From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNegative Outlook for Asian Steel Market: Activity Drops Amid Geopolitical Shifts

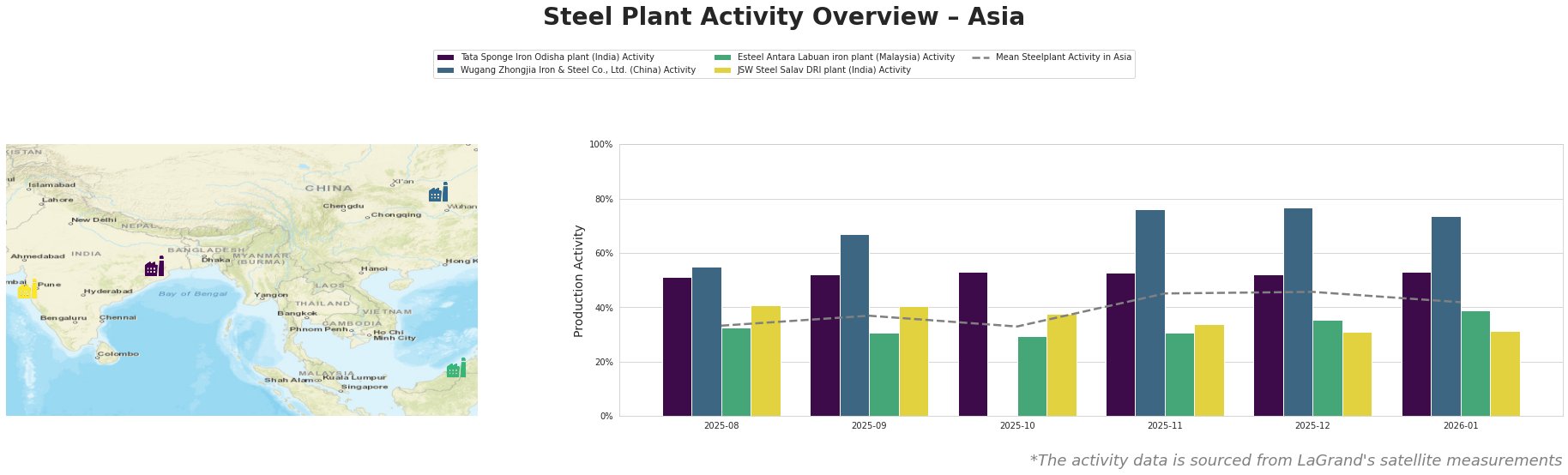

The Asian steel market exhibits a negative sentiment as activity levels decline across key plants. Recent reports such as “Venezuelan crude flows threaten US HSFO gains“ and “US Citgo sale hangs in the balance“ have highlighted instabilities in the market linked to shifts in crude oil supply and refinery operations, indirectly influencing steel demand through rising energy costs and geopolitical uncertainties.

The Tata Sponge Iron Odisha plant maintained activity at 53% for January, slightly up from December, indicating stability amidst overall market declines. Conversely, Wugang Zhongjia Iron & Steel experienced a decline, last recorded at 74%, down from 77% in December, correlating with ongoing geopolitical concerns cited in “Venezuelan crude flows threaten US HSFO gains”, which affects energy prices and production costs.

Esteel Antara’s activity rose to 39% from 36%, likely reflective of regional market demand shifts, though the lack of direct connection to the noted articles limits further interpretation. Meanwhile, JSW Steel Salav saw a drop to 31%, down from 34%, revealing vulnerability amid the turbulent market conditions.

In light of these developments, steel buyers should consider procurement strategies aimed at securing materials from stable sources like Tata Sponge Iron, which is less affected by the geopolitical factors impacting the sector. Additionally, monitoring the potential impact of changing crude oil supplies and price fluctuations on steel production capabilities is essential for adjusting procurement timelines and strategies.

Overall, focusing on regional suppliers with robust activity levels, such as Tata Sponge Iron, offers a more resilient supply chain approach in a negatively shifted market.