From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia’s Steel Market Set for Strong Demand Surge Amid Positive Trade Developments

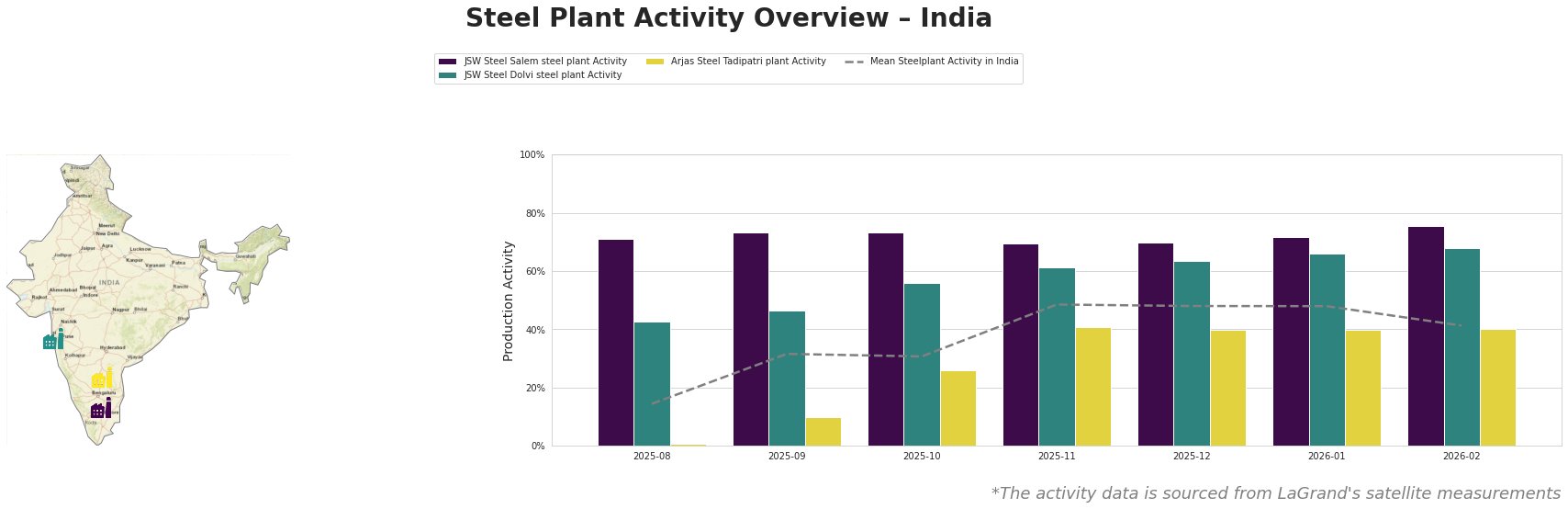

India’s steel industry is experiencing heightened demand potential, driven by the latest developments in the India-US trade deal, as reported in “India-US deal to lift downstream steel demand“ and “India-US deal to boost steel demand in the refining industry”. As trade barriers diminish, activity at key plants shows encouraging trends, notably reflected in real-time satellite data.

JSW Steel Salem plant’s activity shows a substantial increase to 76.0% in February 2026, a peak aligned with rising demand in the energy and automotive sectors, reflective of enhanced sentiment via the trade agreement. No explicit link to direct tariffs or export changes was established in its operations, indicating that internal growth is driving this peak.

The JSW Steel Dolvi plant’s activity also mirrors an upward trend, stabilizing at 68.0% as the recent deal fosters a favorable environment for machinery exports, further emphasizing the importance of downstream usage in the steel supply chain.

Contrary to these bullish trends, the Arjas Steel Tadipatri plant has remained stable around 40.0%, showing no significant movement lately which cannot be directly related to the recent trade agreement nor has it suggested any particular adjustments in operations.

The India-US deal to buy $500bn of US energy, other products is poised to influence coal imports favorably, accounting for a stronger rupee which lowers import costs for metallurgical coal, a critical component for steel production.

Given these trends, procurement professionals should prioritize steel sourced from JSW Steel’s facilities, particularly Salem and Dolvi plants, anticipating heightened supply shifts to meet increasing demands. Continuous improvements in internal efficiencies at these plants position them as key suppliers for the automotive, infrastructure, and machinery sectors, likely expanding their market share domestically.