From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Trends in Europe: Insights From Recent Activity and Developments

European steel market sentiment remains positive as recent reports highlight fluctuating production levels and growing demand for imports, particularly from Ukraine. According to “Global steel production fell by 4.6% y/y in November,” variations in Ukrainian production are noteworthy, with an 18.5% year-on-year increase noted in “Ukrainian metallurgists smelted 641 thousand tons of steel in November.” This aligns with observed satellite data indicating a slight decline in output, which may influence purchasing decisions.

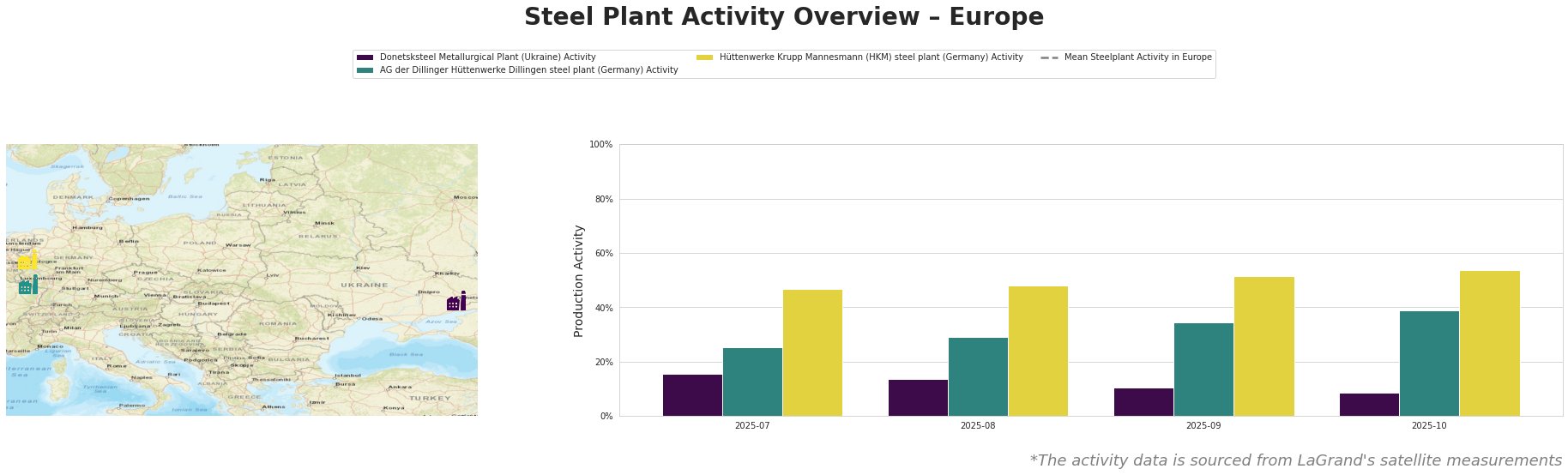

The Donetsksteel Metallurgical Plant has suffered a dramatic drop in activity, with reported output falling from 16% in July to just 9% in October 2025. This decline can be indirectly linked to the broader trends in Ukraine as per “Global steel production fell by 4.6% y/y in November,” which has seen overall production pressures. Meanwhile, the AG der Dillinger Hüttenwerke Dillingen steel plant has shown consistent operation levels, experiencing a slight uptick to 39% activity in October, suggesting a stronger foothold amid turbulent markets.

In contrast, Hüttenwerke Krupp Mannesmann’s (HKM) activity peaked at 54% in October—above the mean—indicating resilience and efficiency in production. This facility maintains a robust supply chain, capitalizing on current demand trends despite external pressures.

As for potential supply disruptions, the Donetsksteel plant presents a risk due to its ongoing downward trajectory in output activity. With significant market dependence on Ukrainian exports, purchasing strategies should adapt by diversifying suppliers and considering alternatives, particularly given the 45% increase in scrap exports highlighted in “Scrap exports from Ukraine increased by 45% y/y over 11 months.” Given expectations from “Ukraine’s 2026 steel output may match 2025: GMK,” steel buyers should closely monitor these developments, particularly with Ukraine’s market stability potentially jeopardized by new regulatory measures.

Consequently, procurement actions should prioritize securing long-term contracts with plants like Dillinger and HKM, utilizing established production stability to mitigate risks associated with plants showing significant activity declines. As market conditions evolve, maintaining flexibility will be key to navigating the complex steel landscape in Europe.