From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Update: Positive Momentum Amid Rising Electric Vehicle Production

Germany’s steel industry exhibits a very positive sentiment, driven by increased activity linked to the automotive sector, particularly electric vehicle (EV) production. Recent reports, including “Electric vehicles increase German production share in 2025“ and “The share of electric vehicles in German production will increase in 2025,” highlight the robust growth in the automotive sector, correlating with heightened steel production demands. Despite a slight decline in overall car production forecasts for 2026, December 2025 showcased a sharp 17% year-on-year production surge, reaffirming the link between automotive growth and rising steel activity levels.

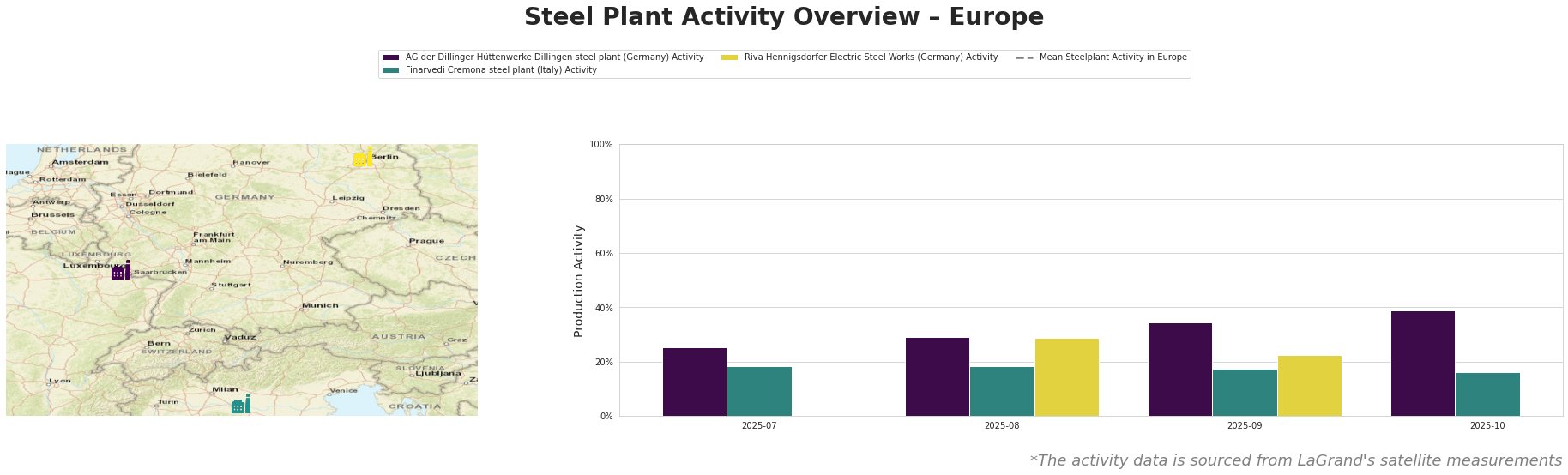

AG der Dillinger Hüttenwerke Dillingen steel plant reflects increasing activity levels, rising from 25% in July 2025 to 39% by October 2025, aligning with the automotive sector’s upswing in production. This growth is significant against the backdrop of Germany’s overall production resilience, as noted in “Germany reduced exports by 0.8% y/y in November,” which contextualizes the plant’s performance within a broader narrative of industrial production improvements despite export challenges.

In contrast, the Finarvedi Cremona steel plant did not exhibit notable growth, remaining relatively stable with a peak of 18% activity. This stability may indicate a focus on meeting existing demands rather than aggressive growth strategies. Meanwhile, Riva Hennigsdorfer Electric Steel Works registered variable activity, reaching 29% in August but with no data for later months, possibly reflecting fluctuations demand in the automotive segment dependent on input availability.

Given these observations, procurement professionals should consider:

- Targeting AG der Dillinger Hüttenwerke Dillingen for increased steel purchase volumes due to its positive activity trends that cater to the EV sector aligned with automotive production growth.

- Monitoring the Finarvedi Cremona plant for developments, considering current stability, as its production aligns closely with automotive needs but may not capture sudden increases in demand.

- Assessing risk within the broader landscape, particularly in light of the 0.8% export decline noted, which may influence steel pricing and availability for other domestic consumers.

Proactive engagement with AG der Dillinger Hüttenwerke and careful vigilance regarding market fluctuations will ensure robust procurement strategies as the European steel market remains optimistic moving into late 2025 and beyond.