From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market in Europe: Positive Trends as Ukrainian Producers Ramp Up Output

Recent developments in the European steel market reveal a very positive outlook, particularly driven by production increases from Ukrainian plants amid challenging conditions. The news articles “Zaporizhstal increased its rolled steel production by 15.1% y/y in 2025“ and “ArcelorMittal Kryvyi Rih produced 1.69 million tons of steel in 2025“ confirm a notable rise in production despite wartime adversities. Satellite data corroborates these findings, showing activity levels at key steel plants remaining robust.

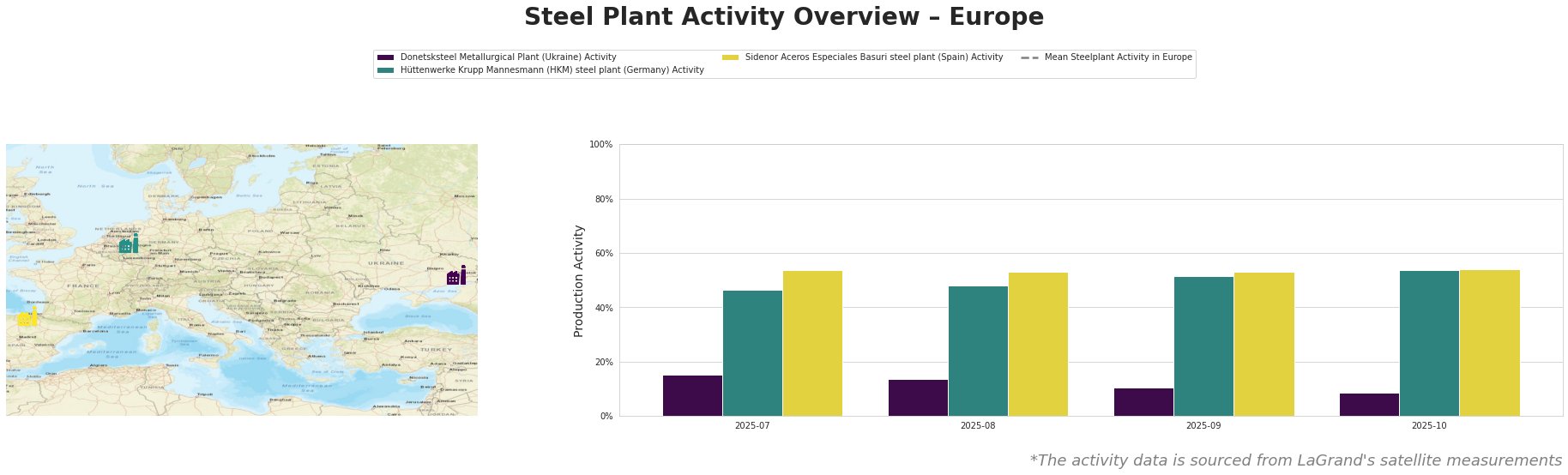

The data indicates a downward trend in overall activity, particularly at the Donetsksteel Metallurgical Plant, which fell to 9% by October 2025, reflecting ongoing regional challenges. In contrast, operations at Hüttenwerke Krupp Mannesmann and Sidenor have been relatively stable, maintaining around 51% and 54% activity levels. The reported increase in production at Zaporizhstal and ArcelorMittal aligns with their relative resilience compared to others. Notably, no direct correlations with satellite-observed data at Donetsksteel can be established from the news articles referenced.

Donetsksteel Metallurgical Plant

The Donetsksteel Metallurgical Plant primarily produces pig iron using integrated processes, yet its activity has sharply declined from 15.0% in July to 9.0% in October 2025. This drop does not connect with any cited news articles, emphasizing the plant’s ongoing struggles amid the broader industry recovery.

Hüttenwerke Krupp Mannesmann (HKM)

Located in Germany, HKM operates a highly integrated facility producing a range of steel products. Its activity, fluctuating between 47% and 54%, reflects operational stability helped by the positive European market sentiment. However, no direct link to recent news suggests a more robust performance compared to others.

Sidenor Aceros Especiales Basuri

Sidenor has maintained a high activity level, consistently at 53%-54%, indicative of strong demand in finished rolled products, particularly for the automotive and construction sectors. The plant’s performance contrasts favorably with the declining trend seen in other regions, albeit no direct connections to news articles have been established.

The observed production increases at Zaporizhstal and ArcelorMittal highlight potential opportunities for procurement, particularly for buyers seeking reliable suppliers amidst fluctuating market conditions. Buyers should prioritize sourcing from these producers, likely to offer competitive pricing due to increased production capacity.

Given the declining activity at Donetsksteel and the uncertainties related to their operational capabilities, steel buyers should cautiously evaluate supply agreements from this plant while considering alternatives from more stable producers like Sidenor or HKM. Enhanced production from Ukrainian producers presents an actionable pathway for procurement strategies, ensuring supply chain resilience going into 2026.