From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Report: Asia Poised for Growth Amid Strong Demand Signals

India’s steel market is showing very positive momentum as negotiations for the India-US trade deal progress, as highlighted in the article India-US deal to lift downstream steel demand. The recent agreement, which is set to reduce tariffs significantly, is projected to stimulate domestic steel consumption, particularly in the machinery and automotive sectors. This aligns with observable data showing increased activity levels in key Indian steel plants, suggesting a robust demand outlook.

Recent Activity Trends

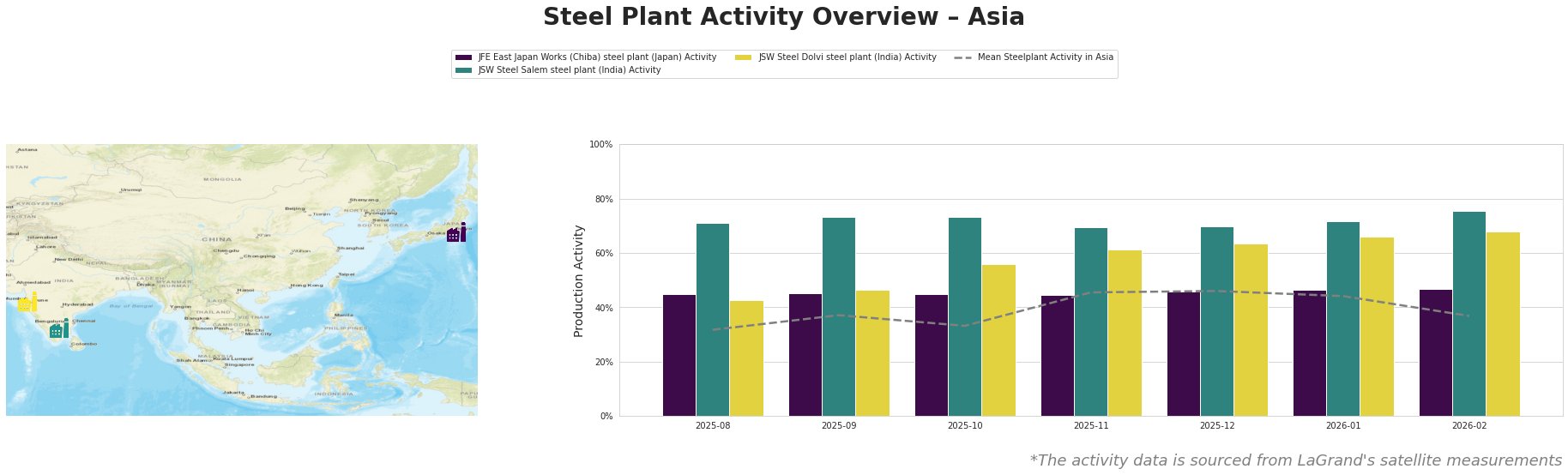

JSW Steel Salem plant experienced consistent growth, peaking at 76% activity in February 2026, aided by the anticipated increase in domestic consumption tied to tariff reductions connecting to the India-U.S. deal to boost steel demand in the refining industry. Conversely, the mean activity across Asia dropped to 37% in February, indicating a significant divergence likely influenced by targeted growth in Indian plants rather than broad regional improvements.

Plant Activity and Insights

The JSW Steel Salem steel plant shows resilience, maintaining a strong connection to downstream demand bolstered by reduced tariffs, as outlined in the India-US deal to lift downstream steel demand. Its activity rose to 76% in February, aligning with the improved sentiment in the industrial sector, reinforcing the positive impact highlighted in various news reports. Furthermore, the plant draws from captive iron ore sources, optimizing its operational costs.

Meanwhile, the JSW Steel Dolvi steel plant demonstrated stable operations with activity peaking at 68% in February. This plant benefits from its diverse production capabilities that include DRI and EAF processes, which can pivot based on market demand. However, given the constraints of U.S. tariffs, it too shall primarily flourish from domestic consumption rather than exports as emphasized in the India-US deal.

The JFE East Japan Works (Chiba) maintained activity levels around 47%, attributed largely to stable domestic demand rather than export prospects. This stability is supported by ongoing operational efficiency but contrasts with the growth seen in Indian facilities where tariff relief is imminent.

Market Implications

Given the anticipated demand surge in downstream sectors due to the India-US deal to lift downstream steel demand, steel buyers should consider the following actions:

– Procure steel products from the JSW Steel Salem and Dolvi plants, as they are positioned to capitalize on increased domestic demand triggered by competitive tariffs. This is further supported by their robust production capabilities and market responsiveness.

– Monitor fluctuations in the import tariffs and potential shifts in Section 232 policies affecting direct export capabilities, as these can alter market dynamics significantly.

– Stay informed on the geopolitical developments linked to trade agreements, as they can affect material costs and availability, particularly regarding metallurgical coal imports.

In conclusion, the unfolding dynamics present a favorable scenario for steel buyers focusing on Indian markets, as domestic steel consumption is expected to rise amid lowered tariffs and improved industrial sentiment.