From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGermany’s Steel Market Thrives as Electric Vehicle Production Surges—Actionable Insights for Buyers

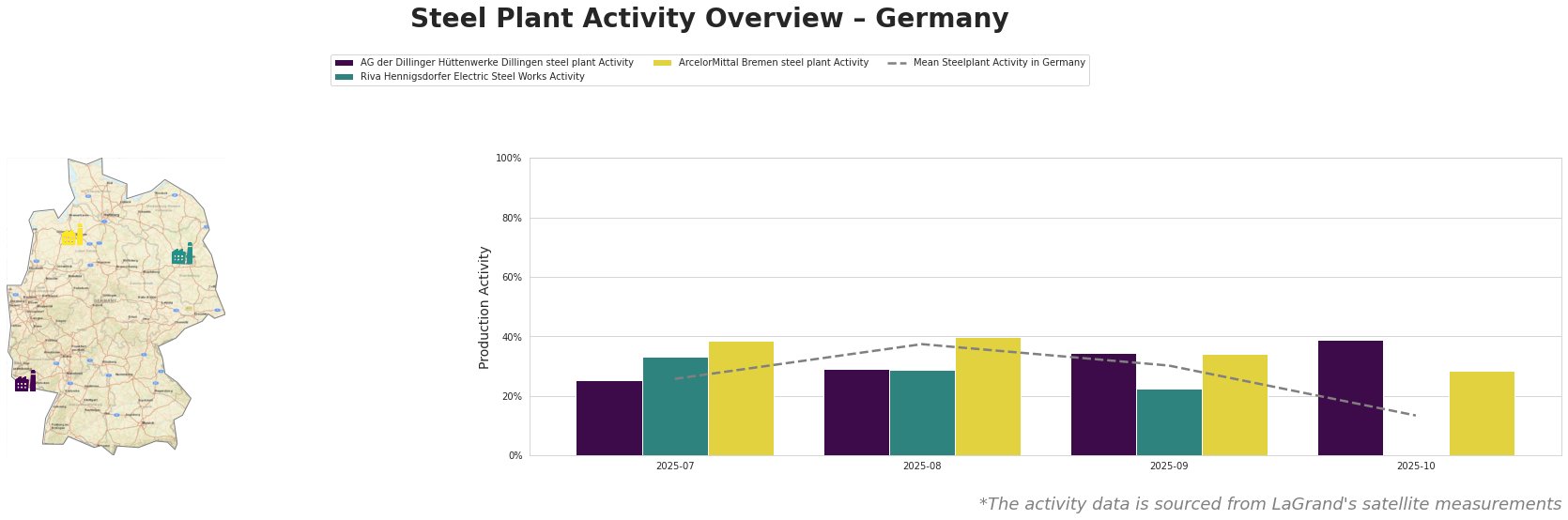

Germany’s steel sector shows a very positive sentiment, driven largely by the automotive industry’s shift towards electric vehicle (EV) production. As highlighted in Electric vehicles increase German production share in 2025, domestic automotive production rose by 2% in 2025, heavily influenced by a surge in EV output. Satellite data reveals a corresponding trend in steel plant activity, particularly in plants integral to automotive supply.

The latest production statistics show that Germany’s steel plants have generally turned upward, aligned with the automotive sector’s growth noted in The share of electric vehicles in German production will increase in 2025. Despite an overall decline in orders, particularly in December, the automotive industry has offset these decreases, leading to a marked boost in steel production levels.

The AG der Dillinger Hüttenwerke Dillingen steel plant has seen fluctuations, peaking at 39% activity in October 2025, likely connected to the automotive sector’s demand for high-strength and specialized structural steels, crucial for EV manufacturing. The plant’s ability to produce diverse steel types positions it favorably as production needs rise.

Riva Hennigsdorfer Electric Steel Works registered lower activity, at 22% in September 2025, with no direct correlation to the recent automotive growth. This lack of relation indicates potential procurement issues if demand shifts rapidly toward electric steel products.

Conversely, the ArcelorMittal Bremen plant consistently operated at high levels, reaching 40% activity in August, supporting automotive production through its output of high-quality hot and cold-rolled steel products. This trend suggests that ArcelorMittal is well placed to benefit from increased automotive demand, particularly for components needing higher-grade materials for EVs.

Evaluated Market Implications

Procurement professionals should closely monitor the performance at Riva Hennigsdorfer Electric Steel Works, as its recent lower operational levels may signal supply interruptions if demand spikes unexpectedly. Meanwhile, diversifying purchases from high-activity plants like AG der Dillinger Hüttenwerke and ArcelorMittal Bremen will ensure a consistent supply, particularly in the burgeoning EV sector, where quality structural steels are increasingly essential. With no imminent supply disruptions projected at these plants, early procurement may yield favorable pricing and availability consistent with the ongoing momentum in steel activity aligned with automotive demands.