From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Germany’s Steel Market: Satellite Data Reflects Increased Activity Amid Political Developments

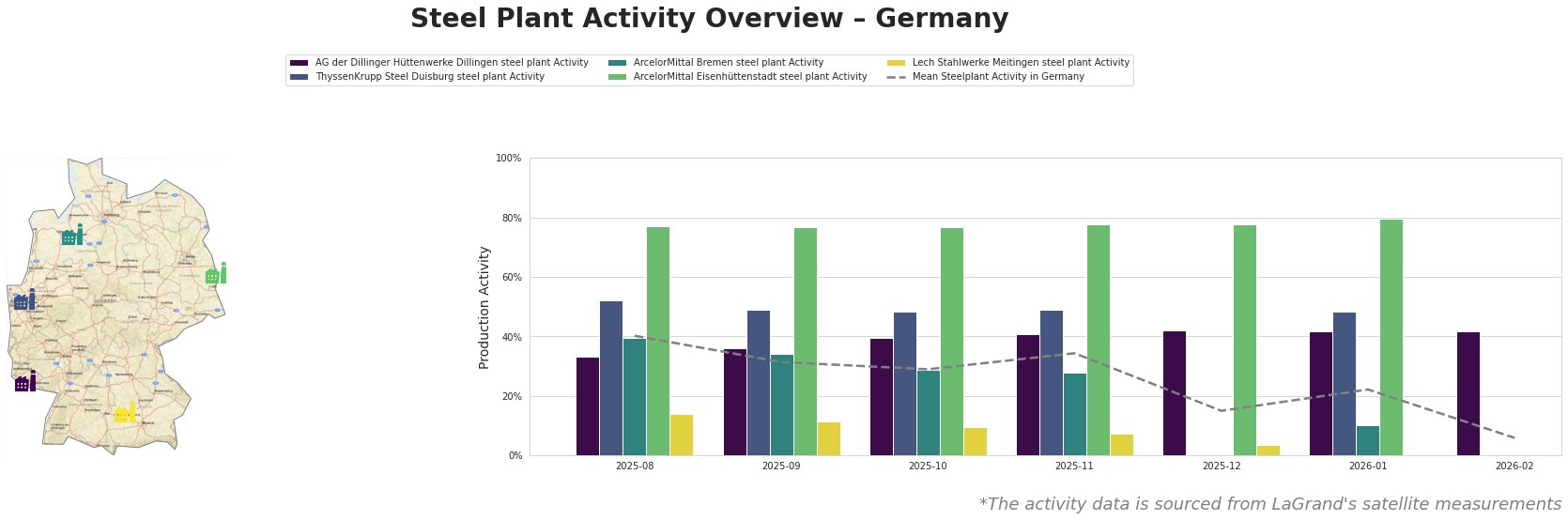

In Germany, recent developments reflect a favorable sentiment in the steel market with rising activity levels in key plants. Notable articles such as Rütteln am Klimaziel: Unternehmen und Gewerkschaften fürchten um Jobs und Geschäftsmodelle highlight ongoing discussions around climate goals that influence industry operations. Although skepticism exists, the political push for economic stability appears to correlate with the observed uptick in plant activity, particularly evident in the satellite data.

AG der Dillinger Hüttenwerke’s activity has notably fluctuated, peaking at 42.0% in December 2025. The plant’s alignment with current sustainability discussions, as outlined in Rütteln am Klimaziel: Unternehmen und Gewerkschaften fürchten um Jobs und Geschäftsmodelle, suggests a response strategy to maintain production amid calls for both economic and climate considerations.

ThyssenKrupp Steel in Duisburg has experienced relatively stable operations, maintaining an average of 49.0% activity, attributing to the continued demand in key sectors like automotive and infrastructure. This stability may be bolstered by the increasing focus on foreign investments detailed in articles like Deutschland-Blog: Merz will Beziehungen zu Golfstaaten erneuern | FAZ, illustrating the importance of securing economic partnerships for sustained growth.

ArcelorMittal Bremen holds significant momentum with its activity aligning with a high of 78.0% in December 2025. This uptick suggests resilience against market fluctuations, potentially influenced by the broader economic strategies highlighted in recent political engagements.

In contrast, the Lech Stahlwerke Meitingen plant has faced considerable declines, with activity plummeting to 0.0% in January 2026, indicating potential operational challenges that may require immediate attention.

Market conditions suggest possible supply disruptions stemming from the variable outputs of smaller plants like Lech Stahlwerke Meitingen. Steel buyers should consider diversifying sourcing strategies to mitigate risks associated with potential volatility within individual plant operations.

Steel procurement professionals are encouraged to capitalize on relationships with stable producers like ThyssenKrupp and ArcelorMittal while remaining vigilant of market signals linked to ongoing political discussions, ensuring they are well-equipped to navigate procurement in this evolving landscape.