From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Report: Neutral Sentiment Amidst Industry Challenges and Activity Fluctuations

The European steel market demonstrates a Neutral sentiment as recent developments indicate a concerning trajectory for domestic steel production. The UK government is under pressure as the BCSA calls for UK government support for steel, citing immediate threats to the sector, while the implementation of CBAM could cost UK industry £800 million annually as EU rules out exemption. These issues align with satellite-observed activity data reflecting declines in specific plants.

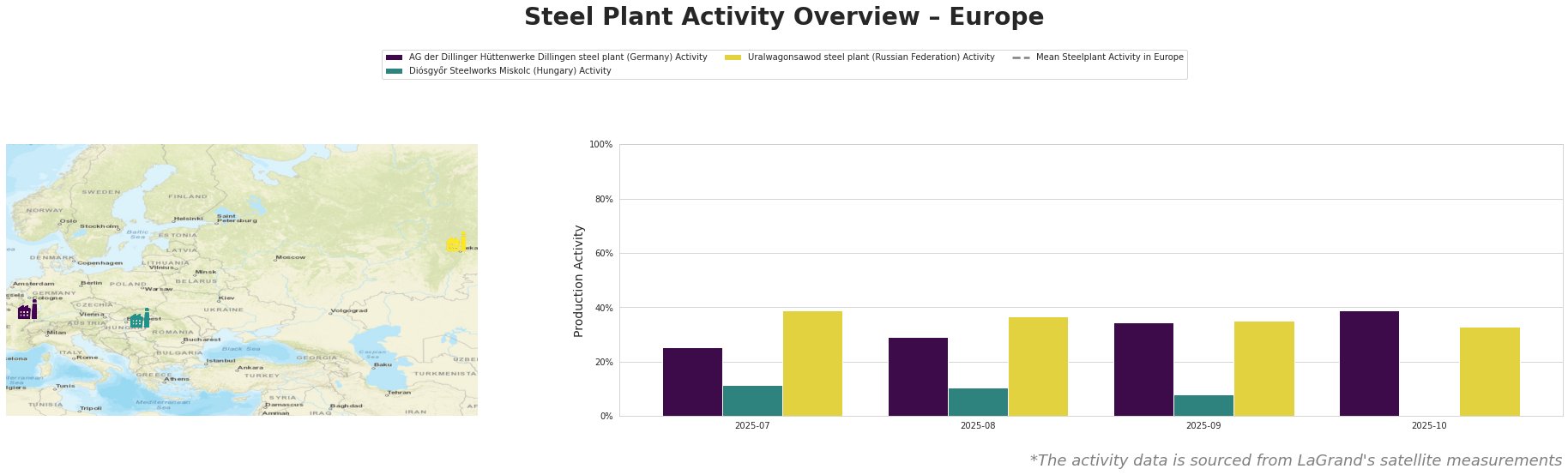

The AG der Dillinger Hüttenwerke Dillingen steel plant has encountered fluctuations, recording a peak of 39.0% in October 2025 but also a dip to 25.0% in July. This aligns with industry concerns outlined in the BCSA’s calls for governmental support, suggesting that uncertainty may affect production strategies. Meanwhile, Diósgyőr Steelworks Miskolc displayed a drop to 8.0% activity by September, indicating operational challenges; however, no clear connection to recent news was established for this specific decline. The Uralwagonsawod plant maintained relatively stable activity around 35.0% to 39.0%, disconnected from explicit news events.

Potential supply disruptions are evident, particularly within the UK market, where the BCSA urges UK government to support steel production, reflecting growing concerns over competitive standing and operational costs attributed to CBAM. Steel procurement professionals should consider strategic sourcing from regions less impacted by such regulations, particularly from EU manufacturers that can potentially outweigh UK production capabilities. Additionally, close monitoring of AG der Dillinger’s improvements and the exploration of electric arc furnace capabilities may be prudent given the current climate of heightened competition and regulatory burden.

These insights must guide and inform procurement practices, ensuring that decisions are data-driven and strategically aligned with industry forecasts and legislative impacts.