From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for European Steel Market Despite Recent Production Declines

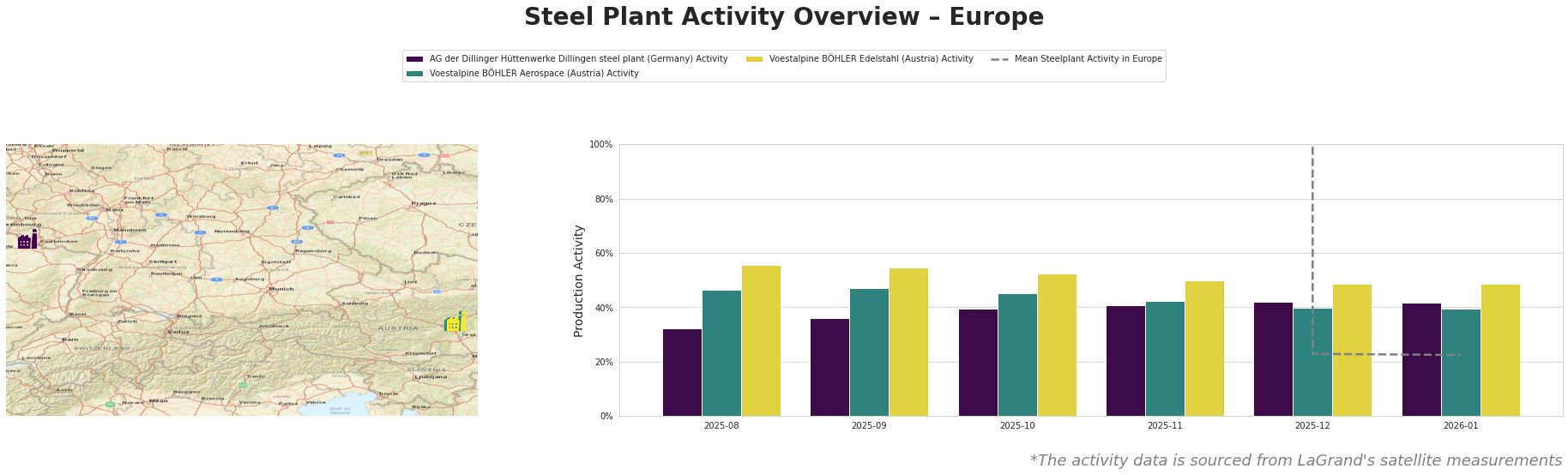

Recent developments in the European steel market show a positive sentiment, buoyed by resilience in some regions despite overall declines. “Germany sees another year of declining steel production” highlights a significant drop in German steel output in 2025, with further declines expected in 2026. This aligns with a 9% decrease reported by WV Stahl, leading to reduced capacity utilization critical for energy-intensive production processes. Notably, satellite data reflects changes in activity levels at several key steel plants.

AG der Dillinger Hüttenwerke Dillingen steel plant in Germany showed a gradual increase in activity from 32% in August to 42% by December 2025, aligning with reports of increasing operational efficiency amidst declining production trends as noted in “Germany sees another year of declining steel production.” This operational improvement is particularly crucial given the plant’s focus on high-value product categories like heavy-plate and high-strength steels, supporting demand in automotive and infrastructure sectors.

Conversely, Voestalpine BÖHLER Aerospace displayed strong stability around its activity levels, peaking at 56% in August before settling to 40% by December. This suggests resilience in specialized segments, potentially mitigating impacts from broader market concerns discussed in “Global steel production in 2025 decreased by 2% y/y.” Voestalpine BÖHLER Edelstahl, while primarily focused on electric steelmaking, also reflects similar stabilization, indicating an adaptation to market fluctuations.

The current landscape presents potential supply disruptions, particularly in Germany, where significant declines in production capacity may limit availability in the short term. For steel buyers, this underscores the importance of securing contracts to access production from operating plants showing resilience, like AG der Dillinger Hüttenwerke. Prioritized sourcing strategies from stable producers can help mitigate risks associated with the overall decline in the German steel market.

In summary, while Europe faces production challenges, monitored activity data indicates specific plants exhibit recovery and stability, suggesting a nuanced environment where opportunities for procurement exist, tailored to market dynamics and production capabilities.