From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Activity in Asia: Current Trends and Insights from Recent Developments

In Asia, the steel market exhibits a Neutral sentiment as the region faces fluctuating activity levels across key plants. Recent news articles including US spot gas prices soar near LNG terminals and US LPG exports, production slowed due to freeze signal potential global market impacts that may indirectly affect steel sourcing strategies. While no direct correlation between these news items and steel activity shifts can be established, they highlight underlying trends in energy prices that steel operators must monitor.

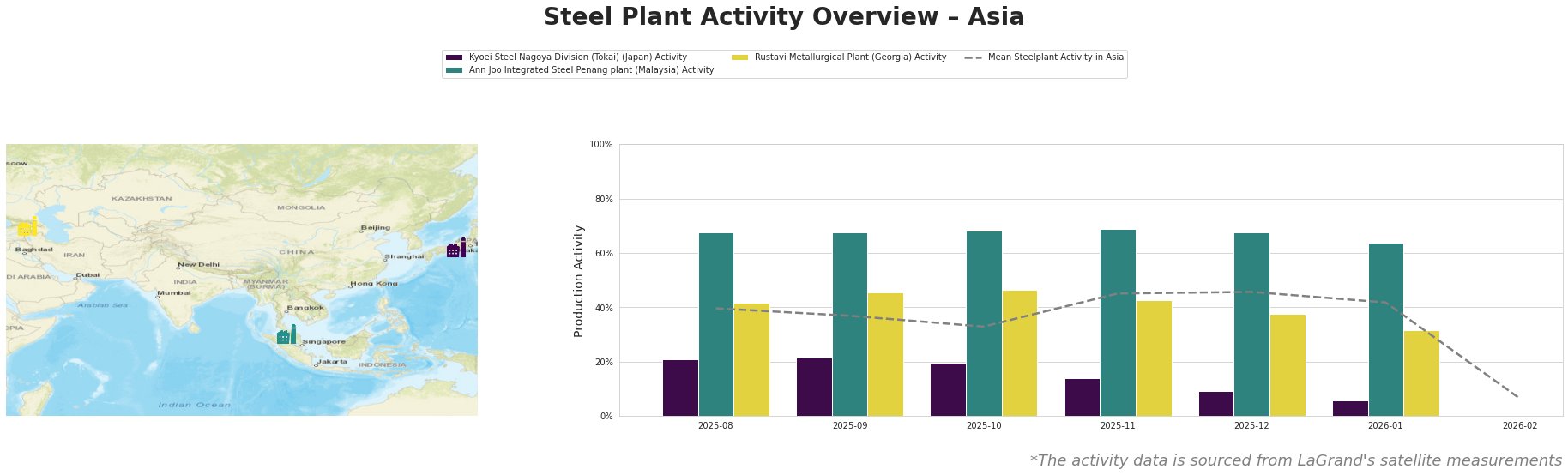

At Kyoei Steel’s Nagoya Division, activity plummeted to 6% by January 2026 from 21% in August 2025, aligning with no apparent news-driven factors. Conversely, Ann Joo Integrated Steel’s activity decreased moderately to 64% in January from 68%, remaining relatively stable throughout the observed period, reflecting resilience amidst broader market fluctuations. Rustavi’s activity experienced a decline to 32% from 42%, indicating significant volatility that necessitates monitoring for potential supply and demand realignments.

Kyoei Steel, primarily using Electric Arc Furnaces (EAF), has seen a diminishing workforce and lower production due to rising energy costs, indirectly influenced by the US spot gas prices soar near LNG terminals report. Ann Joo, leveraging a combination of Blast Furnace (BF) and EAF, has maintained steadier operations, suggesting effective capacity utilization strategies amidst changing market dynamics. Rustavi Metallurgical, with its multipurpose facilities, faces challenges attributed to external supply chain pressures, which could be exacerbated by factors like operational issues reported in US LPG exports, production slowed due to freeze.

The observed decline in activity across these plants signals potential supply disruptions, particularly from Kyoei Steel and Rustavi, where operational flexibility appears limited amid global market developments. Steel procurement professionals should consider diversifying sourcing strategies, particularly for finished rolled products from Ann Joo, while monitoring Kyoei and Rustavi closely for further disruptions linked to energy dependencies. Additionally, the increasing rerouting of LNG exports, as illustrated in LNG Canada cargo diverts mid-Pacific away from Asia, should prompt buyers to secure contracts proactively to buffer against potential price volatility and supply shortages in the near term.