From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market in Decline: Activity Levels Falling Amidst Climate Fund Debates

Recent developments in Europe illustrate a negative trajectory in the steel market, primarily driven by uncertainties surrounding climate initiatives. The news article “Klimafonds-Initiative: Bundesrat wehrt sich gegen zusätzliche Milliarden für den Klimaschutz“ highlights ongoing resistance to increased funding for climate measures in Switzerland. This resistance has been linked to an observable decline in steel plant activity levels, particularly in the context of environmental regulations impacting operational decisions.

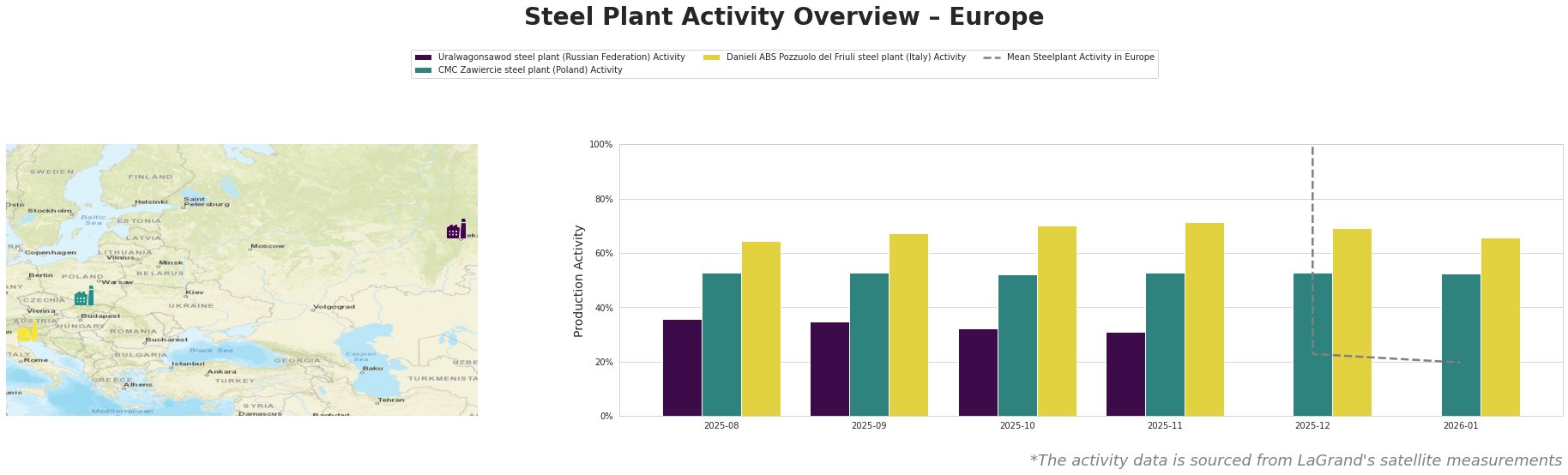

The Uralwagonsawod steel plant in Russia experienced a significant activity drop from 36.0% in August to 20.0% in January, hinting at potential disruptions or operational scaling down amidst fiscal debates, as seen in the aforementioned news. However, there is no direct link to specific news articles documenting this decline.

The CMC Zawiercie steel plant has maintained steady activity around 53.0%, indicating resilience as this plant primarily serves the automotive and infrastructure sectors. This stability, however, could be short-lived if climate policies shift unfavorably or if operational costs rise significantly.

Meanwhile, the Danieli ABS Pozzuolo del Friuli steel plant exhibited a moderate decline—activity decreased from 72.0% in November to 66.0% in January, amidst broader market challenges which may reflect hesitance in investment due to climate funding uncertainty discussed in “Arena” zum Klimafonds – Klimafonds: Zukunftsinvestition oder Angriff auf Schuldenbremse?

The European steel market is facing risks associated with climate-related strategies that could lead to supply disruptions, especially if new regulations or funding requirements become enforced. Steel buyers should closely monitor operational shifts at key plants such as Uralwagonsawod and Danieli, prioritizing procurement strategies that hedge against potential supply volatility through diversified sourcing options. The recommendations of immediate procurement from stable sources, like CMC Zawiercie, may offer some certainty in a turbulent environment.