From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for European Steel Market Amidst Increased Domestic Activity

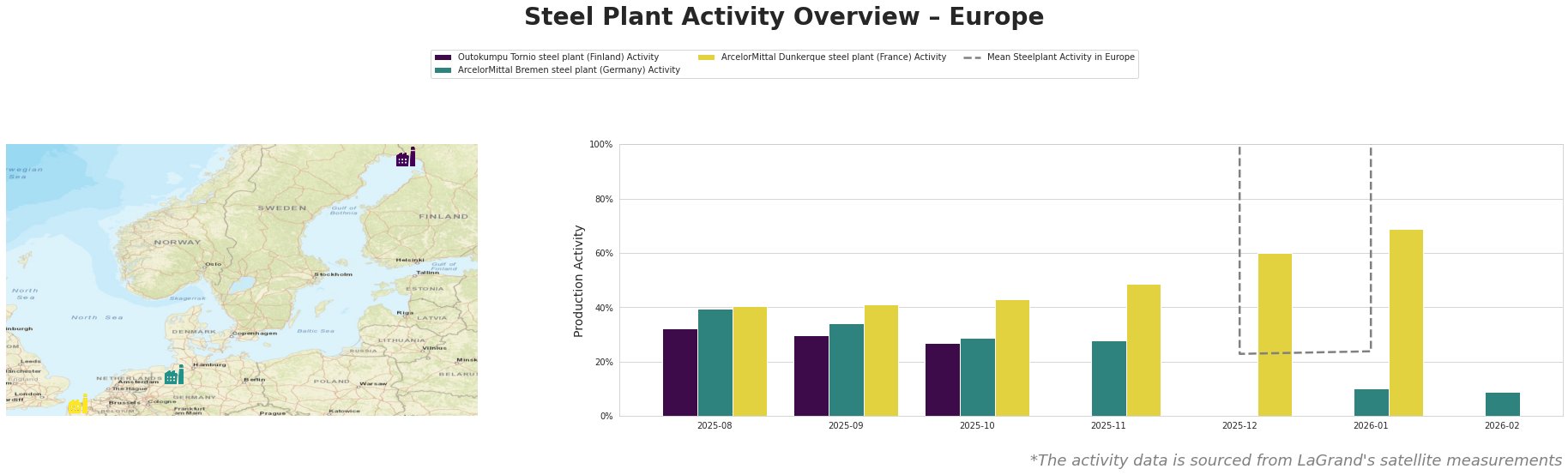

European steel market sentiment remains positive as domestic hot-rolled coil (HRC) prices recover, primarily driven by reduced import volume due to the EU’s Carbon Border Adjustment Mechanism (CBAM) as seen in the article “European domestic HRC prices rise as pressure from import reduces” (Published: 2026-02-02). This trend is corroborated by declining activity levels at several major plants, particularly the ArcelorMittal Dunkerque facility, which reached a 69% activity level in January 2026, following a notable decrease to 60% in December.

The satellite data indicates that the Outokumpu Tornio plant maintained a relatively stable activity level around 40% despite the overall mean activity indicating a downturn, potentially reflecting strong demand in selective markets. Meanwhile, the ArcelorMittal Bremen plant experienced a sharp drop to 10% activity in January 2026, aligning with fluctuations in market demand described in the articles like “European HRC prices flattened by offers outpacing market reality” (Published: 2026-02-05), suggesting mechanical downtimes or strategic slowdowns in production.

Notably, the ArcelorMittal Dunkerque facility, with its 69% activity in January, has demonstrated a successful adaptation mechanism to current market conditions, coinciding with higher domestic HRC price levels becoming mutually beneficial as suppliers adjust their offers. Except for the Outokumpu plant, the activity drops at the other plants do not directly correlate with new import regulations.

Given these insights, steel buyers should focus procurement strategies on locally produced HRC in Germany and France due to the expected pricing stability and availability linked to strong local demand mitigating the import fluctuations. Import obligations and potential delays from the CBAM further recommend minimizing reliance on foreign HRC procurement. Additionally, any future negotiations should reference current pricing trends to leverage the cautious optimism expressed in market reports.