From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Outlook for Europe: Neutral Sentiment with Mixed Activity Trends

Recent news highlights in Europe indicate a stable yet complex landscape for the steel market, particularly in Germany where political dynamics are intensifying. The article “Klimaschutzprogramm: Koalition wird Klimaziel nicht schaffen” emphasizes that the German coalition government is unlikely to meet its climate goals, reflecting growing concerns over emissions. This aligns with recent satellite activity data, showing fluctuations in steel production activity across various plants.

Measured Activity Overview

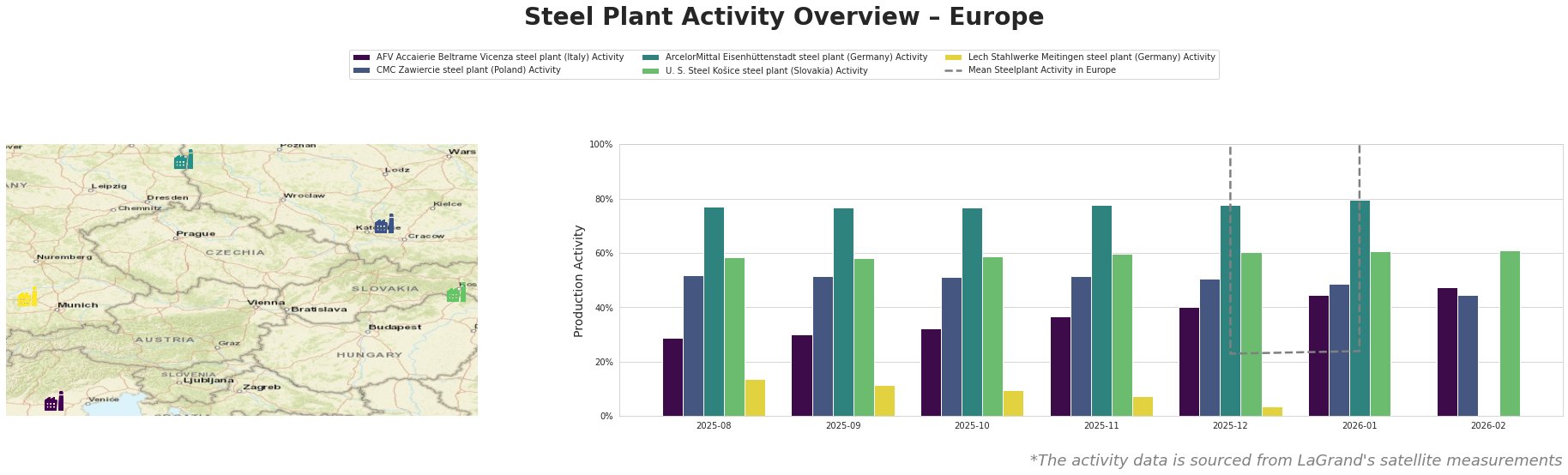

Activity levels at the ArcelorMittal Eisenhüttenstadt steel plant remain relatively high compared to others, peaking at 80% in January 2026. In contrast, the Lech Stahlwerke Meitingen plant witnessed a notable drop to 0% by January 2026, underlining challenges in production capacity. The activity patterns highlight discrepancies, with the mean activity across observed plants stabilizing but reflecting significant fluctuations at individual facilities.

Steel Plant Activity and Market Implications

The AFV Accaierie Beltrame Vicenza steel plant shows a slow activity increase from 29% to 47% from August 2025 to February 2026, which could reflect a cautious response to political concerns outlined in “Klimaschutzprogramm”. This may signify a gradual adjustment in production capacity amid potential regulatory changes that could impact operational outputs.

The CMC Zawiercie steel plant has exhibited stable activity levels, maintaining between 51% and 52%, which does not correlate directly with any of the specified news articles, indicating a stable operational environment that may be resilient to external pressures.

ArcelorMittal Eisenhüttenstadt, with activity peaking at 80%, has been pivotal in the German steel production landscape. However, any supply disruptions due to rising scrutiny on emissions policies (as highlighted in “Klimaschutzprogramm”) could impact future operational capacity and procurement strategies.

Conversely, U. S. Steel Košice exhibited stable performance, scaled between 58% and 61%, yet lacks direct connections to current political events, pointing towards operational continuity.

Recommendations for Steel Buyers

Given the current oscillations in market activity, steel buyers should:

- Monitor ArcelorMittal Eisenhüttenstadt for any regulatory impacts arising from climate policy discussions which could affect supply levels.

- Strategize procurement for AFV Accaierie Beltrame Vicenza, as its gradual production increase may offer favorable pricing ahead of any potential regulatory adjustments.

- Stay informed on CMC Zawiercie‘s consistent output as a reliable supply source.

- Consider U. S. Steel Košice as a strategic partner but be aware of external economic influences that may indirectly impact production efficacy.

In summary, while the European steel market sentiment remains neutral, vigilance is advised as political and environmental factors continue to shape the operational landscape of key steel producers across the region.