From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market Report: Trade Deal Sparks Growth Potential Amid Rising Plant Activity

Recent developments in India highlight a very positive market sentiment, particularly driven by the anticipated impact of the India-US deal to lift downstream steel demand. The trade agreement is expected to enhance competitiveness in sectors that utilize steel, directly tying to significant increases in activity levels at various steel plants.

The wave of optimism is supported by the article “India-US deal to lift downstream steel demand,” highlighting that the newly negotiated trade deal is likely to boost domestic steel consumption rather than affecting export levels. The planned investments and lowered tariffs stated in “India to buy $500bn of US energy, other products,” underline the potential for increased activity at Indian steel plants, a sentiment corroborated by observed satellite data.

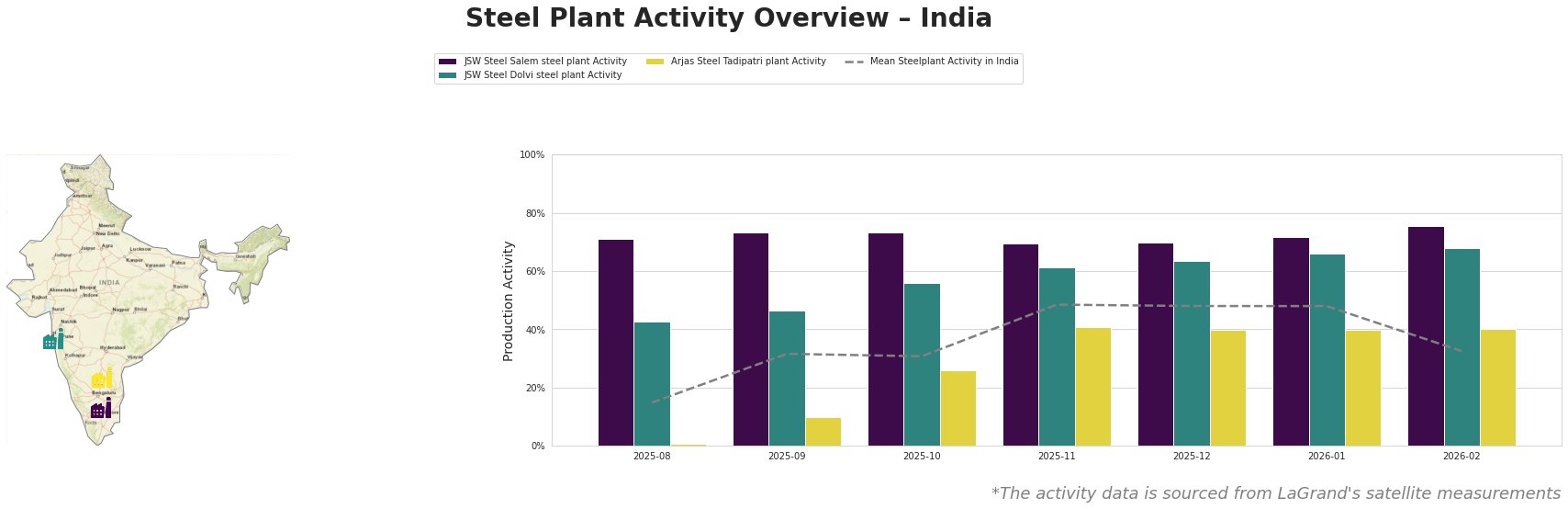

JSW Steel Salem has consistently exhibited high activity levels, peaking at 76% in February 2026, further indicating market confidence. This increase aligns with expectations for improved downstream demand, as stipulated in the “India-US deal to boost steel demand in the refining industry.” Meanwhile, JSW Steel Dolvi demonstrated stable growth, reaching 68%, while Arjas Steel Tadipatri displayed limited growth, remaining stable at around 40%.

The recent surge at JSW Steel Salem likely correlates with the enhanced protection and favorable trading terms that the US deal provides for Indian engineering and machinery exports, as reflected in substantial tariff reductions mentioned in “From Tariffs To Minerals: Joint Statement On India-US Deal Expected Soon.”

Steel Plant focused activity has the following notable features:

JSW Steel Salem: With a capacity of 1,030,000 tpa, predominantly utilising the integrated BF process, the plant showed growth hitting 76% activity in February—an increase of 4% from January. The plant’s strategic use of captive power generation enhances its cost efficiency, critical as it adapts to increased domestic demand spurred by the new trade deal.

JSW Steel Dolvi: This plant, operating a total capacity of 5,000,000 tpa with DRI and BF processes, recorded a steady rise to 68% activity, reflecting the positive outlook on finished and semi-finished output linked to boosting machinery exports following tariff easements.

Arjas Steel Tadipatri: Despite limited fluctuations, this plant maintained activity around 40%, potentially reflecting cautious operational responses amid uncertainties regarding export policies.

Given the findings and correlations from the news and activity data, steel buyers should focus on securing agreements with plants demonstrating rising activity levels, particularly with JSW Steel Salem and JSW Steel Dolvi, which are poised to meet increasing demand driven by the favorable trade landscape. However, Arjas Steel may represent a less favorable procurement option at this time due to its stagnant activity level and lack of alignment with the positive market sentiment generated by the trade deal.

In summary, while the landscape appears lucrative, close attention should be maintained for fluctuations in policy and tariff structures that may impact individual plant outputs.