From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Overview: Neutral Sentiment Amidst Fluctuating Activity Levels

Recent developments in the European steel market reflect a Neutral outlook, influenced by activities at key steel plants and pertinent global news. The article “Australia’s Gladstone LNG loadings fall in December” signals broader economic challenges, as decreased LNG exports from Australia have a potential cascading effect on energy prices and steel production inputs, though direct links to plant activities were not established. Conversely, “Australia’s Gladstone coal exports rise in December” highlights an increase in coking coal demand from China, which could indirectly bolster European steel production as Chinese steelmakers ramp up production.

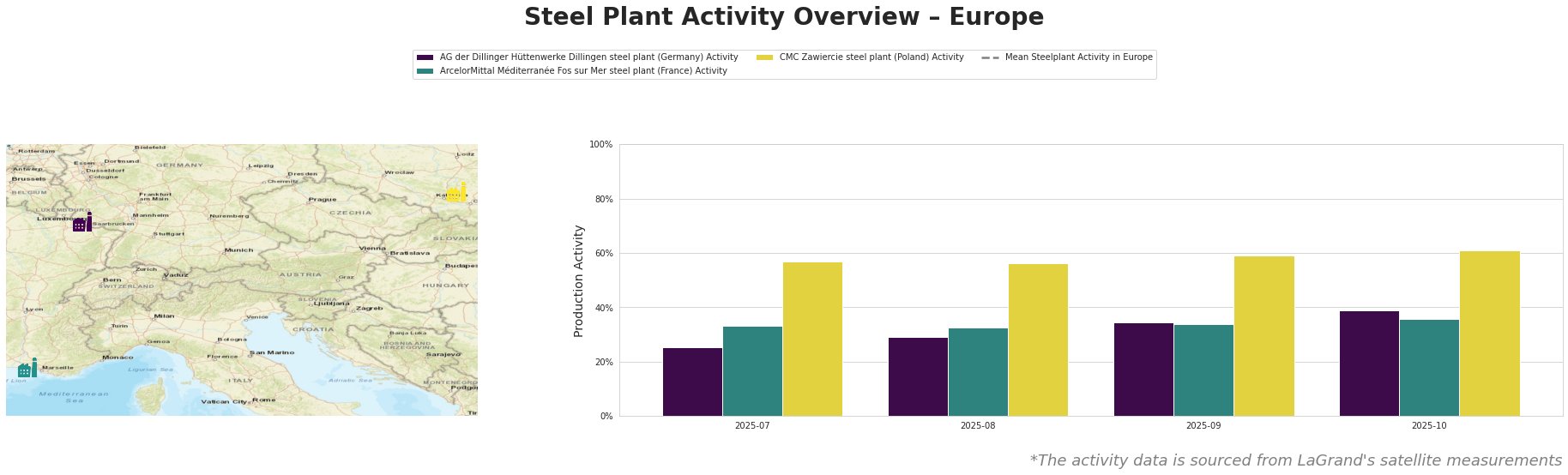

The activity metrics denote notable fluctuations among the major plants. The AG der Dillinger Hüttenwerke Dillingen plant exhibited increasing activity from 25% to 39% between July and October 2025, indicating a strengthening in operations possibly linked to the European market’s adjustments amid global supply shifts. In contrast, the ArcelorMittal Méditerranée plant maintained stable activity levels but experienced a slight decline in October. The CMC Zawiercie plant saw activity rise from 57% to 61%, indicating a robust response to demand but unlinked to any specific news developments.

The AG der Dillinger Hüttenwerke Dillingen plant, located in Saarland, operates using an integrated Blast Furnace (BF) method with a crude steel capacity of 2.76 million tons. The rise in its activity to 39% in October could reflect improved production schedules aligning with broader European demand trends, although no direct news link could be confirmed. Conversely, ArcelorMittal Méditerranée Fos sur Mer operates with a significant crude steel capacity of 4 million tons but has not capitalized fully on the rising coking coal demand, evidenced by its drop in activity. The CMC Zawiercie plant, with an electric arc furnace capacity of 1.7 million tons, is also thriving, increasing its production levels in alignment with recovering steel demands in energy and automotive sectors.

Given the backdrop of rising coking coal exports and steady steel demand forecasts, procurement professionals should remain vigilant to potential supply disruptions. Particularly, the ongoing increase in Australian coal exports signals a favorable price environment, though disruptions such as weather impacts at ports could affect supply stability. Steel buyers should consider strategic contracts with domestic producers to mitigate reliance on potentially volatile international sources while capitalizing on current supply dynamics.

Additionally, maintaining flexibility in sourcing choices and looking for potential long-term agreements with plants like CMC Zawiercie could be advantageous as activity levels are anticipated to sustain growth, despite recent unstable conditions in related sectors.