From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth America Steel Market: Resilient Recovery Amid Tariff Challenges

The North American steel market exhibits a Very Positive sentiment, primarily driven by recent developments in production activity and pivotal trade dynamics. Notably, “Point of view: Production of rolled steel in Mexico may recover in 2026“, highlights anticipated shifts in Mexican steel demand, which correlates with observed activity levels at key steel plants. The “Mexican steel exports to the United States decreased by 30% in January-November” underlines challenges stemming from U.S. tariffs, which also implicates activity changes.

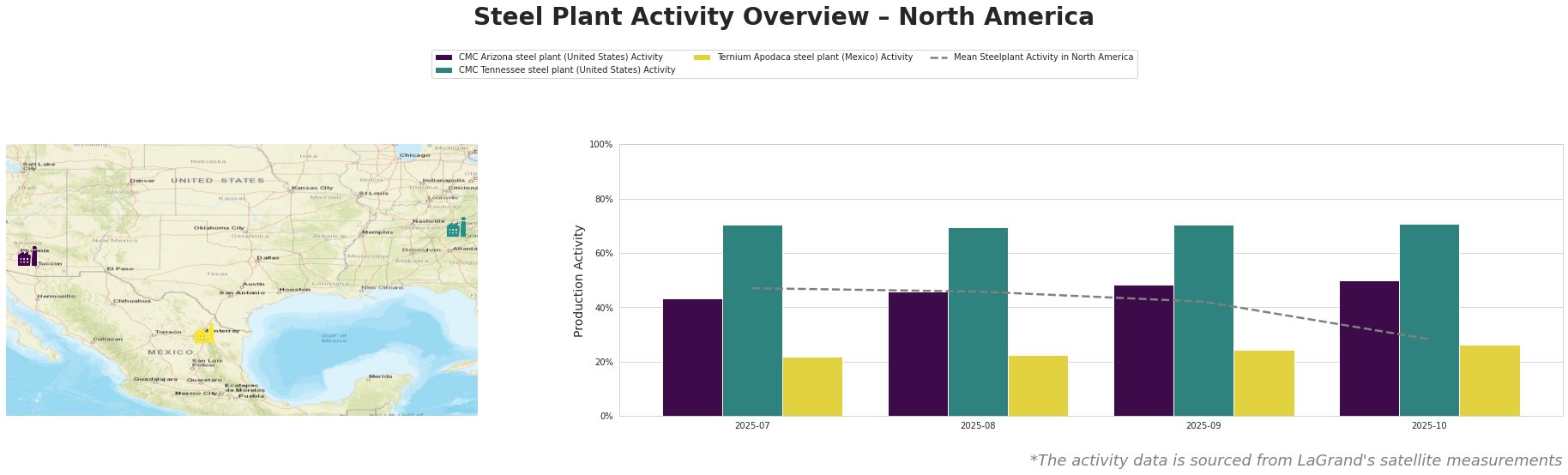

Measured Activity Overview

Recent satellite data indicates fluctuating activity levels across the observed steel plants in North America, with the CMC Arizona steel plant showing a peak activity of 50% in October 2025, aligning with positive trends in local demand. The CMC Tennessee steel plant maintained robust activity at the 71% level, reflecting stability despite external tariff pressures. In contrast, the Ternium Apodaca steel plant in Mexico has struggled, recording a low of 22% activity, consistent with declining exports to the U.S. and a decrease in domestic steel consumption.

Plant Information

The CMC Arizona steel plant operates with a capacity of 354,000 metric tons annually through electric arc furnace (EAF) technology, producing finished rolled products like rebar. Its activity increased by 7% to reach 50% of capacity in October 2025. The anticipated recovery in Mexican steel as noted in “Point of view: Production of rolled steel in Mexico may recover in 2026” emphasizes potential future demand for products like rebar, which CMC Arizona produces.

The CMC Tennessee steel plant, with an EAF capacity of 544,000 metric tons, consistently showed activity around 71%, undeterred by tariff issues that have affected other regions, reflecting its position in the infrastructure and energy sectors, which remain robust.

In contrast, the Ternium Apodaca steel plant has encountered severe challenges, with a peak capacity activity of only 26% recorded in October 2025. This aligns closely with the decline in Mexican exports to the U.S. as highlighted by the “Mexican steel exports to the United States decreased by 30% in January-November”, indicating vulnerability to external tariff pressures while the domestic market remains subdued.

Evaluated Market Implications

Steel buyers should prepare for potential supply disruptions, particularly from Ternium Apodaca due to significantly reduced activity levels linked to decreased exports and production, foreseen in the contextual backdrop of increasing tariffs. Immediate procurement actions should prioritize engagement with CMC Tennessee, which showcases stability despite external pressures, alongside CMC Arizona, which is poised for increased production as market conditions improve. Adapting procurement strategies to focus on regional dynamics will be crucial as post-tariff recovery unfolds, ensuring resilience in supply chains.