From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Update: 2025 Declines Present Opportunities Amidst Challenges

The steel market in Europe is experiencing significant challenges, particularly in Germany and France, where production levels are declining. Reports titled “Germany reduced steel production by 8.6% y/y in 2025“ and “France reduced steel production by 8.7% y/y in 2025“ pinpoint the stark drops in production and capacity utilization, which now lingers below critical thresholds. Recent satellite data reveals a direct correlation, showing marked declines in activity levels across vital plants in the region during the same period.

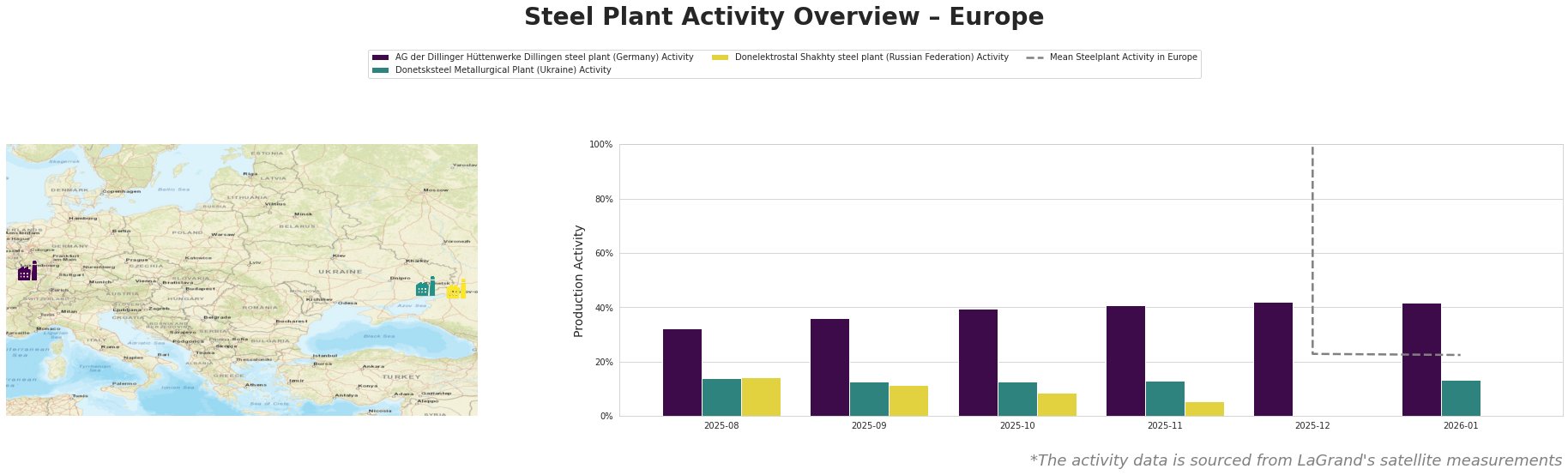

The AG der Dillinger Hüttenwerke Dillingen steel plant, prominent in producing various high-strength steels, experienced a slight uptick, with activity peaking at 42% in December 2025, maintaining steady output during a turbulent market characterized by an overall decline in Germany’s steel production as reported in “Germany sees another year of declining steel production“. This suggests a relatively stable operation compared to its German counterparts; however, the persistent low utilization rates raise concerns about long-term viability.

Conversely, the Donetsksteel Metallurgical Plant’s output has been negligible, with observed activity dropping to 0% by January 2026. The inability to produce steel reflects its ongoing operational challenges, which are exacerbated by geopolitical tensions, impacting its ability to meet demand. There’s no direct correlation to reported news, indicating systemic issues are plaguing the region.

The Donelektrostal Shakhty steel plant has also shown alarming signs, with activity declining to 0% in January 2026, indicating a complete halt in operations. This aligns with global pressures as characterized in “Global steel production in 2025 decreased by 2% y/y“, forecasting further supply constraints in the market.

To navigate these turbulent waters, steel procurement professionals should consider securing contracts with reliable suppliers who are less impacted by the ongoing production challenges. With production in Germany dwindling and the potential for import pressure escalating from countries like China, it is prudent to diversify sourcing and aim for longer-term agreements where feasible. The recommendations stem from the pressing need to stabilize supply chains disrupted by inconsistent production in key markets and a lack of proactive measures from industry leaders to address these losses.