From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Analysis: Positive Trends Driven by Strategic Acquisitions and Activity Boosts

Recent developments in the European steel market illustrate a Very Positive sentiment, primarily influenced by major acquisitions and increased operational activity at steel plants. Notably, US-based Worthington Steel to acquire Klöckner & Co for $2.4 billion and Germany’s GMH Gruppe forms unified open-die forging group are key announcements that underscore strategic shifts impacting production capacity and market offerings. These headlines coincide with satellite data indicating increased activity levels at several plants, with some correlations noted.

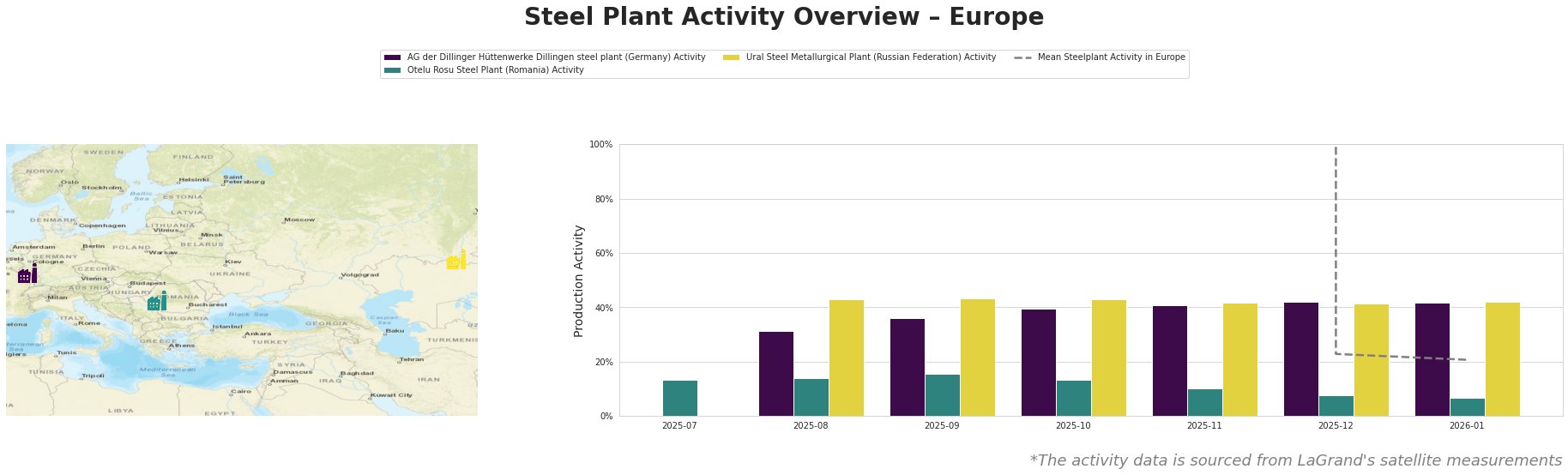

AG der Dillinger Hüttenwerke (Germany) observed a notable increase in activity, reaching 42% in December 2025, aligning with overall positive market conditions but lacking direct connection to the listed news. Conversely, Otelu Rosu Steel Plant (Romania) faced a decline to 7% in January 2026, although no explicit cause related to market news can be established. Ural Steel (Russia) sustained a 42% activity level in January 2026, indicating stable operations amidst market fluctuations.

The market implications are evident. Worthington’s acquisition strategy anticipated to increase operational efficiencies may indirectly boost regional supply stability. The unification of GMH Gruppe reinforces production capabilities, positioning the German conglomerate to adapt quickly to rising demand in segments such as automotive and energy, which holds potential for inventory returns and streamlining operations across borders.

Recommended Procurement Actions:

1. Expand Partnerships with GMH Gruppe for high-quality tool and engineering steels. Their modernization initiatives likely lead to enhanced reliability and supply predictability.

2. Monitor AG der Dillinger Hüttenwerke’s output, which is currently robust, for procurement opportunities as they capitalize on high production capabilities and process efficiencies.

3. Evaluate supply chains with Otelu Rosu, preparing for possible volatility in availability due to declining activity, while noting the unique offerings within specialty steel sectors.

4. Engage with Ural Steel for steady procurement, leveraging their sustained activity towards maintaining supply within building and infrastructure projects where demand is consistent.

By aligning procurement strategies with these insights, buyers can position themselves strategically in a thriving European steel market.