From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Thrives Amid Record Automotive Production and High Activity Levels

Recent observations in Europe indicate a significantly positive sentiment in the steel market, driven by burgeoning automotive production and dynamic plant activities. As per the reports, “Electric vehicles increase German production share in 2025“ and “The new passenger car market ended the year with records,” the automotive sector saw substantial stimulation, correlating with increased steel demand.

The surge in the new passenger car market, particularly in Ukraine where sales escalated by 50% compared to November 2025, is linked to the need for more steel to support this growing sector. Additionally, Germany’s automotive industry reported a 17% year-on-year production increase in December 2025, contributing to heightened steel production demands.

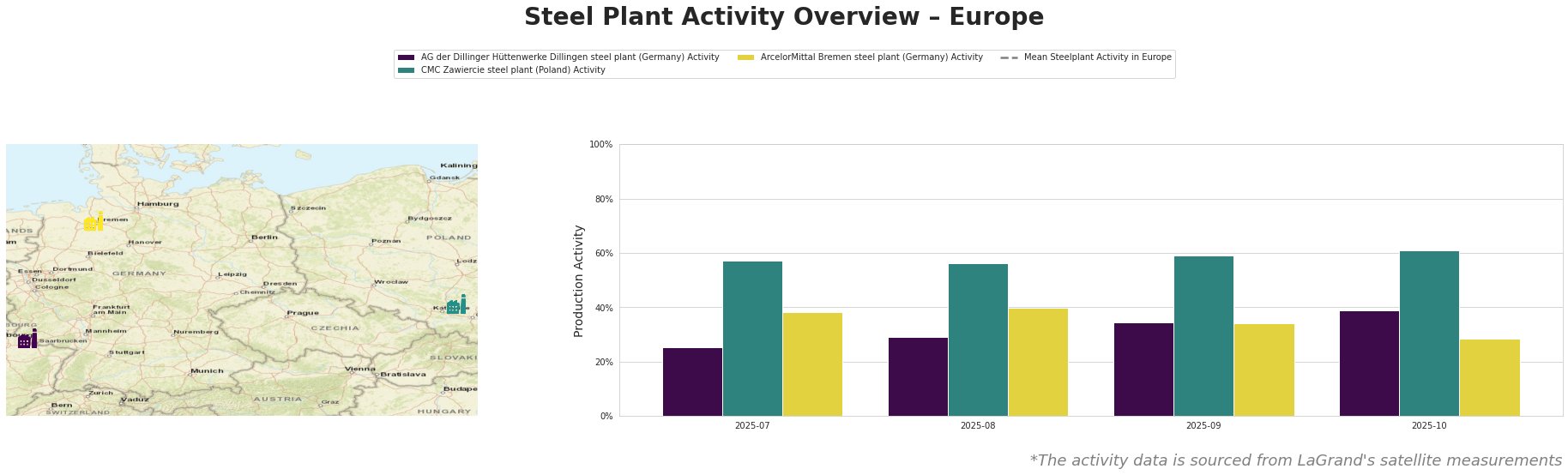

AG der Dillinger Hüttenwerke Dillingen Steel Plant

Located in Saarland, this integrated steel plant has ramped up operations, with activity rising from 25% in July to 39% by October 2025, signaling stronger output. The plant’s focus on semi-finished and finished rolled products aligns with the increased demands from the automotive sector. However, no explicit connection to the recent news articles could be established.

CMC Zawiercie Steel Plant

The CMC Zawiercie plant in Silesia has shown robust and increasing activity, with rates peaking at 61% in October 2025. This increase can be partly attributed to heightened demand linked to the automotive sector’s growth, as mentioned in the news articles, suggesting a direct correlation. The plant specializes in electric arc furnace technology, producing a variety of steel products essential for diverse applications, including automotive.

ArcelorMittal Bremen Steel Plant

The Bremen plant has exhibited fluctuations, reporting an activity decrease to 29% in October, after peaking at 40% in August. Given the rising automotive production and its reliance on steel products, this decline may indicate temporary production adjustments. However, there is no direct link established between these fluctuations and the recent automotive industry reports.

Evaluated Market Implications

A positive outlook on steel sourcing is advised, particularly for buyers targeting products for the automotive and infrastructure sectors due to evident production increases. Procurement professionals should consider securing steel supplies from the CMC Zawiercie plant, which has shown consistent growth and responsiveness to market demands, directly correlating with increased vehicle production. Conversely, careful management of orders from ArcelorMittal Bremen is recommended, given recent activity dips that suggest potential short-term supply disruptions.