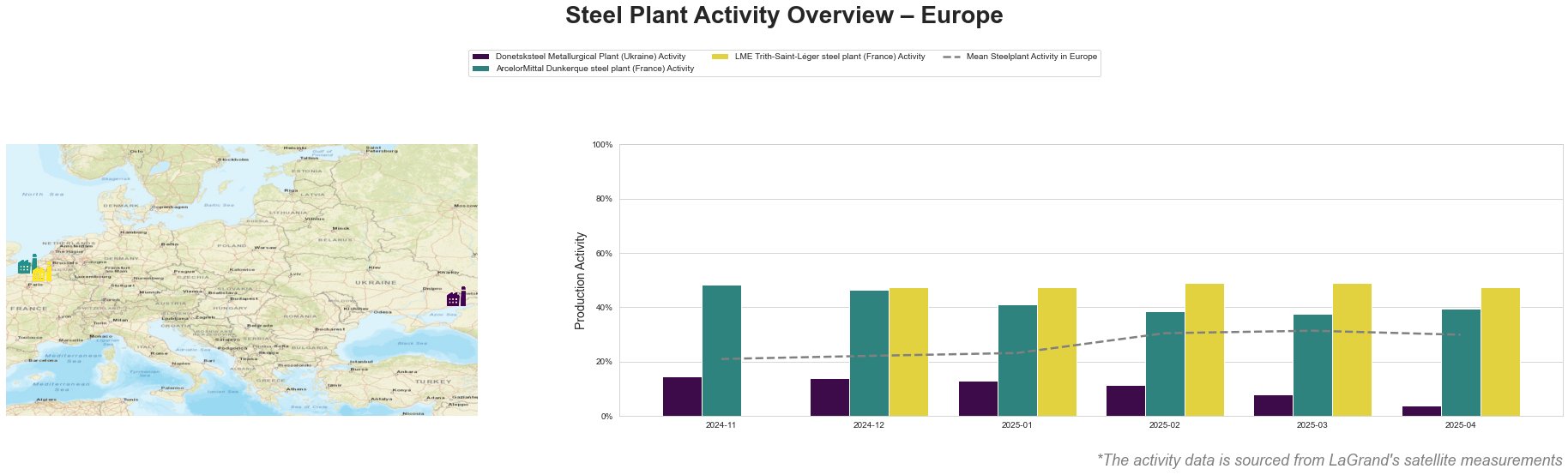

Europe’s steel industry is currently struggling, particularly in Germany, where production has declined sharply. In German crude steel output down 12.5 percent in Q1, significant year-on-year reductions were noted, echoing widespread challenges with a production total of 8.50 million metric tons in Q1 2023. This trend is corroborated by satellite-observed activity levels from key steel plants, revealing further declines, specifically at the Donetsksteel Metallurgical Plant and ArcelorMittal Dunkerque.

Recent satellite data indicates alarming drops in plant activities, particularly with Donetsksteel experiencing a measured activity level at just 4% as of April 2025, a stark decline from earlier months. This trend of diminishing activity aligns with WV Stahl struggles to foresee German production stabilisation, emphasizing the ongoing difficulties in maintaining production levels amidst a competitive market.

The ArcelorMittal Dunkerque steel plant, which holds a capacity of 6,750,000 metric tons, has seen its activity moderately decline to 40%. However, this still positions it above the mean activity level. Despite the drops, it remains crucial for producing hot-rolled products that could serve to stabilize fluctuating market demands amidst production challenges, as highlighted in Stockholding: German steel sales rise 5.6% in March as stocks fall.

Conversely, the LME Trith-Saint-Léger steel plant, primarily operating with electric melting technologies, remains stable at approximately 47% activity, serving as a less affected segment compared to the declining trends seen in Germany.

To address potential supply disruptions stemming from the drastic reductions in German production, steel buyers should consider bolstering their inventory of hot-rolled products from plants with relative stability, such as ArcelorMittal Dunkerque and LME Trith-Saint-Léger, while keeping a close watch on the German market’s further fluctuations. Emphasizing procurement from plants that continue functioning at higher activity levels could mitigate risks associated with procurement reliability in the fluctuating steel market conditions across Europe.