From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for the European Steel Market Amid Rising Prices and Plant Activity

European steel producers are cautiously optimistic, as indicated by recent developments. According to the article “European HRC markets restart slowly; mills push prices up as CBAM creates structural strain on imports“, mills are increasing prices for hot-rolled coils (HRC) due to the impact of the Carbon Border Adjustment Mechanism (CBAM), driving many buyers to favor domestic suppliers. Concurrently, satellite data reveal changes in activity levels at major steel plants, indicating a responsive adjustment to market conditions post-holidays.

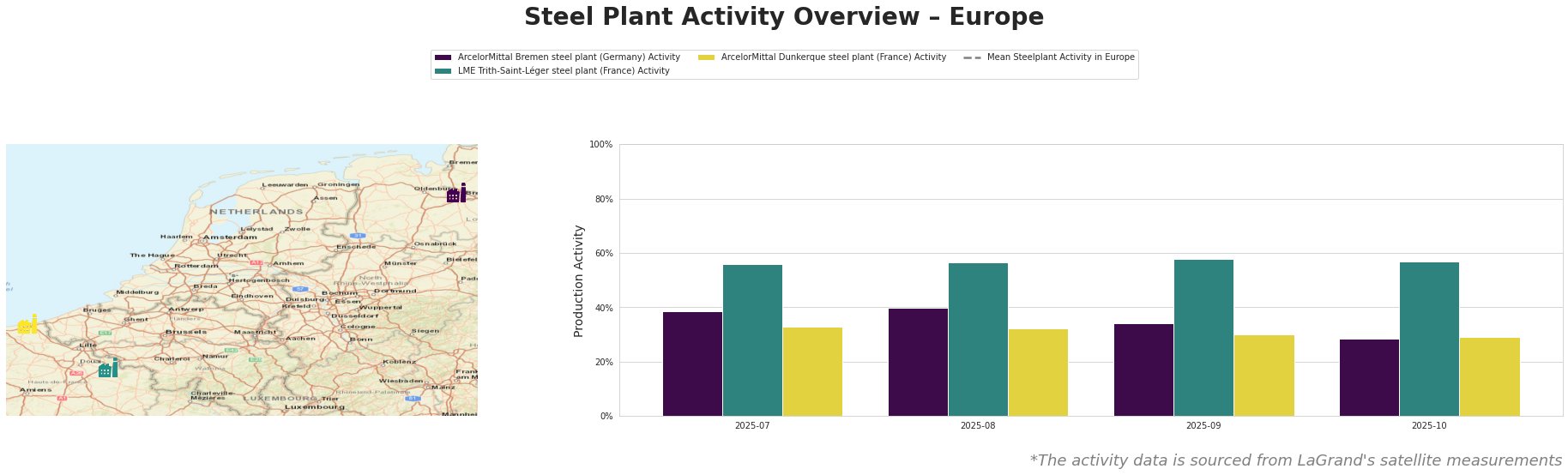

The ArcelorMittal Bremen steel plant in Germany reported a 2% decrease to 29% in activity by October 2025, which aligns with reduced demand amid rising HRC prices; buyers are reluctant as highlighted in the article “European HRC markets are recovering slowly; factories are raising prices as CBAM puts a structural strain on imports.” In contrast, LME Trith-Saint-Léger maintained a stable activity level of 57%, benefitting from continued outputs, as they pivot to domestic demand amidst import challenges arising from CBAM.

ArcelorMittal Dunkerque also faced a decline to 29%, reflecting broader market hesitancy. However, the overall European mean dropped more significantly, which suggests that these plants are adjusting their operations in response to market pressures. This correlation underscores the necessity for buyers to adapt procurement strategies.

As a direct implication of the rising costs and the growing influence of domestic mill reliability, suppliers in Germany are expected to adjust pricing as demand stabilizes, leading to potential procurement opportunities in Q2 2026.

In light of these developments, steel procurement professionals should consider prioritizing contracts with local mills to mitigate risks associated with import disruptions and rising CBAM prices. Additionally, strategic timing in purchasing could yield advantages as further price hikes are anticipated.

The positive sentiment toward stability, amid rising steel costs, presents an opportunity for informed buyers to secure competitive pricing from domestic sources, ultimately leveraging market trends and localized production capabilities.