From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market: Robust Growth Driven by Strategic Budget Initiatives

Asia’s steel market is witnessing a very positive sentiment, bolstered by key governmental budget announcements and strategic investments. The article titled Budget 2026: Big Push For Growth, Jobs And A New Tax Era To Power Viksit Bharat outlines a framework for economic expansion and infrastructure development that is likely to stimulate steel demand. Additionally, as stock markets remain cautious ahead of budget presentations, the article Stock Markets Fluctuate In Narrow Range Ahead Of Budget Presentation highlights that while some entities face declines, the anticipated budget could lead to increased operational activities at steel plants.

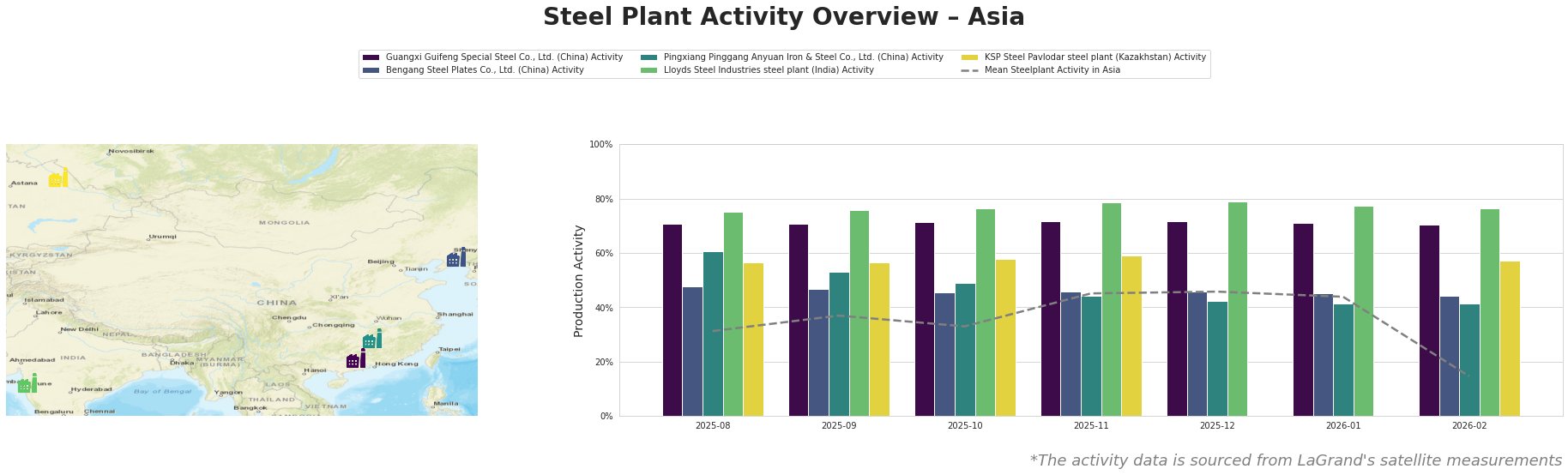

Measured Activity Overview

Recent observations depict significant shifts in the activity levels of steel plants in Asia, most notably a drastic drop in the mean activity level to 15.0% by February 2026. Despite this, Guangxi Guifeng Special Steel Co., Ltd. remained consistently high at 71.0%, suggesting stable operations. Other plants, such as Bengang Steel Plates Co., Ltd., maintained a downward trend with their activity level dropping to 44.0%, aligning with decreased demand expectations influenced by the prevailing market conditions cited in the stock market article.

Evaluated Market Implications

The profound scaling back in activity at several plants highlights potential supply disruptions, particularly for those reliant on the high demand typically stimulated by government investment, such as Bengang Steel Plates Co., Ltd. Despite the positive outlook supported by the budget announcements, plants like Lloyds Steel Industries and KSP Steel indicate resilience with stable productivity, suggesting potential opportunities for procurement strategies. Steel buyers and analysts should focus on securing supplies from plants with consistent activity levels, ideally aiming to leverage the anticipated infrastructural development and government-backed projects to hedge against potential volatility. Direct inquiries regarding availability from Guangxi Guifeng and Lloyds Steel are recommended to negotiate favorable terms based on stable operational statuses.