From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Report: October 2025 – Neutral Sentiment Amid Italian Production Cuts

Italy’s recent steel production decreases, as highlighted in the articles “Italy reduced steel production by 11.8% m/m in November“ and “Italian crude steel production down 2.8 percent in November 2025,” correlate with declining satellite-observed activity at European steel plants. Specifically, with Italy’s November production showing pronounced reductions across flat is steel and long products, industry stakeholders are advised to monitor similar trends in regional supply chains.

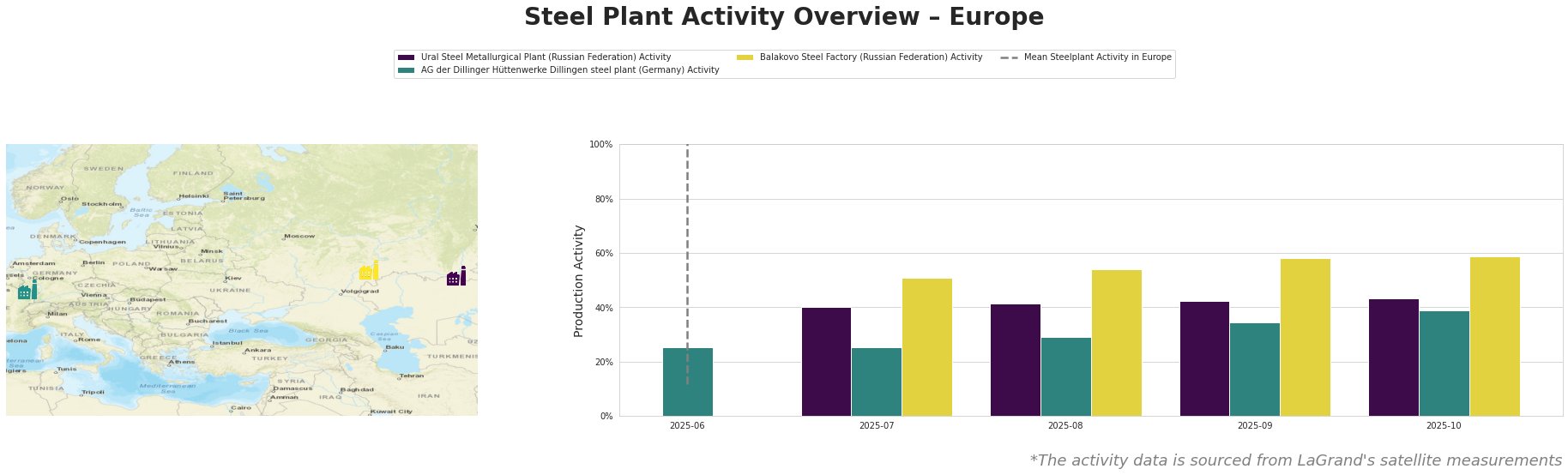

The Ural Steel Metallurgical Plant saw consistent activity at 43% in October, aligning with the mean for the region, indicating stable operations despite overall performance variances. Conversely, AG der Dillinger Hüttenwerke Dilingen had a notable activity peak at 51% in July, temporarily outpacing the mean but did not see a corresponding uptick as demand may have remained restrained due to the broader industry’s declines. The Balakovo Steel Factory remains inactive in this dataset, suggesting no recent operations were observable during this period.

The activity data demonstrates how declining trends may influence specific procurement strategies for buyers. With Italy compressing production further and shifting dynamics at AG der Dillinger Hüttenwerke, procurement professionals could face potential supply disruptions from the Italians facing a cumulative production increase amid individual drops. Special attention should be paid to the rising long product output at Italian producers despite November’s decreases, as indicated by the ongoing capacity in Italy, suggesting possible procurement from this region where conditions stabilize.

Recommendations for steel buyers include:

– Prioritize sourcing from AG der Dillinger Hüttenwerke, where production had previously shown robustness despite recent dips.

– Maintain flexibility in sourcing strategies from Italian long product producers to mitigate short-term supply disruptions indicated by the November statistics.

– Regularly review satellite activity trends across plants to forecast procurement needs and avert stock shortages.

In summary, close observation of plant activities, especially in light of Italy’s changing production landscape, will be crucial for navigating the current neutral steel market sentiment effectively.